If another television commercial or online public service announcement intones this lazy, probably insincere attempt to offer comfort during our collective pandemic experience, I might throw my laptop or television out a window. I might — except, because I’m largely confined these days to a single-story building, it wouldn’t result in the effect or satisfaction that is supposed to accompany this fit of pique. Cranky? Yes, I am! Along with many of my fellow pandemic inmates in cell block H. But while out in the exercise yard walking the dog recently, it struck me that another addition to our virus vernacular, “flatten the curve,” might offer a useful way to think about emerging challenges facing electric grid operators.

As we now unfortunately have all come to understand, in pandemic terms, “flattening the curve” refers to slowing the otherwise exponential spread of a virus to avoid overwhelming limited health care infrastructure and human resources. The analog in our industry is “flattening or shifting the peak,” and it’s not something we’ve historically done well.

Years ago, I likened grid planning and resource adequacy to a church designed to ensure every congregant, visitor, curious heathen, adherent to family tradition and the like was guaranteed a seat for Easter services, with 15% more pews added over the forecast attendance for good measure. As times changed, I shifted toward a more secular illustration: the example of a fictitious ordinance by the city of New Orleans requiring construction of hotels to cater to every person who might want to attend Mardi Gras, plus a prudent reserve. That’s a lot of excess capacity to expect the local hospitality industry to carry over the many sweltering, hurricane-threatened months when most sane tourists would opt for Maine or Yosemite over Bourbon Street.

The point was not to suggest that electricity should be planned and provided like church pews or hotel rooms. Society values continuous, on-demand electricity differently and for many good reasons. But still, the laws of economics aren’t suspended when it comes to our industry. Carrying large, fixed costs associated with infrastructure lying fallow for months on end is either quickly unsustainable or results in high tariffs that over time shift the supply-and-demand equilibrium, resulting in a suboptimal allocation of consumer and producer surpluses and reduced total economic well-being. In other words, in most industries, while shortage may not be a good thing, it is at least a necessary evil.

For grid operators and planners, demand is still largely unexposed or is inelastic to price. Shortage isn’t an option. And the price of electricity, despite being delivered like a guaranteed hotel room during Mardi Gras, is still a good deal as a “value proposition” for most consumers. But from the perspective of those interested in designing organized wholesale electricity markets, the economic inefficiency of our industry’s infrastructure profile keeps people working on demand response, advanced metering and regulatory reform to expose more customers to actual real-time prices for electricity in the wholesale market. Here, the hope is that prices can be harnessed to change consumption behavior to flatten peaks through a curtailment or temporal shift of consumption. As mentioned, despite huge theoretical promise, as an industry we have had modest success at best in identifying and controlling discretionary consumption through either price or programs.

Today, new fronts have opened to tackle this problem. The motivation here isn’t the economic inefficiency associated with transmission and generation infrastructure in waiting. Rather, the concern is operational. Public tolerance to ever-expanding infrastructure, particularly transmission, is limited. Let’s face it: Electric infrastructure has less aesthetic appeal than a cathedral and arguably even less than a Trump Tower hotel. More salient, is the changing generation resource mix and, in particular — through policy mandate, customer preference or otherwise — the increasing penetration of intermittent, renewable wind and solar generation. We’ve all heard of CAISO’s “duck curve” and seen ramp rates become steeper year after year. In a carbon-constrained world, the role of flexible natural gas generation to “back up” and follow load is viewed as a temporary solution at best. So, we redouble efforts to conform an uncooperative supply curve populated by intermittent generation to an inviolate load curve.[efn_note]Admittedly one can find isolated, but significant, efforts by certain large customers to change consumption patterns to better align to the limits of the supply curve. For example, Google, which has a goal of real-time, 24/7 zero-carbon operations, has begun shifting the timing of computing functions that are electricity intensive at data centers “to when low-carbon power sources, like wind and solar, are most plentiful.” https://blog.google/inside-google/infrastructure/data-centers-work-harder-sun-shines-wind-blows/We can hope this kind of participation by large data center customers will eventually involve a more complex optimization of business needs, the availability of renewable electrons, electricity price and communication costs across multiple data centers located in different geographies and in different electricity markets. These actions will change load shape to better conform to a changing supply shape.[/efn_note] We ruminate over ideas such as building more transmission to move solar power from Arizona at the speed of light to meet the 8 a.m. morning pick-up in Los Angeles when the sun is still low in the sky over coastal California, and then push overabundant California solar back to Phoenix as the sun begins to set out there. What about batteries and the promise of other advanced clean technologies to add to our supply mix? It’s old news to note that increasing reliance on renewable resources is creating new challenges for system operators responsible for reliably ramping a system up and down to meeting its peaks.

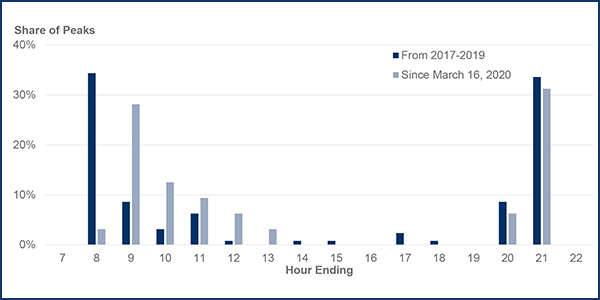

Timing of March/April weekday peaks in PJM | PJM

Fine. But what has the pandemic got to do with any of this? The answer is what today’s grand and involuntary social experiment shows about grid performance and the attendant price outcomes associated with new and different load curves. And while quarantines and shutdowns may persist, they are finite. So, the more interesting point to consider is how more permanent social distancing, work from home and staggered industrial production scheduling could change the load shape, and the grid operation, carbon and economic implications that in turn would follow from this change.

Recently, PJM published data illustrating aggregate impacts of the pandemic situation on its operations over the past six weeks. Of course, it showed overall energy consumption had declined across the region, in a range of about 6 to 8%. It also showed that the peaks had declined by a greater amount — more like 10 to 12%. But things get more interesting looking at the ramp or load shape. Yes, the morning pick-up started later, but it also appears less concentrated in the 7 to 9 a.m. hours and spread out over a longer time period[efn_note]The graph on page 9 of the following document, in particular, illustrates changes to peaks: https://pjm.com/~/media/committees-groups/subcommittees/las/2020/20200505/20200505-item-03-covid-19-impact-update.ashx[/efn_note] — a “flattening of the curve,” if you will. Other operators are also showing evidence of a more gradual and delayed morning peak just like PJM; implications to the evening peak are less conclusive.[efn_note]NYISO spokesperson Zach Hutchins reported: “We continue to observe a more gradual morning ramping period.” (April 2, 2020 9:45 a.m.) https://www.nyiso.com/covid[/efn_note]

I’m not one to characterize anything associated with our current human health and economic catastrophe as a “silver lining.” But very early observations suggest that certain “new normal” post-COVID scenarios affecting how society lives and works may change load behaviors in a way that decades of price incentives and regulatory programs have largely failed to do[efn_note]The data we have after just six weeks of a shutdown that has occurred during the industry’s shoulder season serves as only a glimpse of what we might expect by way of more permanent changes in load profiles.[/efn_note] — behavioral changes that cause a temporal shift in electricity consumption, flatten the peak and, thus, reduce the strain on a supply side increasingly challenged to meet peaks as it transitions toward cleaner, carbon-free resources.[efn_note]It’s also sometimes easy to forget that in order to meet decarbonization goals, the electric sector is going to have to do more. The electrification of transportation, industrial processes and heating in buildings will increase total consumption and also affect consumption patterns.[/efn_note]

To further burden the analogy, a monthlong Mardi Gras allowing access to more people on less costly terms may be less intense, less fun and have a less obvious crescendo, but it’s probably healthier. More gradual load curves that reduce reliance on fossil-fueled, load-following generation promise beneficial carbon reductions while buying additional time for the development of clean supply side and storage technologies.

It remains to be seen — in fact, I have heard these are “uncertain times” — whether we will return to the “good old days” or instead a “new normal” of social distancing with different patterns of work and life. I hope it’s Door No. 1. But the thought nagging me is that we might be better positioned to address our other evolving global crisis, the climate, if we are forced for health reasons to change how we live and work and, as a consequence, we flatten the curve; that is to say, the load curve.

Vincent Duane is presently consulting through his firm Copper Monarch, LLC. He was previously the Senior Vice President: Law, Compliance & External Relations at PJM Interconnection, LLC.