MISO’s Independent Market Monitor said the RTO would be better served by an even higher planning reserve margin, two days after it recorded its first emergency of the summer.

Monitor David Patton said the grid operator should be using a 20% planning reserve margin requirement instead of the current 18% requirement that was in place when it called a maximum generation event on July 7. MISO’s planning reserve margin has climbed steadily in recent years; in 2017, it was just under 16%.

Speaking during a Market Subcommittee teleconference Thursday, Patton said part of the problem is MISO does not assume that planned generation outages and derates occur in the summer months.

But MISO is wrong there, he said.

Had it accounted for historical planned and unreported summertime outages, MISO would find its 18% margin requirement would look more like 11%, Patton said. If the RTO only included load-modifying resources that have lead times of two hours or less, that margin would fall to 8%, he said.

MISO currently allows LMRs with lead times as long as 12 hours to participate in its capacity market. The RTO recently filed with MISO Offers Concession on LMR Capacity Credit Plan.)

Patton said he would be “comfortable significantly reducing LMR accreditation to a two-hour” notification time. He said LMRs with six-hour notification needs provide “almost no reliability value” and wondered why they were being treated comparably with more valuable resources.

“It is the case that MISO has made improvements to notify LMRs to be ready ahead of time. And that’s good. But it’s still the case that MISO cannot see emergencies that far in advance,” he said.

Patton said excluding planned outages from reserve margin planning and accrediting long-lead LMRs contributes to the footprint’s tight conditions.

“We’re not as adequate as we think we are,” he said. “I think we’re adequate for this summer, but improving how we accredit capacity and price shortages will be increasingly important.”

Patton also said MISO needs higher pricing during shortages, especially as more intermittent resources are introduced into the resource mix.

“I’m not sure that we need new [market] products as much as we need really good shortage pricing,” he said.

Another Emergency Declaration

The Monitor’s recommendations were delivered as much of MISO Midwest was gripped by a persistent heat wave.

The high temperatures prompted MISO to issue a maximum generation emergency about 1-5:30 p.m. July 7 for its Northern and Central regions.

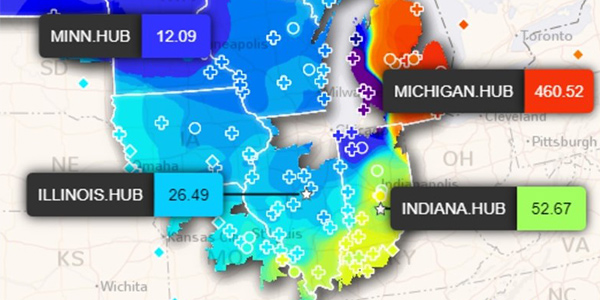

LMPs at the Michigan hub exceeded $400/MWh on July 7 and neared $700/MWh around 3 p.m. Thursday. MISO’s peak load topped out at just over 114 GW on Thursday. The RTO had planned for a 120-GW peak that day.

MISO first issued a hot-weather alert and capacity advisory on July 1 and a conservative operations declaration beginning July 6. Conservative operations — where MISO requests that all transmission and generation outages be put on hold, if possible — were in effect through Friday.

MISO imported capacity from PJM during the July 7 emergency, even as the PJM region was also experiencing stifling heat.

Patton said MISO is mostly saved from capacity deficiencies during hotter-than-normal weather combined with low wind output by its “substantial” import capability from its footprint’s neighbors. He said imports are “utilized to avoid shortages in all the hottest conditions.”

He also reminded stakeholders that MISO still has a “theoretically flawed” capacity market where demand doesn’t set capacity’s reliability value. MISO’s vertical demand curve causes resources to prematurely retire, he said.

Patton also noted that MISO had several warm days with air conditioning demand in March and April. He said spring load would have been slightly higher than average but for the languishing demand introduced by COVID-19 pandemic-related lockdowns.

MISO executives said they will prepare data on and a review of the July 7 emergency event for the Reliability Subcommittee meeting July 30.