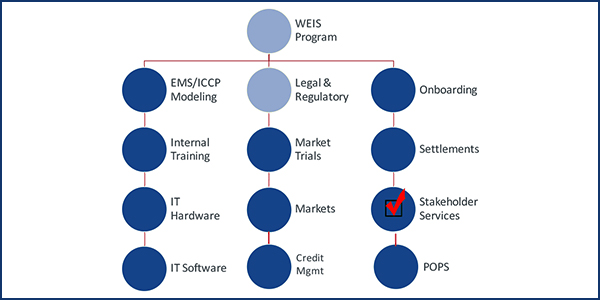

SPP said Wednesday that its Western Energy Imbalance Service (WEIS) market is at risk of falling behind schedule because it is still waiting on FERC approval of the market’s standalone Tariff.

The RTO had asked for a July 21 effective date, but that deadline passed the day before the Western Markets Executive Committee met virtually. FERC in April issued a deficiency letter, asking for more information on 14 issues. SPP filed a response in May.

“Without having any sort of regulatory certainty, we have to recognize that that is a risk to the program,” David Kelley, SPP’s director of seams and market design, told the committee. “There are a number of things waiting to move forward, pending receipt of the FERC order. There’s still a lot hinging on us getting that order.”

Kelley said the rest of SPP’s work to stand up its WEIS market by February 2021 is on schedule and “going according to plan.” Market trials are scheduled to start in August.

The WEIS market is modeled on the Energy Imbalance Market that it operated from 2007 to 2014. It has attracted eight participants. (See SPP Board OKs $9.5M to Build Western EIS Market.)

SPP has proposed a 22-cent/MWh net energy-for-load rate for the first year of market operations, based on annual $5 million operating costs, and said initial implementation costs will total $9.5 million. The commission asked the RTO to describe what costs are included in the implementation costs and to explain the ongoing administrative costs that it intends to recover through the WEIS rate (ER20-1059, ER20-1060).

Colorado utilities Xcel Energy-Colorado, Colorado Springs Utilities, Platte River Power Authority and Black Hills Energy have protested the WEIS filings. They contend an existing and neighboring joint dispatch agreement could be impaired by the WEIS market dispatch and that its market flows may harm the Western Interconnection Unscheduled Flow Mitigation Plan. They also contend SPP’s proposal disregards the Northwest Power Pool’s activities and could island Xcel’s balancing authority area from the NWPP reserve sharing group.

The Colorado utilities have all signed up for CAISO’s Western Energy Imbalance Market.

Advance Power Alliance Now an SPP Member

SPP said last week that the Advanced Power Alliance has become its first alternative power/public interest member, raising its membership count to 102. The group is an industry trade association supporting renewable generation and energy storage in SPP and ERCOT.

APA joined SPP following FERC-directed changes to the RTO’s exit fee after a Federal Power Act Section 206 filing by the group and the American Wind Energy Association in 2018. The commission ordered the RTO to eliminate its exit fee for its non-transmission-owning and non-load-serving members. SPP members pay an annual $6,000 membership fee, but exit fees for non-load-serving entities could cost $600,000 under the old format. (See FERC Tells SPP to End Exit Fee for Non-TOs.)

APA CEO Jeff Clark said the organization is “excited” about the opportunity to have “a more significant impact on the policies discussed and adopted in the RTO.” As a member, APA can now vote and join stakeholder groups.

“The SPP is home to some of the best renewable resources in the world. … The growth of clean, renewable generation in the region has been rapid,” Clark said in a statement.

MMU Releases Spring Quarterly Report

SPP’s average hourly load this spring was down 6% from last year, according to the Market Monitoring Unit’s spring State of the Market report.

The report, which covers March through May, attributed the decrease to a drop in demand because of the COVID-19 pandemic and to fewer heating and cooling days.

The average day-ahead price was $14.03/MWh, and the average real-time price was $12.58/MWh, down 41% and 44%, respectively, from last spring. The April day-ahead price of $14.03/MWh and real-time price of $10.43/MWh were the lowest monthly average prices since the Integrated Marketplace went online in 2014.

Coal-fired generation’s share of the fuel mix again fell, down from 32% last spring to 24% this year. Gas-fired generation and wind energy picked up the slack.

The report’s special issues section discusses the impact of a 2018 FERC order that resulted in a major-maintenance cost component for mitigated offers, addressing market participants’ concerns about recovering costs associated with mitigated resources (ER18-1632). (See FERC Accepts SPP Proposal on Maintenance Costs in Offers.)

Of the 491 thermal units eligible for major-maintenance adders, 113 have been approved, the report says.

The MMU will host a webinar Friday to discuss the report and answer questions.

New Wind Mark of 18,343 MW

SPP said it upped its wind-peak record to 18,343 MW on July 17, breaking the previous mark of 18,259 MW established Jan. 8. The record came at 11:13 p.m.

October Board, MOPC Meetings Now Virtual

SPP’s October quarterly governance meetings will be virtual only. The meetings were originally scheduled to be held at its corporate headquarters in Little Rock, Ark., during the weeks of Oct. 12 and Oct. 26.

The Board of Directors, Members Committee, Markets and Operations Policy Committee, Regional State Committee, Strategic Planning Committee and most other governance groups have not met in person since January.

SPP has discussed a mix of in-person and virtual meetings in 2021. Under that format, the MOPC would meet in person and the board virtually during one quarter, and then switch for the following quarter.