ISO-NE is proposing an installed capacity requirement (ICR) of 34,153 MW for Forward Capacity Auction 15, a 722-MW (2%) increase over FCA 14, in part because of reduced expectations of assistance from its neighbors in an emergency.

The RTO presented its ICR proposal and tie line calculations to the New England Power Pool Reliability Committee on Tuesday. The committee will vote on the ICR and related values on Sept. 23.

ISO-NE calculates the ICR — the minimum system capacity needed to meet Northeast Power Coordinating Council reliability criteria — based on sequential Monte Carlo simulations to probabilistically compute the behavior of loads and resources.

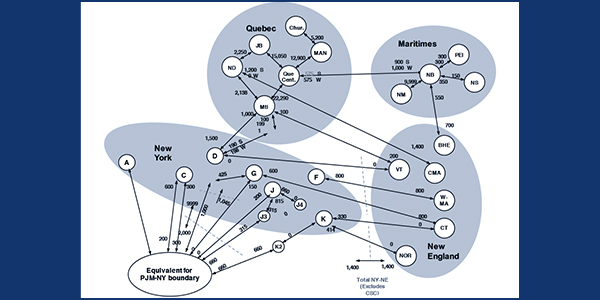

The RTO’s annual calculations also account for operators’ ability to purchase energy from neighboring balancing authority areas during a capacity deficiency under Emergency Operating Procedure No. 4.

The RTO’s Fei Zeng told the committee that the Maritimes, Hydro-Québec Phase II, Québec Highgate, New York AC and Cross Sound Cable ties will provide a combined 1,735 MW of tie line benefits for FCA 15 (2024/25), a 205-MW (11%) reduction from FCA 14 (2023/24).

Benefits from the New York AC ties showed the biggest reduction, a drop of 104 MW (29%), followed by a 47-MW reduction for the Maritimes (9%).

The New York reduction was largely the result of the state’s need to meet higher peak and energy demand forecasts because of increased load forecast uncertainty (40 MW). New York’s increasing need for emergency assistance available from the Canadian control areas reduced the assistance available to New England, Zeng said.

Another 50-MW reduction was attributed to a change in New York’s behind-the-meter PV model: The penetration and hourly shape increased the correlation in the hourly loads between New York and New England.

In addition, a lower Northeast Massachusetts/Boston transmission import capability contributed to a 40-MW reduction, while the retirement of Mystic Units 8 and 9 resulted in a 25-MW decrease. “Tie benefits are a function of how much assistance New England needs and how much assistance our neighboring areas are able to provide,” RTO spokesman Matt Kakley explained. “The retirement of Mystic results in a small decrease in what we would need to be able to replace in an emergency.”

The region’s internal transmission interface transfer limits reflect several anticipated transmission upgrades: the Greater Boston upgrades with the 345-kV Wakefield-Woburn line in service (2021/22); the Greater Hartford/Central Connecticut upgrades; southwest Connecticut upgrades; and the Southeast Massachusetts/Rhode Island reliability project upgrades.

Subtracting the Hydro-Québec interconnection capability credits (HQICCs) of 883 MW (down from 941 MW the prior year), the net ICR is 33,270 MW, a 2% increase over FCA 14. The reserve margin is 16.6% with the HQICCs and 13.5% without.

“HQICCs are capacity credits that are allocated to interconnection rights holders, which are entities that pay for and, consequently, hold certain rights over the Hydro-Québec Phase I/II HVDC transmission facilities,” Kakley said.

The gross cost of new entry (CONE) for the cap of the marginal reliability impact system demand curve for FCA 15 is calculated as $11.951/kW-month, with net CONE at $8.707/kW-month. The FCA will start at a price of $13.932/kW-month.

FCA 15 will model the same zones as FCA 14, with Maine nested inside Northern New England as export-constrained and Southeast New England as import-constrained.

The Participants Committee will vote on the ICR and related values on Oct. 1, with a FERC filing expected by Nov. 10.