The New England Power Pool’s Markets Committee held a three-day meeting last week, with much of the time devoted to revising parameters and inputs for Forward Capacity Auction 16 (capacity commitment period 2025/26). Here are some of the highlights.

ISO-NE Seeks to Sunset Forward Reserve Market

ISO-NE is seeking to sunset the Forward Reserve Market (FRM) to avoid conflicts with its proposed Energy Security Improvements (ESI) initiative.

The FRM awards obligations for 10-minute non-spinning reserves and 30-minute operating reserves.

ISO-NE’s Jonathan Lowell told the committee that transmission investments and market changes, including the anticipated implementation of ESI, have or will relieve many locational constraints and reward resource flexibility. Because of those changes, and prior recommendations by the External Market Monitor, the RTO is proposing sunsetting the FRM on June 1, 2025, assuming FERC approves related ESI components.

Lowell said FRM and ESI cannot “peacefully coexist” because both procure 10- and 30-minute reserves and that FRM’s weaknesses cannot be corrected through incremental fixes. FRM does not use a two-settlement market design, relies on administratively calculated penalties and requires real-time energy offers above cost, resulting in an inefficient co-optimized real-time dispatch, the RTO says.

FRM was created as a supplemental payment to peakers. Although ESI has a different primary purpose — creating incentives to ensure energy security in real time — the two constructs would both award commitments prior to real time.

The RTO would align the FRM sunset with the net cost of new entry updates for FCA 16, contingent on FERC’s acceptance of 10- and 30-minute day-ahead reserves in either the RTO or NEPOOL version of the ESI proposal. (See ISO-NE Sending 2 Energy Security Plans to FERC.)

To receive a FERC order by March 1, 2021, ahead of the retirement bid delist window, the RTO plans to make the sunset filing contemporaneously with Forward Capacity Market parameters by the end of the year. CONE and other assumptions used in FCA 16 depend on estimates of ancillary revenues from sources such as FRM.

Lowell said the RTO is not concerned about removing incentives for new peakers to supplement increasing amounts of intermittent resources because the region has ample generation and fast-start capacity. Market changes over the last 10 years have added rewards for resource flexibility: fast-start pricing, energy market offer flexibility, Pay-for-Performance, sub-hourly settlements and the existing real-time replacement reserve, he said.

The RTO will present proposed Tariff changes to the committee Sept. 8-10, with an MC vote planned for October and a Participants Committee vote in November.

Wholesale Market Consequences of Gross Load Reconstitution Proposal

Bruce Anderson of the New England Power Generators Association (NEPGA) asked the RTO to make a market rule change to avoid suppressing capacity market prices as a result of its proposed gross load forecast reconstitution methodology.

The NEPOOL Reliability Committee on July 21 supported Tariff changes to reduce the quantity by which it reconstitutes the long-term peak load forecast. Instead of including all energy efficiency resource megawatts on the system, it would be limited to those that have cleared an FCA. The intent is to produce gross load forecasts that reflect the amount of EE that will clear in that FCA and avoid counting EE resources with capacity supply obligations (CSOs) as both supply and demand.

The change approved by the RC would set the quantity of load reconstitution based on a trend line reflecting historical measures of EE CSOs compared to the level of installed EE.

Anderson said limiting reconstitution to the trend line based on the forecast could result in EE megawatts clearing in the FCA exceeding the level of forecast EE megawatts reconstituted for that auction.

“If that were to occur, the FCA will understate demand and artificially suppress clearing prices,” NEPGA said in a presentation. “In addition, a lack of a companion market rule change will leave open the possibility of ‘double counting’ EE megawatts, i.e., to count those megawatts as both supply (though the acquisition of a CSO) and demand (by failing to reconstitute for that quantity).”

Anderson gave an example in which the trend line found 2,000 MW of EE will clear in the FCA, but the market clears 2,500 MW.

“The additional 500 MW of EE CSO cleared beyond the reconstitution would have the same effect as understating the capacity requirement by 500 MW and artificially suppress the FCA clearing price. The market would also double count the 500 MW,” he said.

Anderson suggested the region adopt one of two options:

- Do not qualify EE as capacity supply above the level of EE reflected in the reconstituted peak load forecast; or

- add a constraint in the FCA clearing process to prevent EE megawatts from clearing beyond the level of EE reflected in the peak load forecast.

NEPGA asked that the RTO agree to change Market Rule 1 before the September PC vote on the Tariff changes. It asked that the market rule changes be effective for the first implementation of the Tariff change in FCA 16.

Dynamic Delist Bid Threshold

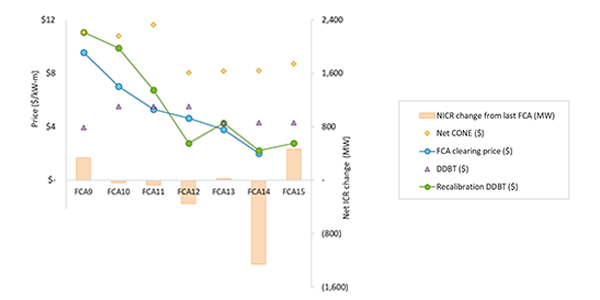

ISO-NE’s Matt Brewster briefed stakeholders on a proposed revision to the methodology the RTO uses to recalculate the dynamic delist bid threshold (DDBT) for FCA 16. The threshold was last updated for FCA 13.

The DDBT sets the price range above which static delist bids are subject to pre-submittal and cost reviews.

Suppliers controlling enough capacity to benefit from market power whose bids exceed the threshold may have those bids reduced by the Internal Market Monitor.

Brewster said the RTO attempts to identify delist bids that may represent market power without unnecessarily interfering in competitive price formation.

ISO-NE’s proposed recalibration method would estimate the competitive clearing price for the next FCA using public data: the last FCA’s cleared supply and clearing price and forecasted demand changes (net installed capacity requirement (ICR), net CONE) for the next FCA.

Brewster said the recalibration estimate showed an average 25% error for FCA 9 through 15 compared with a 39% error with the current “manual” estimation.

He said the proposal’s use of current and forward-looking market information should improve accuracy and allow it to “catch up” with unforeseen market changes by the next period. It also will be aided by the recent transition to demand curves based on the marginal reliability impact (MRI) of capacity, he said.

The committee also heard from Vice President of Market Monitoring Jeff McDonald, who said he sees the function of the DDBT as avoiding mitigation for resources whose bids are too low to create market power concerns. “Constructing the DDBT to achieve this goal requires a method that can reasonably be expected to produce a threshold price that is below the auction clearing price,” he said in a memo to the committee.

McDonald said expanding the function of the DDBT to “support” prices or “complement” the Competitive Auctions with Sponsored Policy Resources (CASPR) could interfere with competitive price formation. “I am not in favor of expanding the function of the DDBT specifically to (i) serve a price support purpose or (ii) increase the amount of capacity that may opt into the Supplemental Auction. Artificial price supports (whether explicit or by way of allowing uncompetitive bidding) introduce inefficiencies, resulting in excess capacity and cost.”

Parameters for FCA 16

ISO-NE’s Deborah Cooke gave a presentation on the recalculation of gross CONE, net CONE and offer review trigger prices (ORTPs) for FCA 16 with a focus on the proposed “level of excess” adjustment for energy and ancillary service (E&AS) revenue calculations.

Cooke addressed a stakeholder suggestion that net CONE estimates should reflect the region’s current capacity surplus rather than using the assumption that the system is “at criterion” — with supply and demand perfectly balanced to achieve the region’s one-day-in-10-years loss-of-load expectation (LOLE).

ISO-NE estimates its excess capacity for FCA 16 is 791 MW, based on an expected net ICR of 33,165 MW and CSOs from FCA 14 of 33,956 MW. (See ISO-NE Capacity Prices Hit Record Low.)

Cooke said the RTO opposed an approach that used the same gross CONE value but calculated the E&AS offsets reflecting the system at surplus.

ISO-NE opposes the change because increased capacity tends to reduce expected E&AS revenues, which would increase the net CONE estimate above the RTO’s proposed value, Cooke said. She said this would induce new competitive entry, even when the system already has more capacity necessary to meet its LOLE standard.

Brett Kruse of Calpine questioned the RTO’s example, saying he was unaware of any generation developer that would rely solely on ISO-NE price estimates.

“I don’t think any developer of any stature would pretend that we’re at equilibrium as they’re figuring out whether their projects go forward,” he said. “I think the ISO’s price point is only one aspect of that, if that. That’s why I think the whole philosophy that you’re building the example on is inaccurate.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

Robert Stoddard, who made the case for assuming a surplus on behalf of NEPGA at the MC’s July meeting, said Cooke’s conclusion depends on the slope of the E&AS price curve being steeper than the slope of the MRI.

“My guess is you could construct a different set of examples by using a steeper MRI value and find that this problem does not occur,” he said. He elaborated on his point in a presentation later in the meeting.

Kruse said after the meeting that generators are hurt by the RTO’s use of inconsistent planning parameters. “One of my concerns is not just the ‘at criterion’ argument here but the fact that they use different metrics; they factor in the oversupply as well as the upcoming state-mandated [resources] when setting the DDBT threshold. … We lose on both sides of the equation.”

Votes by the MC on the DDBT threshold and updated FCM parameters are expected in October with the PC voting in November.