PJM stakeholders unanimously endorsed the sunsetting of a longstanding subcommittee on intermittent resources and accepted the charter of a new committee with a broader mandate at Wednesday’s Market Implementation Committee meeting.

Scott Baker, PJM business solutions engineer, presented the sunset of the Intermittent Resources Subcommittee (IRS) and the charter for the Distributed Energy Resources and Inverter-based Resources Subcommittee (DIRS). The issue was presented for a first read at last month’s MIC meeting. (See “Solar-Battery Hybrids,” PJM MIC Briefs: June 3, 2020.)

The IRS originated as the Intermittent Resources Working Group (IRWG) in 2008 to address issues regarding operations and reliability, energy markets, capacity markets and interconnections, Baker said, and proved to be an “invaluable forum” for discussing issues related to renewable energy, especially as such resources were starting to multiply within PJM.

The new DIRS will be a stakeholder forum on distributed energy resources — defined as energy storage and generation connected to the distribution system and inverter-based wind, solar and storage. With the MIC’s approval, it may also investigate issues related to other resources that are not conventional thermal units, such as run-of-river hydro, pumped storage hydro and fuel cells.

Baker said any solution coming through the new subcommittee will be shaped by the Planning and Operating committees when the solution impacts planning and operations.

One stakeholder said he remembers problems with PJM’s Demand Response Working Group in the early 2000s that “took on a life of its own,” coming up with rule changes that were brought to the higher-level committees and were ultimately voted down. He said he wanted to make sure the same issue wouldn’t happen with the DIRS.

PJM’s Dave Anders said the DR group existed before problem statements and issue charges were a concept, leading to the problems the stakeholder brought up. Anders said that subcommittees can now approve their own issue charges as long as they’re within the scope of their charter, and the DIRS wouldn’t have to come to the MIC for approval of an issue charge.

The first meeting for the DIRS is scheduled for Aug. 3.

PRD Credits Disposition

Members unanimously approved an issue charge to address a disconnect in PJM’s settlement rules regarding payment for price-responsive demand (PRD).

PJM’s settlement rules call for revenues associated with PRD to be credited to the load-serving entity for an area and do not address the roles of electric distribution companies (EDCs) or curtailment service provider (CSPs), meaning some LSEs are paid for PRD service supplied by EDCs and CSPs.

Sharon Midgley of Exelon provided a second read of the problem statement and issue charge calling for the MIC to consider changes to the payment mechanism. PRD providers represent retail customers that have the capability to reduce load in response to prices.

PJM has an increasing share of load responsive to changing wholesale prices as a result of the implementation of dynamic and time-differentiated retail rates and utility investment in advanced metering infrastructure. Several EDCs cleared PRD as a capacity resource for the first time for the 2020/21 delivery year.

The work effort is expected to take six to nine months, Midgley said, with changes implemented in advance of the 2021/22 delivery year.

Performance Assessment Interval Settlement Endorsed

Stakeholders endorsed an issue charge to increase the transparency of settlement calculations for capacity nonperformance charges, with one member voting against the measure in an acclamation vote.

Governing language on the measurement and settlement of performance assessment intervals (PAIs) were drafted as part of the Capacity Performance initiative in 2014, but the first PAI that resulted in settlement did not occur until Oct. 2, 2019. PJM staff said the first settlement indicated the governing documents weren’t clear or detailed enough to provide sufficient transparency into the process.

Susan Kenney of PJM reviewed the problem statement and issue charge for the initiative, which is expected to last six months.

In March, PJM released a report on the PAI settlements as an addendum to its review of the October event, when an abnormal heat wave led to emergency procedures and the first call on demand response resources in more than five years. (See PJM, Stakeholders Baffled by DR event.)

The incident resulted in $8.2 million in nonperformance charges.

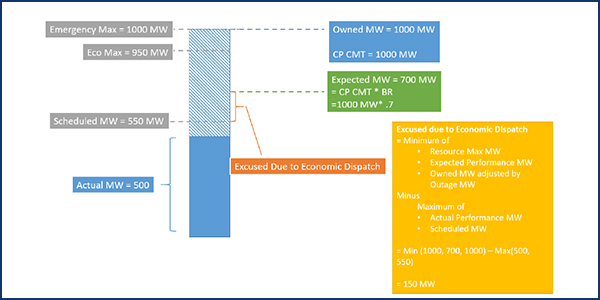

Kenney said special sessions of the MIC will start in September. PJM says there is a lack of clarity on the identification of assessed resources; the calculation of real-time reserve and regulation assignments; calculations for scheduled megawatts; and accounting for resources with both Reliability Pricing Model and fixed resource requirement commitments.

Members balked at a change PJM agreed to make to the issue charge as a result of discussions with the Independent Market Monitor after the first reading at the June MIC meeting.

The inserted issue charge language states, “Rule clarifications developed through this problem statement/issue charge will be documented in the appropriate agreement or PJM manual and, if necessary, used to recalculate prior PAI settlements as applicable.”

Kenney said PJM doesn’t anticipate the need to resettle any prior PAI settlements after work on the issue charge is completed but acknowledged it could occur.

Gary Greiner, director of market policy for Public Service Enterprise Group, said the additional language didn’t seem like something that needed to be included in an issue charge. Greiner said PAI resettlements can always happen if discrepancies are uncovered.

“It seems out of place here, and I would prefer to strike the language,” Greiner said.

Midgley supported Greiner’s comments and said the stakeholder process should be focused on prospective changes. Midgley said the inserted language seemed “inappropriate.”

Monitor Joe Bowring said he disagreed with the removal of the language from the issue charge. He said the language was meant as a clarification and to put stakeholders “on notice” that resettlements could happen after work is completed.

PJM decided to remove the language before the issue charge was brought to a vote.

MOPR Subsidy Guidance

Paul Scheidecker, PJM senior lead engineer, teamed up with Alexandra Salaneck of Monitoring Analytics to provide an overview of the “guidance document” the RTO and the Monitor will provide capacity providers to identify which programs they consider state subsidies under the expanded minimum offer price rule (MOPR).

Scheidecker said PJM and the Monitor will create and update the list of subsidy programs based on information provided by capacity market sellers. She said the guidance document is not intended to be legal advice; capacity market sellers will be responsible for certifying whether a capacity resource is subject to a state subsidy.

Requests for program reviews will be submitted through the Monitor’s Member Information Reporting Application (MIRA) system, Scheidecker said, with PJM and the Monitor reviewing all requests collaboratively. A public notice of all MOPR determinations will be posted on PJM’s website, Scheidecker said.

Where PJM and the Monitor come to different conclusions, both determinations will be noted.

ARR/FTR Market Task Force Update

PJM’s Anders provided an update on the ARR/FTR Market Task Force, telling stakeholders that the RTO has issued a request for an independent consultant to do a review of the auction revenue rights and financial transmission rights market constructs.

The hiring of a consultant was one of the recommendations in last year’s independent consultant report on the GreenHat Energy default. The review is anticipated to take 12 weeks. (See PJM Revises Consultant Scope for ARR/FTR Review.)

Anders said PJM is now looking for feedback from stakeholders to decide if the ARR/FTR Market Task Force should go on hiatus as the consultant review is conducted or to continue work. Anders said a nonbinding poll is now open on PJM’s website, and the responses will be used to form the task force’s recommendation to the MIC regarding the next steps for the group.

Poll responses are due by 5 p.m. ET this Thursday. Both voting and affiliate members are allowed to respond once each to the poll.