The Market Implementation Committee will be asked next month to choose between a PJM proposal and one from the Independent Market Monitor to resolve pricing and dispatch misalignment issues in the RTO’s fast-start pricing plan.

PJM and the Monitor had been working on a joint proposal in response to PJM, IMM at Odds on 5-Minute Dispatch, Pricing Rules.)

At the MIC meeting Wednesday, PJM’s Tim Horger outlined the RTO’s plan, which calls for three “work streams”: short-term market changes to address pricing alignment; LMP verification “enhancements and clarifications”; intermediate operational changes to implement more “regimented” real-time security-constrained economic dispatch (RT SCED) case approvals; and long-term operational changes to investigate changing SCED timing and consider previous dispatch instructions.

Vijay Shah of PJM provided a first read of the RTO’s proposed Operating Agreement and manual changes.

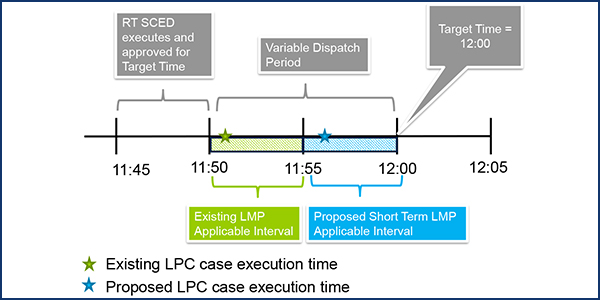

PJM’s proposed short-term fixes align the locational price calculator (LPC) to use the reference RT SCED case for the same target time. LPC would calculate prices for the interval from 11:55 a.m. to 12 p.m. using the RT SCED solution for a 12 p.m. target time.

“PJM is committed to both the short-term changes and the intermediate changes,” Horger said. “We will be moving forward with these.”

Rebecca Carroll provided a timeline for the PJM intermediate solution that calls for conducting operator training and making software changes to limit automatic execution of RT SCED cases to once for every five minutes. Additional cases may be manually executed and approved as needed by dispatchers under what PJM calls this “intermediate” change.

Carroll said PJM already switched from a three-minute interval to four minutes for operators in February, moving closer to the desired five-minute dispatch interval. Carroll said no adverse impacts to pricing were discovered with the time change, but she said closing the gap gives less flexibility for operators to make changes in real time and urged being “cautious” before taking the next step.

The “more regimented five-minute case approval [is] very different from what PJM’s operators see today and have done [as long as] they’ve worked for PJM,” Carroll said. “It’s definitely going to be a philosophy shift in the control room.”

Catherine Tyler of Monitoring Analytics presented the Monitor’s proposal, which was originally the joint package between it and PJM. The RTO withdrew from the proposal at the April 15 MIC meeting.

Tyler said the proposal includes changes to dispatch SCED calculations and settlements, while the PJM proposal only includes making the settlement changes.

“The difference is not in the timing of implementation so much as commitment to making all of the changes that need to be made,” Tyler said.

Carroll and Adam Keech, vice president of market services, insisted the RTO is committed to making the changes, although it can’t say when. “PJM is planning to move forward to a five-minute periodic dispatch,” Keech said. “We need to take operational precautions … we need to learn along the way.”

Stability Limits in Markets and Operations

PJM’s Joe Ciabattoni told the MIC that the RTO could support the Monitor’s proposal to use capacity constraints to curtail generating output when needed to maintain stability during maintenance outages or continue using thermal surrogates.

Generating units must sometimes be reduced below their normal economic max limit if a planned or unplanned transmission outage presents stability problems that could result in damage to the units.

After stakeholder discussion and feedback at April’s MIC meeting, “PJM can still jointly sponsor the existing package with the IMM but can also support the status quo,” Ciabattoni said. (See “Work Continues on Stability-limited Generators,” PJM MIC Briefs: April 15, 2020.)

Ciabattoni said some of the feedback received from stakeholders was that the stability constraint or generator output constraint doesn’t fully resolve the issue that the LMP would not be aligned with the dispatch signal. Current rules require the RTO to implement a thermal surrogate to reflect the stability constraint in the day-ahead and real-time markets and to bind the constraint, affecting the unit’s dispatch.

Tyler reviewed the Monitor’s proposal. It says surrogate constraints are not modeled consistently in the day-ahead and real-time markets, resulting in differences that traders can take advantage of.

XO Energy FTR Forfeiture Rule Complaint

PJM’s Thomas DeVita provided an update on the RTO’s response to a complaint filed with FERC last month over its forfeiture rules for financial transmission rights.

XO Energy asked FERC to order PJM to change its FTR forfeiture rule or abandon it and adopt “a structured market monitoring approach” like the one used by Trader Challenges PJM FTR Forfeiture Rules.)

DeVita said he couldn’t give specifics as to how PJM is going to respond to the complaint, but he said the RTO’s answer will focus primarily on compliance with FERC’s January 2017 order (EL14-37). In that order, FERC instructed PJM to change how it implements the forfeiture rule, saying the RTO’s focus on individual transactions failed to capture the impact of a market participant’s overall portfolio of virtual transactions on a constraint. (See FERC Orders Portfolio Approach for PJM FTR Forfeiture Rule.)

PJM filed Tariff revisions in April and June 2017 describing its new approach (ER17-1433). In September 2017, the RTO began billing forfeitures based on its new approach, XO said in its complaint, even though the commission has never acted on it.

“It’s been pending at FERC for three years, which is a significant amount of time, even by FERC standards,” DeVita said.

Comments on the XO complaint are due June 1.

PJM Seeking Consultant on ARR FTR Task Force

PJM is seeking a consultant to aid the ARR FTR Market Task Force in a review of the FTR and other markets.

PJM’s Dave Anders said the consultant is being hired in response to a recommendation of the Report of the Independent Consultants on the GreenHat Default, which called for expert help “to conduct a general review of the FTR market and other PJM markets in order to evaluate risks and rewards of structural reforms.”

After focusing primarily on the education portion of the key work activities, Anders said the task force has reached the point of needing to engage expert help in the review process.

The scope and timing of the review is currently being developed, Anders said, with PJM looking at the task force’s remaining key work activities to determine what can be accomplished and what should be put on hiatus during the external consultant review. The scope and timing plan will be discussed at the next task force meeting on May 27, Anders said, which has been cut back to a half-day of discussion.

Gary Greiner, director of market policy for Public Service Enterprise Group, asked if PJM has a sense of what the external consultant’s mission will be. He said it would be important to have an idea of the scope of the work ahead of time in order to pick the right consultant.

Anders said PJM is currently working on the scope and welcomed ideas from stakeholders on what they would like to see included in the work.

“We want to share the scope with stakeholders, but we’re not really ready yet because it’s still in development,” Anders said. “The selection is going to be interesting because there certainly are a number of experts out there that have deep knowledge of the products and the market.”

‘Quick Fix’ for NITS Rule

The MIC approved an issue charge and a “quick fix” Tariff revision to address a regulatory change in Ohio concerning the billing of network integration transmission service (NITS). PJM requires load-serving entities to sign NITS agreements and post collateral based on their peak market activity. The expected duration for Tariff revisions is two to three months. (See “‘Quick Fix’ on PMA Credit Requirements,” PJM MIC Briefs: April 15, 2020.)