Participants at a joint meeting of the New England Power Pool Markets and Reliability committees were encouraged to look west, think big, consider NYISO’s example in planning for a grid in transition and keep the bigger picture in mind to avoid getting bogged down in irrelevant details.

Advanced Energy Economy (AEE) submitted a paper recommending that ISO-NE and NEPOOL consider borrowing from NYISO’s effort, which identified as its central proposition: “how the wholesale markets in New York can continue to provide the pricing and investment signals necessary to reflect system needs and to incent resources capable of resolving those needs.”

New England’s study “should similarly address the transition to the future grid, not just the end state,” AEE said.

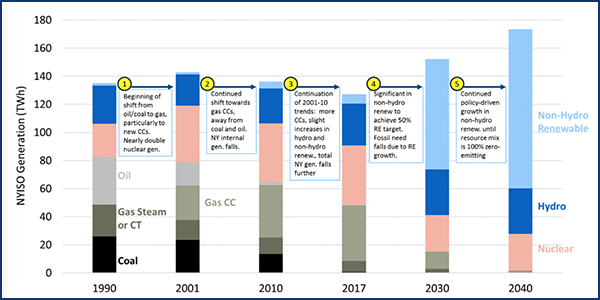

NYISO in December 2019 issued its Grid in Transition report to map the planning for a grid increasingly dominated by a slew of clean energy resources, a transition driven primarily by state policy. The ISO this year is devoting at least one day a month for stakeholders to discuss reliability and market issues related to the challenge of integrating renewable resources. (See NYISO Focus Turns to Grid ‘Transition’.)

Change in New York supply, 1990-2040 | NYISO

“Importantly, discussion of these potential market reforms is not being held up while The Brattle Group completes a longer-term quantitative analysis as part of a related but separate process that kicked off earlier this year,” AEE said.

Brattle representatives in May presented NYISO stakeholders with an interim report on New York’s evolution to a zero-emission power system, modeling operations and investment in scenarios of increasing electrification for the years 2024, 2030 and 2040. They are considering feedback before presenting the final study results in June. (See NYISO Examines ‘Evolution’ to Zero Emissions.)

Focus on Task

New England States Committee on Electricity Senior Counsel Ben D’Antonio presented NESCOE staff’s preliminary thinking on the transition study that NEPOOL expressed interest in conducting. The presentation was to focus stakeholders on prior and ongoing studies to help define what study areas remain.

In response to a stakeholder question about possible gaps in current market rules, NESCOE Director of Analysis Jeff Bentz clarified the states’ collective aim.

“We didn’t want to be in a place where we are with ESI [Energy Security Improvements], where we have this market construct problem and we’re all forced to do it in a hurry,” Bentz said. “The idea here was, can we look at where we think we’re going to be 10 years from now and then try to determine whether the market construct we have today will work in that future state, and if not, what market construct will we need?” (See ISO-NE Sending 2 Energy Security Plans to FERC.)

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

Bentz added that “by knowing where we need to be in the future, it could inform the best transition path.”

Pete Fuller of Autumn Lane Energy agreed that NEPOOL and the RTO need to focus on a “broad-brush” effort.

NESCOE points out the gap in current studies between business-as-usual versus mitigation scenarios through 2050 for New England. | NESCAUM

The goal isn’t to hit a precise target, such as “intercepting an asteroid in a particular time and place,” but to establish a market framework to move the system in the right direction, said Fuller, who presented recommendations with the endorsement of NEPOOL members NRG Energy and Sunrun.

“I’m concerned that we could get ourselves caught in some highly detailed analysis … and missing the big picture here,” Fuller said.

“I think we can make a number of assumptions about what is the transmission topology and that it will resolve itself over time as offshore wind gets developed and integrated, as new resources enter, as electrification happens and flows change, as energy storage comes and so forth,” Fuller said. “That all can largely be left to be worked out by parallel, different processes, not this one.”

Giving policymakers comprehensive economic comparisons of various levels of decarbonization? Determining whether the region needs a higher-voltage bulk network, potentially including offshore cables, to integrate the future resource mix? Evaluating the technical potential and viability of hydrogen electrolysis and storage, CCS, modular nuclear and any number of other new technologies?

“That’s not our task here,” Fuller said.

The task, according to Fuller, is to focus on two key questions: “Will our current market designs support a reliable low-carbon resource mix? And if not, what should we do about it?”

Future is Now

Other stakeholders said that New England has already effectively started the future grid planning process, as Brattle last September issued a study on what the region must do to achieve at least an 80% reduction in greenhouse gas emissions by 2050.

Xiaochuan Luo, ISO-NE technical manager for business architecture and technology, presented a slidedeck covering the RTO’s current capabilities for modeling and tools addressing various time horizons.

“If the Future Grid study would benefit from these capabilities, the ISO offers them to assist in that effort,” Luo said. “If there is a gap between our modeling processes and tools and those deemed necessary for the Future Grid studies, the ISO will work with stakeholders on the best way to address such gaps.”

The RTO is accepting stakeholder proposals for what kinds of analysis should be performed in the future grid study and associated analysis assumptions this year, with agenda topics and timing to be submitted to the MC secretary by June 12 for the next meeting.