MISO’s margins are tighter and the footprint could face a generation shortfall as early as 2022, but interconnection projects could save the day, according to the annual capacity projection by the Organization of MISO States and the RTO.

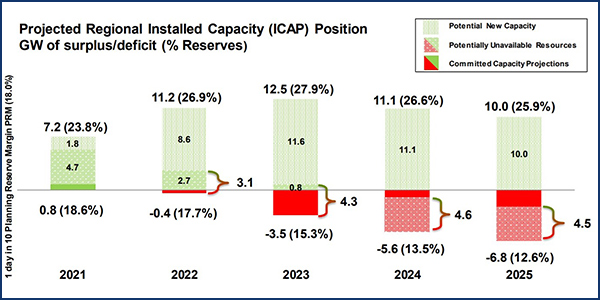

The OMS-MISO resource adequacy survey released Friday forecasts 0.8 GW in excess firm capacity beyond the planning reserve margin for 2021. All other years in the five-year outlook contain the potential of a capacity shortfall.

However, the survey still shows greater potential for surpluses larger than any possible deficit through 2025. In addition to the nearly 1 GW near-certain excess in 2021, there’s also potential for a surplus as high as 7.2 GW. And while 2022 could hold a 0.4-GW shortfall, it would see a 11.2-GW surplus if all proposed resources in the interconnection queue were realized.

The best of times, worst of times picture gets starker over the next three years:

- 2023 could bring a 3.5-GW deficit or 12.5-GW in excess capacity;

- 2024 could hold a 5.6-GW shortfall or an 11.1-GW surplus; and

- 2025 might contain a 6.8-GW deficit or a 10-GW surplus.

The survey paints a less rosy supply picture than last year’s assessment. MISO attributed the greater possibility for near-term shortages to a steadily climbing planning reserve margin — upped from nearly 16% in 2017 to about 18% today — and “modest” load growth. Last year’s survey predicted adequate reserves through 2022 and showed MISO’s footprint could experience anything from a 6.8-GW surplus to a 2.3-GW shortfall by 2024. (See Supply Future Brighter, OMS-MISO Survey Shows.)

Speaking at a special conference call to review the results Friday, MISO Executive Director of Market Operations and Resource Adequacy Shawn McFarlane said that since the last survey, some generation completed MISO’s interconnection queue, reducing possible risks, though some zones remain vulnerable. This year’s assessment singled out Lower Michigan’s Zone 7, Southern Illinois’ Zone 4, Wisconsin and Upper Michigan’s Zone 2, and Indiana and western Kentucky’s Zone 6 for the greatest resource adequacy risks. The 2019 survey also called out Zone 7, Zone 4 and Zone 6 for supply risks.

McFarlane also said MISO’s projected annual demand growth rate rose from 0.2% in 2019 to 0.3% this year. He added that the survey also does not contemplate the long-term effects of the coronavirus pandemic.

“Even with the supply risk, we do have a healthy queue, and it looks like zones will be able to firm up resources in the coming years,” McFarlane said. “The range that we have here is a reflection that resource planning is an ongoing process. … In fact, one of the purposes of the survey is to have utilities and regulators react to the risk and plan accordingly.”

Clean Grid Alliance’s Natalie McIntire asked if MISO is considering that it also needs a transmission buildout, especially in the Upper Midwest, to facilitate the generation in the interconnection queue that the RTO is betting will cover deficit risks. “Not only do we need generation in the queue, we need transmission to deliver it,” she said.

Customized Energy Solutions’ David Sapper also asked about the “mass exodus” in the queue last year, when several planned projects were canceled because of high network upgrade costs. MISO had about 100 GW in the queue last year; that has since dropped to about 80 GW.

“I’m not trying to imply that, ‘Everything’s great; we can relax.’ I’m saying there’s enough generation with a high degree of certainty in the queue that can help with risks in these coming years,” McFarlane said. “Certainly, looking out to 2025, there’s some ground to plow in terms of getting to a comfort level in resource adequacy. … The queue does have several projects in advanced stages that could turn potential capacity into committed.”

OMS President Matt Schuerger said the survey is more important than ever as the generation mix changes. This year, MISO said more than 94% of load-serving entities responded to the survey.

MISO will again review survey results with stakeholders during the Resource Adequacy Subcommittee’s July 8 conference call.