The company reported a $270 million ($0.34/share) net loss compared with a $680 million net loss ($0.86/share) in the first quarter of 2019.

CFO Jim Chapman said unfavorable weather conditions impacted utility earnings by 9 cents as Virginia recorded its third warmest first quarter on record. The first quarter marked Dominion’s 17th straight quarter of delivering results within the company’s guidance range, which was set at between $1.05 and $1.25/share.

Dominion is initiating a second quarter operating earnings guidance with a range of 75 cents to 85 cents/share, Chapman said, while affirming the annual guidance range of $4.25 to $4.60/share. The second-quarter and full-year guidance ranges reflect preliminary expectations for the impacts of the pandemic.

Dominion officials are assuming that the U.S. economy will begin to ramp up through late summer, and Chapman said electricity demand in Virginia has remained positive in relation to recent years despite the pandemic.

“Virginia load is continuing to prove extremely resilient,” he said, attributing the resilience to several factors.

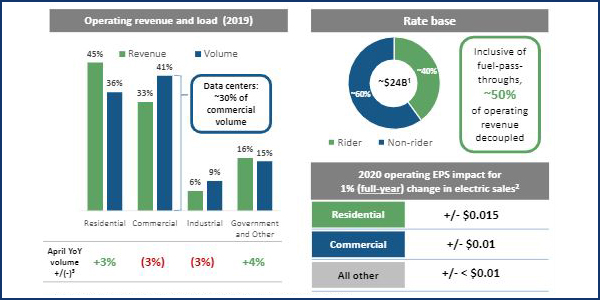

Residential usage within Dominion Energy Virginia (DEV), which typically accounts for around 45% of revenue, increased in year-over-year volume by about 3% in April as more individuals worked from home.

Despite the stay-at-home order in Virginia, Chapman said commercial load decreased by only 3% in year-over-year volume as losses from shuttered businesses were offset by the “proliferation of data centers in our service territory,” which has accounted for 30% of commercial volume since 2019.

A limited industrial exposure within Dominion’s Virginia footprint also kept load impacts from being severely impacted, he said, with only 6% of DEV’s revenue attributable to industrial usage.

Finally, government and military electricity usage, which accounts for 16% of revenue and 15% of volume, was up almost 4% year-over-year in April.

“Based on observable data, we’re not at present forecasting major COVID-driven revenue impacts associated with reduced load at Dominion Energy Virginia during the remainder of 2020,” Chapman said. “Of course, the situation is dynamic.”

CEO Thomas Farrell said the company has taken steps to help customers struggling in the uncertain economy created by closures because of the pandemic, including voluntarily suspending nonpayment service disconnections and waiving late fees across all utility service territories.

The COVID-19 response within the company has involved utilizing frequently drilled crisis response plans, he said, as well as the activation of its remote connection infrastructure, which is enabling more than half of Dominion’s workforce to operate remotely.

Farrell said Dominion has been fortunate that, among its 19,000 employees in 20 states of operation, “very few” workers have tested positive for COVID-19. Most of the positive cases are asymptomatic or mildly symptomatic, and most of them have already returned to work.

A Renewable Future

The proliferation of renewable energy resources within Dominion also played an important part of Tuesday’s conference call. The company filed its 15-year long-term integrated resource plan for Virginia on Friday. The IRP includes plans to increase solar, wind and energy storage capacity, with some increases coming from mandates in recent clean energy legislation signed into law in April by Gov. Ralph Northam. (See Va. 1st Southern State with 100% Clean Energy Target.)

Dominion’s long-term IRP also includes:

- more than 5,000 MW of offshore wind planned by 2035, including the 2,600-MW Coastal Virginia Offshore Wind project that has a targeted in-service date of late 2026;

- an increase of its solar fleet, already the fourth largest among U.S. utility holding companies, to develop and procure approximately 16,000 MW in the state over the next 15 years; and

- expanding energy storage capacity to about 2,700 MW through battery storage pilot programs already approved and scheduled to be online in Virginia in 2021.

Farrell said the proliferation of renewable and intermittent resources across Dominion’s system will require continued investment in transmission infrastructure, especially as solar and wind emerge around the state.

Farrell said the Virginia State Corporation Commission’s pointed March 26 decision denying certain elements of smart meter technology proposed by Dominion because of projected costs was a blow to the company.

The commission estimated that Dominion’s proposal, if approved in full, would have cost customers nearly $7 billion over 10 years. Smart meter technology was one of the most expensive elements of the plan, coming in at $752 million in total costs.

Renewables “will require an increasingly modern grid, which is why the recent [Virginia] commission decision to reject certain, although certainly not all, aspects of our most recent grid transformation filing was disappointing for our company and particularly for our customers,” Farrell said.