By Michael Kuser

A new initiative will aim to help NYISO improve its monitoring of fuel and energy security (FES) across the New York grid, stakeholders heard last week.

The effort comes after NYISO last year engaged Analysis Group to produce an FES study, which was posted in November along with ISO management’s response.

The study’s findings have prompted NYISO to include additional fuel security elements in both its winter capacity assessments issued each fall and cold weather operations presentations provided each spring, Vice President of Operations Wes Yeomans told the Installed Capacity/Market Issues Working Group during a teleconference April 14.

The ISO also plans to create forward load forecasts and possibly develop fuel-related “thresholds or triggers” to help identify potential future FES concerns.

NYISO will expand the outlook of its forward-looking, short-term internal operational assessments by an additional week to allow for improved consideration of FES matters, Yeomans said.

“Certainly in the winter time frame, there’s an opportunity for us to take a lot of those constructs from the FES study and do it internally when we do that weekly capacity review,” Yeomans said. “Ultimately, that weekly internal review is intended to evaluate electric capacity sufficiency, out seven or 10 days, to meet the projected loads or peaks, and now we’re going to extend the time frame to be 14-plus days.”

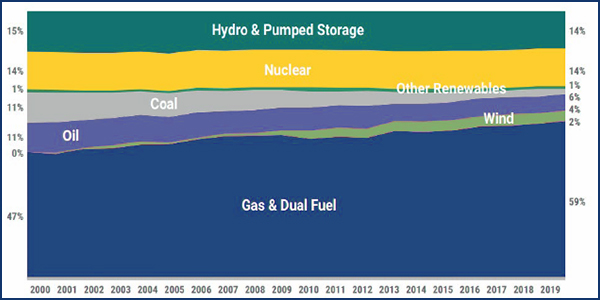

| Analysis Group

Any large deviations in actual conditions versus the assumptions used in the FES study that impact reliability may trigger a need to refresh the study, he said.

“There are two categories of thresholds, or triggers, that may require a full-blown rerunning of the study,” Yeomans said. “One would be if some set of variables change in a radical way; another one may just be that actual events don’t play out as assumed. There may be less wind developed, or less solar gets developed, or maybe the offshore wind assumptions for Long Island get delayed by two or three years; maybe there’s some accelerated retirements — there are a lot of variables that went into that study.”

Luthin Associates’ Aaron Breidenbaugh, representing a group of nonprofit institutional customers known as Consumer Power Advocates, asked “if the ISO has any process going forward for looking at the general reliability implications of the COVID-19 pandemic.”

Yeomans responded that NYISO’s operations department talks to the New York transmission owners every week to assess issues specific to the pandemic. NYISO says it “has communicated with generation operators to facilitate awareness of asset plans for ensuring continued operations and any concerns about impacts of COVID-19 on availability of critical staff.”

“A lot of those discussions are more on critical employees than infrastructures, but we do talk about implications out in the field,” Yeomans said. “If any TO was projecting implications with transmission capability transfers, whether Central East or otherwise, the NYISO would be informed of such conditions.”

Regarding longer-term infrastructure enhancements, the ISO has to date not been informed of any projected delays in four large transmission infrastructure projects over the next couple of years, including public policy transmission projects, he said.

The latter include North America Transmission and the New York Power Authority building the double-circuit 345-kV line from Edic to New Scotland for Segment A of the AC Transmission Public Policy Transmission Need (PPTN), which feeds the Central East interface. National Grid’s Niagara Mohawk Power and NY Transco are building Segment B of the project, a section of the grid feeding the Upstate New York/Southeast New York electrical interface. (See “AC Public Policy Tx Projects near Approval,” NYISO Management Committee Briefs: Feb. 27, 2019.)

In addition, NYPA has a couple big projects of its own, including rebuilding and upgrading the existing 230-kV lines from Messina to National Grid’s Adirondack substation, Yeomans said.

NYISO will return to stakeholders in fall 2020 to discuss enhanced fuel security findings as part of the 2020/21 winter assessment, he said.

Planning the Future Grid

Energy market design specialist Ashley Ferrer led a discussion of the ISO’s “Grid in Transition” initiative, focusing on nine areas of market design that the ISO believes merit “immediate attention.”

Stakeholders last month began exploring detailed assumptions and models to be included in a Brattle Group study on transitioning New York’s grid to cleaner resources. (See N.Y. Looks at Grid Transition Modeling, Reliability.)

The ISO recommends that it implement market design changes through 2024 regarding carbon pricing; comprehensive mitigation review; participation models for distributed energy and storage resources; enhancing energy and shortage pricing; energy and ancillary services product design review; enhancing resource adequacy models; revising resource capacity ratings to reflect reliability contribution; and adjusting capacity demand curves.

New York’s 2019 downstate generating capacity, Zones F-K | Analysis Group

“Some of these recommendations do have projects that are current, mainly in the operating reserves portion, but some of them do not have projects,” Ferrer said. “The purpose of going through these is to understand what some of these market design recommendations are, and if there are specific ones that project ideas come from, then that is something that we’ll work into the normal project prioritization process.”

New York lawmakers this month passed a budget amendment to speed up the permitting and construction of renewable energy projects in order to meet the state’s ambitious clean energy goals, which are driving the grid transition. (See Cuomo Proposes Streamlining NY’s Renewable Siting.)

A reliability gap assessment identified potential high-level market design concepts for existing and potential future components of NYISO’s markets, which the ISO divided into two categories: ancillary service products and energy market mechanics.

“When you’ve identified a potential reliability gap, there still may be multiple different ways of closing that gap and addressing the issue,” said Couch White attorney Michael Mager, who represents Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers.

Referring to the ISO’s standard approach of conducting consumer impact analyses only after a specific proposal has been finalized, Mager said, “We may get some idea of what the impact of the proposal is compared to the status quo, but we don’t really get any type of analysis of maybe three or four different ways to skin this cat, and these are the differing economic impacts associated with each of the options. I’d like the NYISO to bear this in mind as it starts developing potential proposals or market rule changes.”

NYISO will present on interregional coordination May 11 and is planning two additional presentations, tentatively for next month, to provide in-depth analysis of the market design components addressed. Planners by June will also present an overview of recommendations related to the ISO’s operations processes, Ferrer said.