NYISO will need to expand its bulk transmission and some low-voltage lines to meet New York’s 2030 climate goals, according to the latest Congestion Assessment and Resource Integration Study (CARIS).

Jason Frasier, the ISO’s new manager of economic planning, presented the study to the Business Issues Committee on Wednesday, which recommended it be approved by the Management Committee.

Business as Usual

The report, the first phase of the ISO’s two-phase economic planning process, contains a “business as usual” base case that includes only incremental resource changes based on known planned projects with a high degree of certainty. It simulated hourly grid operations from 2019 through 2028, based on the 2019-2028 Comprehensive Reliability Plan, which includes the Western New York and AC Transmission Public Policy Transmission Projects scheduled to enter service on June 1, 2022, and Dec. 31, 2023, respectively.

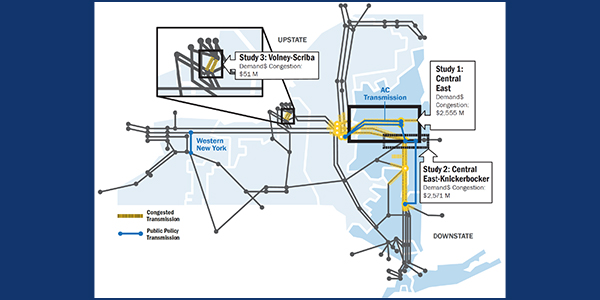

The model simulated how investments in transmission, generation, demand response and energy efficiency would impact congestion in the three most congested transmission corridors: Central East, Central East-Knickerbocker and Volney-Scriba.

As in past studies, the base case found “limited opportunities for transmission buildout based solely on production-cost reductions” reflecting the current “generation-rich” system, the ISO said.

“The solutions … offered a measure of congestion relief and production costs savings but did not result in projects with benefit/cost ratios in excess of 1.0. Following the energization of the AC Transmission projects, the congestion is substantially reduced and shifts to the Central East-Knickerbocker corridor.”

The study does not attempt to project changes in energy consumption caused by the COVID-19 pandemic. “The study provides in-depth analysis of long-term system usage trends and of system congestion and curtailment patterns over the next decade that are likely to persist notwithstanding the lower energy forecasts for 2020 and 2021 that the NYISO produced for the 2020 Gold Book,” the ISO said.

‘70×30’ Scenario

CARIS’ primary focus, however, is on the “70×30” scenario, reflecting the 2019 Climate Leadership and Community Protection Act (CLCPA) requirement that 70% of the state’s end-use energy be generated by renewable energy systems by 2030.

The scenario, which modeled two hypothetical buildouts of renewable energy facilities, identified transmission-constrained pockets that could prevent renewable production from being fully deliverable to customers. Unlike the base case, it did not include a benefit-cost analysis.

The CLCPA included technology-based targets for distributed solar (6,000 MW by 2025), storage (3,000 MW by 2030) and offshore wind (9,000 MW by 2035), with a goal of making the electric sector emissions free by 2040.

The system model for the scenario added about 110 sites of land-based wind, offshore wind and utility-scale solar, along with additional behind-the-meter solar across the system.

Sufficient renewables were added to the system to equal 70% of state energy consumption, taking into account the “spillage” of generation when renewable production exceeds load within the New York Control Area — power that could either be exported or would have to be curtailed.

To study the impact of one potential renewable resource mix that could meet the 70×30 goal, the model included about 15,000 MW of utility-scale solar, 7,500 MW of behind-the-meter solar, 8,700 MW of land-based wind and 6,000 MW of offshore wind in addition to existing hydro generation. ISO staff also included a sensitivity analysis assuming the policy target of 3,000 MW of energy storage.

The study used a new screening tool to identify five “renewable generation pockets” where insufficient bulk and local transmission network (115-kV and some 230-kV lines) capacity could prevent renewables from being delivered to consumers statewide. The study concluded that about 11% of total potential renewable energy production of 128 TWh/year would be curtailed without transmission improvements.

The North Country pocket saw the highest curtailment by percentage, the highest curtailed energy by gigawatt-hours and the most frequent congested hours. Offshore wind also would be constrained in New York City (Zone J) and Long Island (Zone K) because of constraints on the land-based grid.

The increase in intermittent renewable generation meant lower production from the state’s fossil fuel generators compared to the base case.

“In many cases, however, the reduced output is accompanied by an increased number of generator starts, indicating the need for dispatchable and flexible operating capabilities in the future. Fossil fleet operation can also be highly dependent on transmission constraints,” the report said. “In particular, comparison of operations in the relaxed and constrained cases makes apparent that simple cycle combustion turbines may run more and start more often due to transmission constraints.”

The conclusion: “Additional transmission expansion, at both bulk and local levels, will be necessary to efficiently deliver renewable power to New York consumers.”

The report also found that energy storage could decrease congestion and help to increase the use of the renewable generation, particularly solar generation, when “dispatched effectively.”

“The targeted analysis showed that energy storage likely cannot by itself completely resolve the transmission limitations in the pockets analyzed.”

MMU Review

Pallas LeeVanSchaick of Potomac Economics presented the Marketing Monitoring Unit’s review of the report, saying the transmission constraints identified in the 70×30 hourly resource modifiers (HRM) scenario “also substantially affects investment incentives” for intermittent renewable generation and battery storage. Under HRM, renewable resources are modeled to allow their outputs to change on an hourly basis.

Wholesale market incentives will encourage developers to locate assets where the transmission system is not already saturated with a particular renewable technology, the MMU said.

While renewable generation and battery storage projects may rely on revenues from sources outside the wholesale market, “the wholesale markets are as important as ever in channeling investment,” LeeVanSchaick said.

Many renewable generators seek to reduce market risk by signing long-term (20- to 25-year) contracts for “index” renewable energy credits, which pay a price per megawatt-hour equal to a fixed strike price minus the index price for a nearby pricing hub. A generator with a strike price of $65/MWh located near a trading hub that averaged $30/MWh over a month would receive $35/MWh for its RECs for that month.

But index RECs don’t eliminate all risks in the 2030 scenario, the MMU said.

The MMU cited the “technology discount” — the difference between the simple average zonal LBMP in the day-ahead market and the generation-weighted average zonal LBMP in the real-time market by technology. This affects technologies that tend to produce electricity at times when zonal LBMPs are below the day-ahead average.

Generators also face a “nodal discount” — the generation-weighted average differential between the zonal locational-based marginal prices and the nodal LBMP for a particular technology and location. This reflects reduced revenue when local transmission constraints further discount the energy revenue to a particular technology and location.

Neither of the discounts are much of a factor in 2020, LeeVanSchaick said. “But you see those tend to grow over time as [intermittent renewable] penetration increases.”

In the 70×30 scenario, the MMU found technology discounts of 27 to 87% of average zonal LBMPs for solar generation in Zones A to G, with solar in Zone K facing a potential 14% revenue reduction. Land-based wind would face a 2 to 21% discount in Zones A to E, with a 6 to 13% discount for offshore wind in Zones J and K.

Nodal impacts could range, from a 79% discount to a 29% premium for solar. Land-based wind could see between a 56% discount to an 8% premium, with offshore wind ranging between a 68% discount to 23% premium.

The MMU emphasized that the 70×30 scenario does not constitute a prediction of the resource mix in 2030, and its analysis is not a prediction of future market outcomes. It said the scenario does provide useful information about market incentives as the state works toward the 70×30 goal.

“If additional entry into saturated areas is motivated by raising index REC prices in the future, it will result in large financial risks to renewable generation developers that invest sooner (i.e., before the area has become saturated with a particular intermittent generation technology),” the MMU said. “Thus, a stable and predictable policy regarding index REC price levels may facilitate progress towards the state’s goals.”

It also said the high renewable penetration in the 2030 scenario would result in “strong incentives” for entry by unsubsidized battery storage developers.

“This market response would moderate energy prices and reduce market risks for renewable generation investors. Hence, a competitive wholesale market for energy, ancillary services and capacity will ultimately facilitate state policy objectives.”

Next Steps

CARIS Phase 1 will be brought to a vote at the July 1 Management Committee meeting and is expected to be considered by the NYISO Board of Directors at its July meeting.

The ISO said it will build on the CARIS results in the upcoming 2020 Reliability Needs Assessment and the Climate Change Impact and Resilience Study.

After CARIS Phase 1 is approved by the board, NYISO will begin Phase 2 of the economic planning process, in which developers will be invited to propose projects to alleviate the identified congestion.

The ISO will evaluate proposals to determine their impact on congestion and whether the projected economic benefits make the project eligible for cost recovery under the ISO’s rules.

“While the eligibility criterion is production cost savings, zonal LBMP load savings (net of transmission congestion contract revenues and bilateral contracts) is the metric used in Phase 2 for the identification of beneficiary savings and the determinant used for cost allocation to beneficiaries for a transmission project,” the ISO said.