ISO-NE told stakeholders Friday it will file a rule change with FERC to eliminate capacity performance payments from energy efficiency resources, endorsing a proposal by LS Power.

Henry Yoshimura, the RTO’s director of demand resource strategy, told the New England Power Pool’s Budget and Finance Subcommittee that the change to Market Rule 1 would improve the design of the Forward Capacity Market.

In a memo to committee members, Yoshimura said the change is a recognition that EE resources “permanently reduce energy consumption [and] create a reduction of demand across all conditions and prices.”

Capacity performance payments, which are intended to provide resources with incentives to provide energy or reserves in real time, should be limited “to those resources whose performance could be at risk,” Yoshimura said, citing generators, imports, batteries and demand response. In contrast, EE has no real-time performance and thus can’t trip offline, Yoshimura said.

The RTO also will change its Financial Assurance Policy (FAP) to eliminate EE’s requirement to provide collateral for the FCM delivery financial assurance to cover negative capacity performance changes.

In a presentation to the NEPOOL Markets Committee in June, LS Power’s Mark Spencer said EE resources were charged $551,000, its pro rata share of the insurance pool, for a Capacity Scarcity Condition event on Sept. 3, 2018, because the actual event occurred during hours when EE is not measured and scored.

Had the event occurred during DR on-peak hours, at the current Pay-for-Performance (PfP) cap of $5,455/MWh, EE would have received net payments of at least $13.1 million, Spencer told the committee in July.

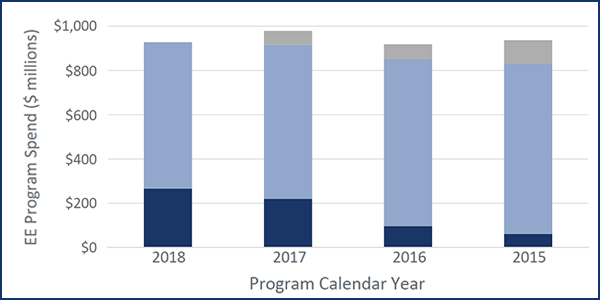

Spencer said most EE funding comes from surcharges to retail customers and Regional Greenhouse Gas Initiative revenues, with capacity markets providing 7 to 29% of total revenues. He said “long‐run expectations” of PfP to total funding are “likely less than 1%.”

The proposed change to Market Rule 1 will be presented to the MC in September.

RTO to Close Loophole on Prior Defaults

The RTO also presented a revision to the FAP to bar applicants with prior uncured payment defaults from rejoining the market under a new name. Action on the “Know Your Customer” changes was postponed at the NEPOOL Participants Committee meeting June 23 to evaluate stakeholder concerns.

“The ISO will evaluate relevant factors to determine if an entity seeking to participate in the New England markets under a different name, affiliation or organization, should be treated as the same customer or applicant that experienced the previous payment default,” the new language says. “Such factors may include, but are not limited to, the interconnectedness of the business relationships, overlap in relevant personnel, similarity of business activities, overlap of customer base and the business engaged in prior to the attempted re-entry.”

Applicants would not be required to cure a payment default that was discharged through bankruptcy.

The RTO will create a “frequently asked questions” document on the proposal and resume discussions at the Budget and Finance Subcommittee’s next meeting in October.