New England’s total wholesale costs of electricity last year fell 19% to $9.8 billion, driven mostly by lower energy costs, according to the ISO-NE Internal Market Monitor’s 2019 Annual Markets Report.

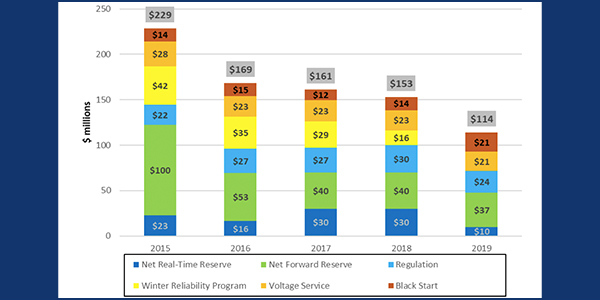

Energy and capacity costs collectively composed about 93% of the overall decrease, as shown by highlights from the report presented by IMM Director Jeffrey McDonald to the New England Power Pool Markets Committee last week.

Energy costs fell primarily on lower natural gas prices and lower loads, totaling about $4.1 billion and down about 33% from 2018.

Last year contrasted with a 2018 that saw both an extended winter cold snap and a hot and humid summer, which elevated natural gas prices in winter and boosted electricity prices in both seasons. Natural gas prices declined 34% last year to an average of $3.26/MMBtu.

Electricity demand in the third quarter of the year decreased by 6%, or by 1,011 MW per hour, on average, and drove a 4% decrease in annual demand. On a weather-normalized basis, demand was down slightly, continuing a longer-term downward trend because of the increase in utility-backed energy efficiency programs and behind-the-meter photovoltaic generation, McDonald said.

ISO-NE also reported that the Forward Capacity Auction procured surplus capacity for the sixth consecutive year as clearing prices continued a downward trend. FCA 14 in February cleared at an all-time low price of $2/kW-month. (See ISO-NE Capacity Prices Hit Record Low.)

FCA 14’s surplus was almost 1,500 MW, or 5%, above the installed capacity requirement, despite a significant amount of capacity (more than 2,500 MW) exiting the capacity market, mostly for a one-year period, in response to low prices, according to the report.

Exempting EE from Pay-for-Performance

Mark Spencer of LS Power led discussion of a Jericho Power proposal to exempt EE resources from Pay-for-Performance (PfP) in order to eliminate up to $19 million in credit support costs for all capacity resources.

ISO-NE rolled out PfP in June 2018 to ensure fuel security under severe winter conditions. Under the program, all resources with capacity supply obligations (CSOs) are assessed a charge — based on their gross FCA payments — when a “measurable” real-time operating reserve (RTOR) deficiency triggers a capacity scarcity condition (CSC). The RTO then redistributes the money collected from that charge as payments to CSO resources based on their performance during the RTOR event.

Critics contend that the current PfP arrangement has the potential to overcompensate the performance of EE resources during CSC events, which could be remedied by altogether removing those resources from PfP because their RTOR deficiencies are not technically measurable.

A Sept. 3, 2018, CSC event used as an example showed that “EE received a charge of $551,000” while “non-EE capacity supply obligation holders shared in the pool charge to the tune of $7.3 million,” Spencer said.

Spencer posed a hypothetical circumstance of when EE can be overcompensated: “We’re now on the cusp, with FCA 15, of moving from the $2,000 [CSC charge] rate that was in effect during the September 2018 event, to … $5,455/MWh; EE’s charge would have been $1.5 million, [and] non‐EE CSO holders would have been charged $20 million” if the new rate was applied to the 2018 event, Spencer said.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

“If applying on-peak rules to that hypothetical case, then EE’s net payment would have been $10.3 million, so just toggling the same event between off-peak and on-peak, it goes from $1.5 million to a net payment of $10.3 million,” he said.

This increase in net payments to EE as system load decreases is in “direct contradiction to the evidentiary record” of EE performance, LS Power contended. Under the proposal, net charges or net payments to EE in any hour of any CSC would be zero.

ISO-NE has estimated that for the 2019/20 capacity commitment period, the face value of credit support required because of EE’s participation in PfP was $11 million to $19 million, and the cost of providing this support is higher for smaller, nonpublic companies that may have lower credit ratings.

“If EE did not participate in PfP, this requirement, and its associated cost, would be eliminated,” Spencer said.

The proposal would retain EE’s base capacity payments, remove EE from the PfP settlement including the “insurance pool” and eliminate EE’s requirement to provide credit support for the FCM Delivery Financial Assurance.

Backers of the proposal will continue to develop it before the MC this summer before seeking a vote on the Market Rule 1 and Financial Assurance Policy changes at the September PC meeting.

FRM Sunset by 2025

ISO-NE Market Development Analyst Jonathan Lowell led discussion of the RTO’s proposal to sunset the Forward Reserve Market on June 1, 2025.

The FRM awards obligations to deliver 10-minute non-spinning reserves and 30-minute operating reserves in real time.

The FRM sunset proposal is not linked to FERC approval of the RTO’s Energy Security Improvements filing or to development of seasonal forward market for ESI energy options, according to meeting materials.

However, the RTO is following the suggestion of the External Market Monitor, which in its annual report published June 3 reiterated what it has been recommending since 2014. The EMM said that the FRM is no longer necessary, and that the settlement rules by themselves don’t create incentives for resources to be available in real time, forcing reliance on administrative penalty provisions.

Markets have evolved in other ways to reward resource flexibility and better performance, and transmission investment has addressed many locational constraints, the Monitor showed.

“The weaknesses are manifest, and FRM weaknesses outweigh any negligible remaining benefits,” the RTO’s materials said.

The RTO wants to establish a sunset date of June 1, 2025; otherwise, the assumptions used in FCA 16 for cost of new entry (CONE) and other parameters would not properly reflect expected ancillary service market revenues, according to the proposal.

The updated FRM sunset stakeholder schedule now anticipates an MC vote in October and a Participants Committee vote in November.

Rethinking Net CONE for FCA 16

In a matter related to the FRM sunset proposal, ISO-NE is proposing to update the CONE and net CONE calculations, and to recalculate existing — and establish new — offer review trigger prices (ORTPs) using updated data for FCA 16, to be held in 2022 to cover the 2025/26 capacity commitment period.

CONE estimates the cost to build a new resource in New England, while net CONE indicates the net revenue needed by the resource to be economically viable. ORTPs are low-end estimates of net CONE for specific — and less common — technologies.

Engaged by the RTO to support the updates, Concentric Energy Advisors’ Danielle Powers and her colleagues presented analysis with preliminary technology costs for the calculations, determination of ORTP technologies and indicative FRM revenue-offset component values.

ISO-NE aims to make its estimates consistent with FERC’s 2017 order directing that net CONE should be high enough to attract new entry, but not so high as to introduce unnecessary costs (ER17-795). The RTO proposes to file any calculation changes with FERC by Dec. 1.

CEA will continue its evaluation and analysis of technologies for CONE and ORTP calculations and provide initial assumptions for the financial model.

At the July MC meeting, the consultants will provide energy and ancillary services offsets, including a detailed approach, inputs, dispatch models and preliminary results for CONE and ORTP.