Renewable energy’s proliferation has played a key role in helping ERCOT meet demand, but it is also beginning to cause transmission constraints that are likely to increase during the next five years.

Staff are previewing what they say are necessary future conversations. They say that while planning studies have not shown that transmission constraints will hamper resource adequacy in the near term, they will pose an increasing challenge requiring more training, detailed models and more powerful software.

The problem is that new resources are being sited farther away from urban load centers, taking advantage of Texas’ ample wind and solar potential. This shift from traditional, large fossil-fired plants near load centers to smaller renewable resources on the farthest reaches of the ERCOT system has led to the stability challenges.

“Every year, we’re seeing generation getting a little further from load. That’s our underlying issue,” said Woody Rickerson, ERCOT’s vice president of grid planning and operations. “It’s inherently harder to serve load on the edge of the system, where it’s not networked deeply into the system.”

Rickerson told ERCOT’s Board of Directors during its Aug. 11 meeting that most new generation projects are inverter-based resources. These resources are added to the planning models six months to two years ahead of their commercial operation date, but transmission upgrades resolving congestion can take up to six years to complete.

Planning studies beyond 2022 don’t include wind or solar projects, Rickerson said, “because the development time frame puts them inside the 2023 timeline.”

“The planning process will result in some lag and congestion,” he said.

Jeff Billo, ERCOT’s senior manager of transmission planning, said the grid operator’s “generator-friendly” interconnection process has also played a role. Beginning with the Competitive Renewable Energy Zone (CREZ) initiative — which resulted in 3,500 miles of transmission facilities in 2013, freeing up 18.5 GW of West Texas wind energy — the grid operator’s stakeholders have set up processes designed to quickly add generation to the grid.

“Most developers I talk to prefer the ERCOT way, with the firm transmission rights and being able to get interconnected in less than two years, versus other [regions], where I hear anecdotally it can take six to seven years,” Billo said. “We really needed to build some amount of transmission that was appropriate for new generation.”

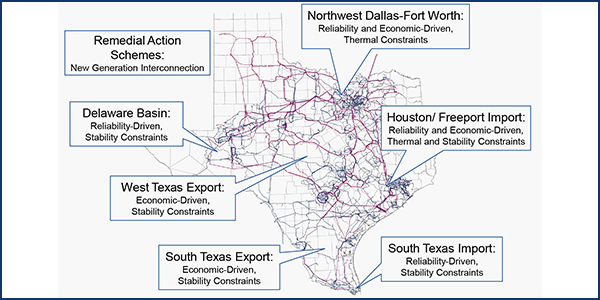

Not surprisingly, ERCOT has identified its West Texas zone, home to most of the state’s wind resources, as one of five geographical areas where it expects emerging reliability and/or economic issues. Reliability issues are driven by load growth, and economic issues are typically driven by generation growth.

Rickerson said 28 GW of renewable generation is expected to be connected in West Texas, far beyond CREZ’s plans. Stability limitations are expected to lead to high levels of congestion on West Texas exports, he said, but ERCOT is studying the region’s congestion solutions in its 2020 Regional Transmission Plan.

Far West Texas is also home to the oil-rich Permian Basin’s Delaware Basin, the fastest growing load in Texas. The region’s annual peak load has grown by more than 10% since 2010, compared to the ERCOT’s systemwide growth rate of about 1.5% during the same time frame.

Staff analyzed the Delaware Basin and has identified a five-stage roadmap of transmission upgrades to continue meeting the oil and gas load.

“If you are moving power across a longer distance, you’ll have more marginal losses and reactive losses. With the inverter controls, you’re pushing a lot of power on your circuit … and getting stability challenges,” Billo said. “Going forward, stability is going to be more limiting than thermal issues. That’s just the way our generation fleet is evolving.

“Because we have that generation-friendly environment, we can wait until the last minute [for developers] to turn in their data or make a commitment,” he said. “We don’t have a lot of lead time to know where the generation constraints are through this process. We’ve seen the system is evolving to where we see more and more stability constraints on the system, but the stability studies take time.”

Interconnecting resources are increasingly requesting remedial action schemes (RASes) as a protection scheme. These hardwired relay systems detect predetermined system conditions and automatically take corrective actions, which can include transmission reconfiguration and load sheds or generation trips that allow resources to produce beyond local transmission constraints.

“When [an RAS] sees a condition, it doesn’t call the operator. It acts,” Rickerson said. “A lot of study goes into them from a reliability standpoint. It’s something you really have to pay attention to.”

ERCOT has drafted a change to the Nodal Operating Guide (NOGRR215) that is currently winding its way through the stakeholder process. The change proposes boundaries for new RASes that limit reliability risks associated with their potential widespread use.

The schemes were a major topic of conversation last week during a workshop on transmission issues related to generation constraints. EDF Renewables, SolarPrime and other renewable interests submitted presentations advocating for RASes and the need to meet economic criteria.

The grid operator also relies on generic transmission constraints (GTCs), predefined collections of transmission elements, to maintain grid reliability to subject the aggregate power flow to a defined limit in real time. This is necessary because economic dispatch, reliability unit commitment and other existing market tools are not capable of calculating other operating limits.

ERCOT held a GTC-themed workshop in February and has drafted a GTC white paper to educate and inform stakeholders.

Five of the grid operator’s 12 GTCs can be found in South Texas, which faces both import (reliability) and export (economic) stability constraints. LNG facilities in the Rio Grande Valley could require up to $1.2 billion in transmission improvements and additional generation development in the region could lead to further stability constraints.

ERCOT’s other staff-flagged transmission-constrained areas include:

- The Northwest Dallas-Fort Worth Import: One of the highest congested areas in recent planning studies, generation development northwest of the DFW area and load growth within the metroplex is expected to exceed the region’s transmission capacity. Rickerson said staff are actively analyzing project options to relieve these constraints.

- Houston-Freeport Import: The Houston Import went into service in 2018 and the Freeport Import will be completed in 2021. (See ERCOT Stakeholders OK $246.7M in Freeport Reliability Projects.) However, the 2014 Houston Import Project study indicated additional upgrades would be needed by 2027 to continue meeting reliability criteria. Recent planning studies indicate congestion will increase in coming years as power is imported into the Houston and Freeport areas.