Austin Energy has officially notified ERCOT that it plans to permanently retire one of the two original gas-fired steam units at its Decker Lake generating facility, effective Oct. 31. The municipal utility filed a notification of suspension of operations on Monday.

The 315-MW Decker 1 unit began commercial operation in 1971 and is the oldest generating unit in Austin Energy’s fleet. Decker 2 went into service seven years later and has 420 MW of capacity.

According to the utility’s latest resource plan, approved in late March by the Austin City Council, Decker 2 will be retired following the 2021 summer peak. An Austin Energy spokesperson said both units are nearing the end of their normal life expectancies.

Four other gas turbines at the facility, with a combined capacity of 192 MW, will continue to operate.

ERCOT has projected reserve margins of 17.3% and 19.7% in 2021 and 2022, respectively. Those figures include Decker 2’s capacity.

2 Market Participants File Appeals with PUC

Two ERCOT market participants have filed appeals with the Public Utility Commission regarding last year’s resettlement of 21 operating days, necessitated by a series of software errors.

Monterey TX, a qualified scheduling entity (QSE), said it is seeking “financial and injunctive relief” over what it says are “improper” charges for point-to-point (PTP) congestion revenue rights obligations in excess of its not-to-exceed bid prices in September 2019. Monterey is asking that the PUC direct ERCOT to halt its “unlawful behaviors” and is seeking more than $89,400 and accrued interest in compensation (50881).

Independent power marketer DC Energy appealed ERCOT’s resettlement of certain PTP obligations at prices more than 1 cent/MWh above the company’s not-to-exceed bid prices. DC Energy is seeking “redress of the economic penalty” it suffered from resettlement “that would put it in the same position economically” if ERCOT had honored the terms of its not-to-exceed bid prices when it resettled the day-ahead market (50871).

Both companies said they attempted to resolve their disputes with ERCOT, eventually submitting requests for alternative dispute resolution proceedings. Those requests were dismissed in April.

ERCOT’s Board of Directors in December approved the price corrections for 21 operating days, dating back to September, after it determined that real-time prices were “significantly affected” by the software error. (See “Directors Approve Price Corrections for 21 Operating Days,” ERCOT Board of Directors Briefs: Dec. 10, 2019.)

ERCOT Adjusts to DG, DR Resources

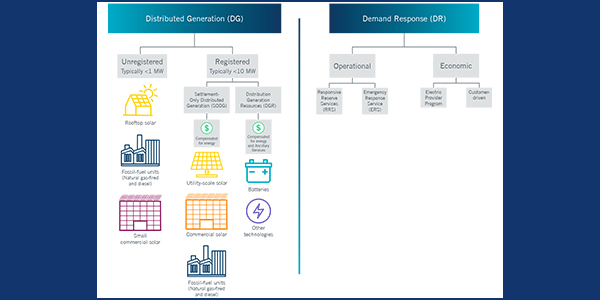

ERCOT has published a backgrounder and an accompanying video on how distributed generation and demand response are used in its footprint. Both can be found on the grid operator’s Distributed Generation webpage.

Staff have been working to catalogue the various forms of DG and DR in the region, primarily utility-scale solar, commercial solar and batteries. ERCOT only has 2 MW of operational DG but has another 374 MW in its interconnection queue.

“All generation resources provide great value to the grid, and our goal is to ensure these newer resources can participate in the ERCOT market and help provide reliable electric service to Texans,” ERCOT Director of Grid Coordination Bill Blevins said in a statement.

ERCOT defines distributed generation as electrical generating facilities located at a customer’s point of delivery, of 10 MW or less and connected at a voltage less than or equal to 60 kV, which may be connected in parallel operation to the utility system.

DG that intends to be dispatched by ERCOT or provide ancillary services must register as a DG resource and undergo qualification testing. DG with installed capacity of more than 1 MW and capable of providing a net export of energy into the distribution system is required to be registered as a settlement-only distribution generator.

TAC Passes Revised ERS Change

The Technical Advisory Committee on Tuesday unanimously approved a change to how emergency response service resources return following recall.

The Nodal Protocol revision request (NPRR1006) returns ERS resources in a linear curve over a four-and-a-half-hour period following recall, instead of 10 hours. It also changes the process for annually updating the parameter so that the TAC does not have to file an NPRR.

The vote was conducted by email after a previous version was rejected on May 27 in a similar email vote. Direct Energy offered revisions that removed a real-time deployment price adder from the original language. (See “Members Disagree over Change to ERS’ Return,” ERCOT Technical Advisory Committee Briefs: May 27, 2020.)

NPRR1006 passed by a 26-0 margin and now goes before the board during its June 9 teleconference. The measure failed 4-20, with two abstentions, the week before.

NPRR1066’s implementation is expected to cost between $140,000 and $180,000 and take up to nine months.