RTMEP Process Ready to Move Ahead

PJM told the Planning Committee on April 14 that it is standing behind its intention to seek stakeholder approval of a new regional targeted market efficiency project (RTMEP) process without first developing cost allocation rules.

PJM attorney Pauline Foley reiterated her statements from the committee’s March 10 meeting, saying LS Power Challenges PJM on MEP, SATA.)

LS Power’s Sharon Segner acknowledged that cost allocation is the TOs’ responsibility, but she said FERC Order 1000 requires any regional planning process to be accompanied by a cost allocation methodology. Segner reviewed a legal memo filed by LS Power regarding cost allocation for the new project category.

Foley said she agreed with LS Power’s contention on the importance to know the cost allocation methodology before PJM designates a project or implements a planning process. But she disagreed with the memo’s contention that a methodology must be simultaneously filed with the planning process. “I don’t see anything in Order 1000 that says that,” she said.

PJM officials noted that stakeholders have been working on the issue for at least 18 months and said that if it’s pushed back any further, it could prevent implementation before 2022. PJM stated it is prepared to seek a vote on a new measure at the May PC meeting.

Alex Stern of Public Service Electric and Gas provided a response from the TOs regarding the LS Power memo. He said the plans that have been proposed follow existing transmission planning principles and comply with Order 1000.

“Once we have an effective [stakeholder-approved] package, the TOs will begin developing any needed cost allocation revisions that emerge,” Stern said. “This is consistent with the transmission planning approach that has been followed in the past.”

Segner said there remains a “long path ahead” on the RTMEP process for stakeholders. She said there has been no consensus on the proposals submitted thus far.

“The members deserve to know the cost allocation methodology for an entirely new type of regionally planned project category,” Segner said. “If FERC can’t accept these filings without understanding what the cost allocation methodology is going to be, why should the members? Why is it that the members are considering approving changes without knowing what the cost allocation framework is going to be?”

Competitive Planner Nears Debut

Ilyana Dropkin of PJM presented an update on the Competitive Planner, a new web-based application for TOs and developers to participate in the RTO’s competitive planning process under Order 1000.

By publishing a set of criteria violations and soliciting solutions from competing developers in the new application, Dropkin said, PJM and FERC are hoping to encourage innovative and cost-effective solutions for transmission needs.

Dropkin said that having a web-based application increases the speed and accuracy of the process and provides near-real-time tracking of submissions.

Anyone looking to participate in PJM’s competitive planning process can get access to Competitive Planner by prequalifying through the critical energy/electric infrastructure information (CEII) process, Dropkin said.

Training for the application is expected to be available on May 6, Dropkin said, and the full implementation of Competitive Planner is expected by June 24.

Transmission Expansion Advisory Committee

Deactivation Notifications

Phil Yum of PJM provided the Transmission Expansion Advisory Committee an update on two recent generation deactivation notifications.

The first highlighted was PPL’s Keystone NUG, a 4.9-MW coal-fired unit scheduled to retire on May 31. Yum said PJM determined during analysis that no violation was identified with the unit’s closure.

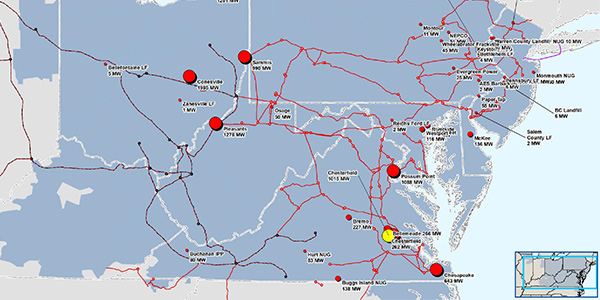

Second, Chesterfield Units 5 and 6, producing 1,015 MW in the Dominion zone, are scheduled to retire on May 31, 2023. Yum said a generation deliverability problem was discovered at the Chickahominy 500/230-kV transformer that was overloaded for loss of the Chickahominy-Surry 500-kV line.

Yum said PJM is recommending installing a second Chickahominy 500/230-kV transformer at an estimated cost of $22 million.

PJM: Error had no Impact on Project Selection

PJM’s Brian Chmielewski told the TEAC that FirstEnergy’s admission that it included an incorrect winter-normal rating in its proposed rebuild of the 115-kV Hunterstown-Lincoln line did not affect the RTO’s selection of the project (HL_622).

PJM selected the $7 million proposal by FirstEnergy’s Mid-Atlantic Interstate Transmission (MAIT) subsidiary as the solution for the Hunterstown-Lincoln congestion driver following the 2018/19 long-term window.

After MAIT told PJM of the error on March 6, the RTO’s market efficiency unit reran the proposal with the updated rating, Chmielewski said. “There was no change to the congestion or dispatch when that rating was updated,” he said, adding that PJM stands by its decision.

In February, Ameren asked PJM to reconsider its selection of the project over 22 other proposals, including the company’s proposal for installing a SmartWires SmartValve. (See PJM Rejects Ameren Challenge on Tx Project.)

RTEP Window Delayed

PJM’s Aaron Berner said delays in the development of Regional Transmission Expansion Plan cases have pushed its schedule back by three weeks. Posting of preliminary violations, originally targeted for April 15, is now expected on May 8. The opening of the 60-day proposal window, originally expected June 1, is now set for June 24.

Supplemental Project

Paul Mills of Commonwealth Edison presented needs and a solution for several supplemental projects, including the Lisle 345/138-kV Transformer No. 83 that acoustic testing showed higher-than-expected vibration levels and increased frequencies associated with looseness in the core/coil assembly. The solution calls for replacing the transformer and adding a high-side circuit breaker at a cost of $8.5 million.

— Michael Yoder