The COVID-19 pandemic and the associated economic crash has forced ERCOT to lower its financial forecasts for this year and into 2025, but the Texas grid operator said it is still in a “sound financial position.”

“We’re feeling comfortable with where we’re getting to in 2020 and 2021,” CEO Bill Magness told his Board of Directors during a June 9 videoconference.

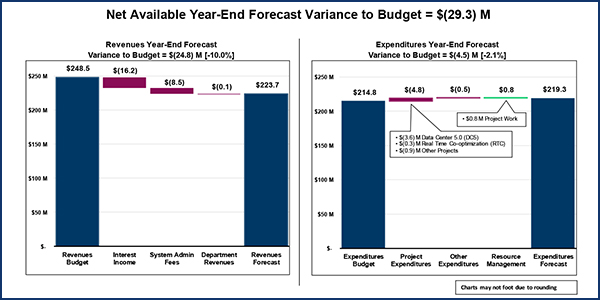

ERCOT is facing a $29.3 million budgetary shortfall this year, primarily because of a $16.2 million drop in interest income that is part of a 10% unfavorable variance in net available revenues. Expenses are up $4.5 million as a result of “timing differences” related to a data center refresh and major software projects.

The ISO’s system administration fee collections are down $8.5 million through April, forcing staff to revise its expectations for the year. Based on revised weather forecasts and economic conditions, ERCOT now expects to bring in $218 million in administrative fees and interest income, down from original projections of $242.6 million.

“That’s similar to historical performance,” CFO Sean Taylor said as he detailed future expectations for the board. “There’s not yet a reason for large concerns.”

Taylor said ERCOT’s administrative fee of $0.55/MWh still seems “appropriate, given current projections.”

There were no questions from board members after Taylor’s presentation. Director Peter Cramton did urge Magness to continue moving forward with the data center refresh and “innovative” software solutions.

“I don’t want to slow down at all,” Cramton said.

Demand Down, but Record Peak Expected

Staff said it still expects a record demand peak this summer, albeit about 1.5 GW lower than earlier forecasts. ERCOT’s final seasonal resource adequacy assessment reduced its projected peak demand to 75.2 GW, still above last year’s record of 74.8 GW. (See ERCOT’s Summer Reserve Margin up to 12.6%.)

The grid operator will begin the summer with a 12.6% reserve margin. ERCOT survived last summer with an 8.6% reserve margin, calling two emergency alerts when wind resources unexpectedly dropped during the early afternoon amid above-average forced outages.

“We’re still in the range where we could call energy emergency alerts because of higher-than-expected demand, a larger number of forced outages or lower-than-expected wind, but we don’t expect any reliability concerns,” said Dan Woodfin, ERCOT’s senior director of system operations.

Woodfin said that while the ISO has seen lower demand in the early-morning hours while Texans sheltered at home, it hasn’t experienced much of a shift from normal peak demand. “That’s largely driven by air conditioning load,” he said.

Consumer demand, down 3 to 4% during the early weeks of the pandemic, is now down 1 to 2%.

Mark Ruane, ERCOT’s director of settlements, retail and credit, reminded the board that the market’s operating reserve demand curve will operate with a 0.25 standard deviation shift this summer, the second of two such shifts directed by the Texas Public Utility Commission in 2018. That will result in higher and more frequent price adders, he said.

ERCOT’s daily average August forward prices on the Intercontinental Exchange have dropped from almost $100/MWh in mid-March to just above $80/MWh by mid-May.

Michigan PSC’s Talberg Among Director Nominees

The directors unanimously approved a special meeting of ERCOT’s corporate members to consider three nominees for the ERCOT board, including Michigan Public Service Commission Chair Sally Talberg and retired ISO–NE General Counsel Ray Hepper.

Talberg and Hepper have been put forward by the board’s Nominating Committee to serve three-year terms as unaffiliated directors. The COVID-19 pandemic has hampered the committee’s ability to complete interviews for the third nominee.

Assuming their approval by corporate members followed by that of Texas’ Public Utility Commission, the nominees will replace Board Chair Craven Crowell, Vice Chair Judy Walsh and Karl Pfirrmann, whose terms all expire on Dec. 31. The meeting has been scheduled for July 10.

The Nominating Committee also recommended unaffiliated director Terry Bulger receive a second term after his current term expires March 30, 2021.

Talberg was appointed to the Michigan commission in 2013 by former Governor Rick Snyder and became chair in 2016. Her term ends in July 2021, but Talberg said she would step down from the PSC should she be appointed to the ERCOT board. She has previously worked in an advisory capacity with Texas’ Public Utility Commission, served on the Organization of MISO States’ board (and as its president) and holds a master’s degree in Public Affairs from the University of Texas’ Lyndon B. Johnson School of Public Affairs.

Hepper retired from ISO-NE in 2018 and serves on the Board of Trustees for the Perkins School for the Blind in Watertown, Mass. He spent time with the U.S. Department of Justice during part of his career.

Walker Reminds MPs of PUC’s Role

PUC Chair DeAnn Walker again brought up her concerns that commission staff’s anonymous comments on an ERCOT change request are not being considered by some market participants, a repeat of her comments during a May 14 open meeting. (See “Commissioners Defend PUC Staff,” Texas Public Utility Commission Briefs: May 14, 2020.)

Walker said she had since talked to one of the market participants involved and received further information on the May 13 Protocol Revision Subcommittee meeting, where stakeholders discussed a Nodal Protocol Revision Request (NPRR) seeking to clarify battery-storage technologies’ interconnection and operations.

She said a meeting summary she had read showed a market participant had asked for the names of the commission staff that provided comments on the change request. Walker added that the market participant indicated staff’s comments “hold little bearing” and that the NPRR would not be considered until they heard from the commissioners.

“I find it totally unacceptable that a market participant or multiple market participants believe they can demand action from this commission prior to the ERCOT market participants doing their duty as market participants,” she said. “I wanted to address this here so people are clear that ERCOT market participants don’t dictate to this commission what this commission does.”

Walker suggested ERCOT stakeholders read the Texas Public Utility Regulatory Act to correct their “basic misunderstanding” of the commission’s — and its staff’s — role in ERCOT proceedings and the PUC’s “exact authority over ERCOT in any market matters.” She said in reviewing the grid operator’s Protocols, she found language indicating commission staff may comment on revision requests.

“That’s exactly what this staff did, was comment on a revision request,” Walker said. “I could get into trouble if I keep going.”

“I couldn’t agree more with your comments,” Crowell said, noting he was unaware of what Walker planned to say. “I’m assuming your comments will serve to correct the situation going forward.”

Crowell opened the phone call to further comments, but there were none.

Parakkuth Approved as ERCOT’s New CIO

The board approved Jayapal “JP” Parakkuth as vice president and chief information officer, effective with his May 11 start date.

According to his LinkedIn profile, Parakkuth, a power engineer, has more than 24 years of experience in “successfully visualizing, designing and implementing software solutions” for the grid. He has spent more than 20 years with Siemens, specializing in the digital grid and delivering major projects to PJM and CAISO.

Parakkuth has a master’s degree in power systems and electronics from the Indian Institute of Technology in Bombay and an MBA in information systems and finance from the University of Minnesota. He replaces Jerry Dreyer, who left ERCOT on May 1.

Parakkuth “hit the ground running here,” Magness said.

Corpus Christi Tx Project Gets OK

The directors approved the Regional Planning Group’s (RPG) $219 million Corpus Christi North Shore Project, which addresses more than 1 GW of future industrial load growth expected by 2024 on the north shore of Corpus Christi Bay. (See “Corpus Christi Tx Project Gets OK,” ERCOT Technical Advisory Committee Briefs: May 27, 2020.)

The RPG classified the project as a Tier 1 project because its price tag exceeds the $100 million threshold. Previously endorsed by the Technical Advisory Committee, the project is comprised of 36 miles of 345-kV lines, 8 miles of new and upgraded 138-kV lines, two new 345-kV substations and three 345/138-kV transformers.

An independent staff review found multiple NERC and ERCOT reliability planning criteria violations in the area. Staff identified several options that supported voltage needs but was unable to analyze the dynamic characteristics of the coming load. ERCOT and American Electric Power, the project’s owner, agreed to re-visit reactive compensation needs as short lead-time projects, once the load dynamic characteristics information becomes available.

Board Approves Bylaw Amendments, 13 Changes

During their July 10 special meeting, corporate members will consider bylaw amendments that widen the definition of “urgent matters” to allow virtual board and committee meetings by various electronic means. The board approved the amendments, along with other voting items, through a series of roll call votes.

ERCOT’s legal staff has approved the use of electronic votes by stakeholders during the national emergency, asking only that such meetings use communications equipment that allows attendees to hear each other. If necessary, votes can be validated after the meeting, staff said.

The directors also approved a consent agenda that included nine NPRRs, a change to the Nodal Operating Guide (NOGRR), another binding document revision request (OBDRR) and two system change requests (SCRs):

-

-

- NPRR933: Adds specific timing requirements for retail electric providers and non-opt-in entities to notify ERCOT of the demand response and price-response programs they offer to customers, the level of participation in those programs and the deployment events associated with those programs.

- NPRR975: Clarifies that load forecast models will be used to select the seven-day load forecast based on expected weather and requires ERCOT operations to explain its selection, improving transparency for market participants.

- NPRR987: Includes the contribution of energy storage resources (ESRs) to physical responsive capability and real-time online reserve capacity in the ancillary service imbalance calculation.

- NPRR989: Establishes ESRs’ technical requirements for voltage support service (including reactive power capability) and primary frequency response.

- NPRR1006: Returns ERS resources in a linear curve over a four-and-a-half-hour period following recall, instead of 10 hours, and changes the process for annually updating the parameter.

- NPRR1018: Clarifies several provisions regarding the termination and suspension of a qualified scheduling entity (QSE) and the ability of a load-serving entity or resource entity to act as a “virtual” or “emergency” QSE.

- NPRR1019: Addresses switchable generation resources (SWGRs) moving from a non-ERCOT control area to the ERCOT control area by creating a proxy energy offer curve with a price floor of $4,500/MWh for each RUC-committed SWGR and including a lost revenue cost component to the switchable generation cost guarantee.

- NPRR1021: Shortens the default uplift invoice’s issuance timeline from 180 days to 90 days and allows ERCOT to use the best available settlement data when calculating each counterparty’s share of the default uplift.

- NPRR1022: Modifies how QSEs and congestion revenue right account holders (CRRAHs) submit banking information changes to ERCOT by removing the ability to submit the information with a Notice of Change of Information via email or fax. Creates a new form, Notice of Change of Banking Information, that a QSE/CRRAH must execute and submit through the market information system’s certified area.

- NOGRR204: Together with NPRR989, codifies concepts described in the Battery Energy Storage Task Force key topics and concepts No. 4 (KTC 4) and establishes ESR technical requirements.

- OBDRR017: Aligns language within the operating reserve demand curve’s methodology for calculating the real-time reserve price adder with protocol revisions under NPRR987 and changes the real-time operating reserve calculation to consider an ESR’s state of charge when calculating the resource’s contribution to the online operating reserves.

- SCR807: Increases the CRRAHs’ total CRR transaction limit by 33% to 400,000 market transactions during CRR auctions.

- SCR809: Updates the validation rules imposed on ERCOT’s external telemetry and used in the resource limit calculator.

-