CAISO on Monday issued a proposal outlining the leading edge of its plan to bring day-ahead trading to the Western Energy Imbalance Market.

The extended day-ahead market (EDAM) straw proposal represents the culmination of an effort set out two-and-a-half years ago in CAISO’s 2018 Policy Roadmap after a second attempt to regionalize the ISO’s market failed in the California legislature and the grid operator faced new competitive efforts from other potential market providers, including CAISO Plan Extends Day-Ahead Market to EIM.)

The proposal released Monday addresses only the first “bundle” of topics in CAISO’s EDAM initiative: resource sufficiency rules; use of transmission; and the distribution of congestion and “transfer” revenues — the last being a new concept introduced in the plan to accommodate flows across balancing authority areas in the West.

CAISO says the second bundle of the EDAM initiative will deal with greenhouse gas accounting, ancillary services, implementation of phase two of the extension of the ISO’s full network model and the administration fee. The third, and final, bundle will deal with price formation, convergence bidding, external resource participation, market power mitigation improvements and “any additional topics identified through the consideration of the first two bundles.”

Monday’s proposal also offered an important assurance to potential market participants — and state regulators — still wary of enlisting in an organized market, particularly one dominated by California. (See Tx Summit Explores California’s Link to Rest of West.)

“The approach contemplated in this effort does not require full integration into the CAISO balancing authority area as participating transmission owners (PTO), nor does it require formation of or participation in [a] regional transmission organization,” CAISO said in the executive summary of the plan.

The proposal makes explicit the promise of flexibility around the EDAM for EIM members, who would still retain their own balancing authority and planning functions — unlike entities participating in an RTO/ISO.

“The EDAM will incorporate the same principles of the Western EIM: voluntary participation, low-entry cost, no exit fees and retention of balancing authorities’ operational control over their resources and transmission,” CAISO said. “Participation in EDAM will be optional for EIM entities. Therefore, the proposed design must contemplate that some EIM entities may still elect to participate only in the CAISO’s real-time market and not EDAM. However, participating in the EDAM requires participation in the EIM.”

The proposal touted the expected benefits of EDAM, including using CAISO’s existing day-ahead market capabilities “for more efficient hourly shaped economic transactions across the West,” lower renewable integration costs because of increased geographic and resource diversity and reduced renewable curtailments.

It also cited improved reliability through better coordination among Western BAs, a conclusion that aligns with the preliminary findings of a WECC study released early this year showing that the reliability benefits of EDAM will likely outweigh any risks. (See Study Gauges Reliability Benefits of EIM Day-ahead.)

No Leaning

The EDAM straw proposal makes clear that participating load-serving entities — and their state or local regulators — retain responsibility for resource adequacy. But CAISO envisions EDAM will rely on a day-ahead resource sufficiency evaluation similar to the one currently in place for the real-time EIM to ensure that no participating BA leans on other BAs to meet its RA requirements.

Western stakeholders “expressed explicit concerns that leaning can enable balancing authority areas to systematically avoid self-sufficient forward procurement practices, which would erode the regional diversity benefits that can be obtained through the EDAM,” CAISO said. “Given the potential incentive to avoid forward procurement to serve their load, several stakeholders suggested the resource sufficiency evaluation should serve in a preventative mitigation function rather than a retroactive financial penalty as it would be difficult to determine the appropriate level of financial penalty.”

CAISO’s proposal calls for the resource sufficiency evaluation to require that all participating BAs “offer sufficient resources to meet their bid-in demand, reliability capacity to meet forecasted net load, … ramp capability to meet their 24-hour net demand variation and their forecasted ancillary service and imbalance reserve requirements.” Any BA that fails the evaluation will not be permitted to engage in transfers within the EDAM “beyond the amount of contracted capacity and transfer capability” demonstrated by the evaluation.

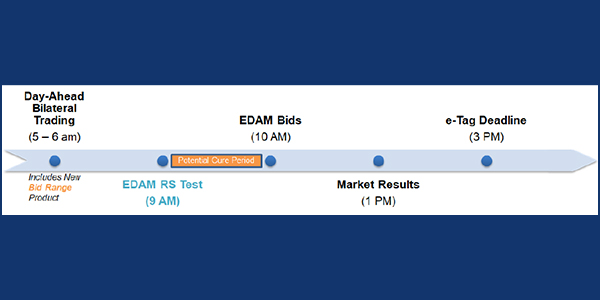

The ISO plans to run the resource sufficiency evaluation at 9 a.m. of each trading day, three hours after the conclusion of the region’s bilateral trading and one hour before the deadline for receiving EDAM bids. Market results would be published at 1 p.m.

The resource sufficiency aspect of the plan could also entail implementation of a “diversity benefit” that allows EDAM participants to share obligations for flexible ramping resources needed to cover load forecast error for the EDAM footprint. Under the program, the ISO would calculate the imbalance requirement for each BAA independently, then for the EDAM footprint as a whole based on the pooling of resources, then credit back to each BAA a prorated share of the savings derived from the pooling in order to reduce its resource sufficiency requirement.

“The CAISO views the diversity benefit as foundational to the benefit of EDAM and believes, if correctly applied, it will not result in unequitable leaning by any single participant,” the ISO said.

Transmission an Open Question

The straw proposal’s plan for transmission provision under EDAM is less developed than that for resource sufficiency.

Currently in the EIM, participants make transmission available to support real-time energy transfers by donating interchange rights or available transmission capacity. The latter category represents “residual” capacity unused after the T-20 e-tagging deadline, with the EIM given the lowest priority. If any portion of that capacity is used for a bilateral trade, the EIM redispatches the real-time market to ensure its transfers stay within the unused portion.

“EDAM will require a different approach than EIM,” the proposal explains. “Transmission customers can use transmission in real time up until just prior to the operating hour; however, the EDAM design cannot assume all transmission available in the day-ahead time frame will remain unused by real time. At the same time, transmission for EDAM day-ahead schedules for energy, ancillary services, reliability capacity and imbalance reserves must [be] available with high confidence, since each balancing authority area remains responsible for meeting its balancing authority area reliability requirements.”

CAISO is proposing a system in which EDAM BAs provide the ISO with limits for the use of their transmission systems ahead of the day-ahead market process.

“The EDAM balancing authority area may elect not to release all transmission to the day-ahead market, since transmission customers can elect to use transmission, for example, to support bilateral trades, up until 20 minutes prior to the operating hour (T-20),” CAISO said. “If the transmission is used to support day-ahead schedules, and subsequently if a transmission customer elects to use transmission after the day-ahead market, the real-time market will need to redispatch EDAM participating resources.”

The cost of that redispatch would be included in the EIM’s real-time congestion offset, which is calculated individually for each BAA to avoid cost-shifting among them.

But the ISO cautioned that day-ahead congestion could occur when transmission capacity is not included in the day-ahead market but a transmission customer chooses not to use it in real time: “The cost of this inefficiency may sometimes be greater than the potential for redispatch resulting in real-time congestion offset charges.”

A New Concept

The EDAM proposal presents a new concept of “transfer revenue” — similar to congestion revenue — that CAISO plans to introduce into both the EIM day-ahead and real-time markets as part of the EDAM effort. The ISO created the concept in response to stakeholder concerns that the voluntary nature of transmission provision in the EDAM could impede procurement of transmission rights while also incentivizing participants to withhold those right to maximize their congestion revenues.

Under the ISO’s plan, a transmission provider would be allowed to make transfer capability available in the day-ahead market at a usage fee. That fee would be included in the market optimization, generating transfer revenue to be collected by the provider.

“The CAISO believes that this approach will encourage transmission providers to offer additional unsold transmission into EDAM,” the ISO said.

CAISO also envisions allowing EDAM participants to adopt the ISO’s congestion revenue rights (CRRs) approach within their own BAAs. “An EDAM balancing authority area may choose to utilize the CAISO’s congestion revenue rights design to distribute congestion revenue to its transmission customers that are participating in the EDAM, in which case the CRR holder will be compensated directly by the CAISO. Remaining congestion revenue payments to the EDAM entity scheduling coordinator will be further allocated to its transmission customer based upon its [tariff],” it wrote.

EDAM participants choosing not to adopt CRRs will need to develop another method to settle congestion costs with transmission customer, the ISO said.

CAISO has scheduled stakeholder meetings on July 27 and 29 to discuss the EDAM proposal. Stakeholder comments on the plan are due Sept. 10. It expects to seek approval from its Board of Governors and the EIM Governing Body in late 2021 or early 2022.