While Exelon and Public Service Enterprise Group last week expressed support for pulling out of PJM’s capacity auction over the expanded minimum offer price rule (MOPR), Dominion Energy says it is undecided.

Exelon and PSEG officials discussed their views of the fixed resource requirement (FRR) option during their quarterly earnings calls. (See related stories, Clock Ticking on Exelon Illinois Nukes Under MOPR and PSEG Turns Bullish on NJ FRR Option.)

But Dominion told the Virginia State Corporation Commission in its proposed integrated resource plan May 1 that it is still evaluating the FRR alternative in response to FERC’s December order expanding the MOPR to new state-subsidized resources and “has made no decision at this time.”

“If the company were to elect FRR, it would have to do so in advance of the next RPM [Reliability Pricing Model] base auction,” Dominion said. “Typically, this election would need to happen about six months prior to that auction; however, due to the pending MOPR-related filings with FERC, the schedules may be compressed. The schedule depends on if, and when, FERC accepts PJM’s recent compliance filing.”

PJM currently estimates the next Base Residual Auction to occur in late 2020 or early 2021, about six and a half months after FERC rules on the RTO’s compliance filings.

FERC had previously exempted from MOPR self-supply resources owned by public power entities (cooperative or municipal utilities), vertically integrated utilities subject to traditional bundled rate regulation like Dominion and load-serving entities that serve retail customers.

But in the Dec. 19 order, FERC said new self-supply resources would no longer be exempt, ruling that they suppress capacity prices under PJM’s RPM. The commission said the self-supply exemption would be limited to resources that had either cleared the RPM or were in development and in PJM’s interconnection queue before the December order.

Dominion asked FERC to expand eligibility for the self-supply MOPR exemption to any resource that is planned under a self-supply entity’s IRP. (See Dominion: FERC MOPR Rulings Inconsistent on Self-supply.)

But in its April 16 rehearing order, the commission rejected Dominion’s request. “Integrated resource plans do not replace the PJM interconnection process; granting rehearing in this manner would expand the number of resources eligible for the exemption beyond those that reflect established investment decisions, to include resources that may not even be sufficiently developed to be in the PJM interconnection process at all,” FERC said. “We find that the demarcation clarified above is sufficient to recognize those resources that are sufficiently along in the interconnection process to warrant exemption under the commission’s stated goals.” (See FERC: RGGI, Voluntary RECs Exempt from MOPR.)

Dominion Energy Virginia, which owns 27,100 MW of generation, is planning to build 2.6 GW of wind generation off the coast of Virginia and is about halfway through a plan to add 3,000 MW of solar generation. Its proposed IRP for 2021-2045 would quadruple the amount of solar and wind generation in its previous 15-year plan, a response to Gov. Ralph Northam’s executive order on climate change and the Virginia Clean Economy Act, signed last month. (See Va. 1st Southern State with 100% Clean Energy Target.)

In its discussion of the FRR option, Dominion noted that American Electric Power, parent of Appalachian Power in Virginia and West Virginia, is “the only significant utility in PJM” to have adopted FRR.

“Because of its five-year minimum commitment requirement, risks to FRR election should be carefully weighed against the benefits,” Dominion told the SCC. “Risks include future environmental changes, regulatory changes, zonal constraints, and capacity and energy market changes. The potential benefits of FRR election include [a] lower required reserve margin and the absence of MOPR risk to new generation used to meet the load obligation.”

Under the expanded MOPR, Dominion said, “virtually all new generation resources will need to offer at net [cost of new entry] or an otherwise calculated market seller offer cap — which could be above the RPM market clearing price — resulting in $0 revenue for these uncleared resources.” (See MOPR Ruling Threatens to Upend Self-supply Model.)

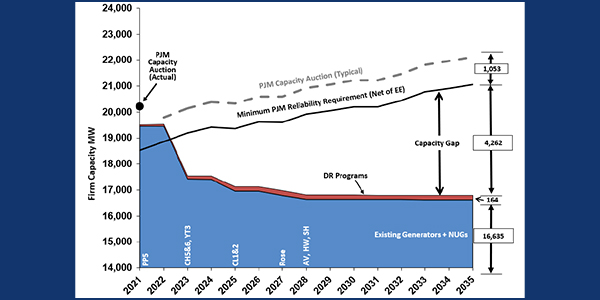

Dominion said the reliability requirement for the FRR service area would be the forward load forecast plus the target reserve margin. “This is one of the primary differences between RPM and FRR, as the PJM coincident peak target reserve margin for FRR is forecasted to be approximately 15% — over 5% less than where the RPM market has been clearing recently. From a long-term planning perspective, this reserve margin requirement difference could be significant. If the company’s forecasted load was 20,000 MW, for each percent difference between [the] cleared reserve margin and target reserve margin, electing FRR would result in about a 200-MW reduction in [the] purchase requirement.”

But the company cautioned that “both the clearing price and the clearing reserve margin of the upcoming RPM forward capacity market remain highly uncertain.”

And it noted that capacity resources committed under an FRR plan will continue to be subject to the same Capacity Performance requirements as those committed through the RPM. “To the extent an LSE has capacity in excess of its load requirement, those excess capacity resources may not generate the same revenue as if offered into the RPM market,” it said.