NYISO on Monday told stakeholders that it supports most of its consultants’ proposed parameters and assumptions for the installed capacity (ICAP) demand curves for capability years 2021/22 through 2024/25.

In their quadrennial review for the demand curve reset (DCR), Analysis Group and Burns & McDonnell recommended that General Electric’s 7HA.02 turbine be selected as the peaking plant for the ICAP demand curves for all of the state.

The consultants determined preliminary reference points — which equal the clearing price at 100% of the minimum capacity requirement — ranging from $7.74/kW-month for the New York Control Area (without selective catalytic reduction (SCR) emissions controls) to $21.36/kW-month for New York City, with SCR.

Capacity Market Design Manager Zachary Smith, who presented the draft staff recommendations to the Installed Capacity/Market Issues Working Group, said ISO staff are continuing to evaluate certain of the consultants’ recommendations, including the maximum clearing price, which is set at 1.5 times the estimated monthly value of the cost to develop a new peaking unit.

Both the reference point price and the maximum clearing price calculations require translating annual values into monthly values.

But while the translation of the annual reference value — also known as the net cost of new entry (CONE) — to the monthly reference point value uses a translation factor to account for excess conditions and seasonal differences in capacity availability, the factor is currently not applied when determining the monthly value of gross CONE.

As a result, NYISO said, there is a potential for the different methodologies to produce a reference point price that exceeds the maximum clearing price, with a greater risk of such outcomes in smaller regions. To avoid such an outcome, the ISO is considering whether to applying a translation factor in determining the monthly gross CONE value used to determine maximum clearing prices.

“Obviously, most of the focus in this process has been on the reference point; however, we are required to come up with a maximum price, as well as the zero crossing point [the point at which the value of marginal capacity declines to zero] for each locality and the NYCA,” Smith said.

Staff said they preliminarily agreed with the consultants’ proposed handling of scaling factors used to adjust the historic prices used for estimating net energy and ancillary services (EAS) revenues to the Tariff-prescribed level of excess conditions assumed for the DCR.

These scaling factors — the level of excess adjustment factors — did not take into account proposed retirements identified in compliance plans for the state Department of Environmental Conservation’s “Peaker Rule,” new NOx regulations that go into effect May 1, 2023. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

NYISO said it agreed with excluding the impact of the Peaker Rule because only four months of market prices impacted by the rule’s 2023 requirements would be used in the net EAS model. This would occur as part of the annual update for the 2024/25 capability year, for which the historic data period ends Aug. 31, 2023.

The ISO said applying Peaker Rule retirements to all years covered by the DCR “does not fairly reflect the expected system that will be reflected in the historic data periods used for determining net EAS revenue offset estimates for this period.”

MMU Review

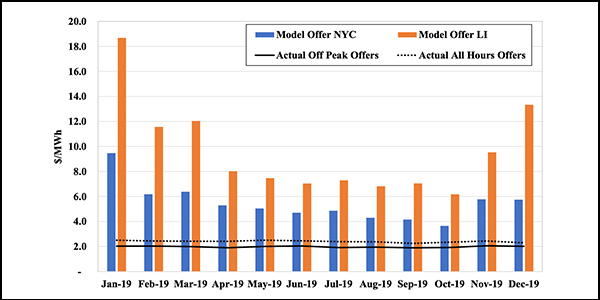

Potomac Economics, the Market Monitoring Unit for the ISO, said it also supported most of the consultants’ methodology and recommendations but called for revising three assumptions that “are not supported by market data or reasonable economic considerations,” all of which result in inflating net CONE.

“This is particularly harmful at this time given that NYISO is substantially oversupplied, and inefficiently high demand curves will serve to impede efficient retirements and perpetuate the current capacity surpluses,” it said.

Potomac called for:

- reducing the cost of debt to a range of 6 to 6.5% from the proposed 6.7%. The MMU said the rate should be “based on a broader view of the available data that does not overemphasize the recent COVID-19-related financial market turbulence.”

- replace the fuel-procurement cost for the sale of operating reserves with a cost of $2/MWh for dual-fuel units, which it said “would more accurately reflect the fuel reservation costs of reserve providers in New York with oil backup that would not likely incur large gas-procurement costs when selling reserves.” Todd Schatzki of Analysis Group said that based on data provided by the MMU, the consultants agree with its recommendation to adjust the day-ahead cost of offering to provide operating reserves for dual-fuel units.

- increase the amortization period to 20 years from 17, which it said was “unreasonably low and ignores publicly available information on how the power system will adapt to the zero-emission provision of the Climate Leadership and Community Protection Act.”

Kieran McInerney of Burns & McDonnell, who presented portions of the consultants’ interim final report, noted that they had seen a wide range of land lease costs in Zone J, used in developing the estimated CONE, but left those costs unchanged as the current assumption is within the observed range.

The consultants previously reviewed market transactions, property tax values and stakeholder feedback, and also considered quoted values obtained through discussions with property owners in the potential acquisition of land.

Stakeholders expressed concerns about modeling values for land lease costs having been adjusted for inflation only.

Timeline

NYISO staff will issue its final DCR report to stakeholders and the Board of Directors on Sept. 9. Stakeholders will have until Oct. 9 to provide written comments to the board, which will hear presentations and debate on Oct. 19. The ISO will file the approved outcomes with FERC by Nov. 30.