The New England Power Pool Participants Committee on Thursday approved a change to how ISO-NE accounts for energy efficiency in its gross load forecast reconstitution methodology.

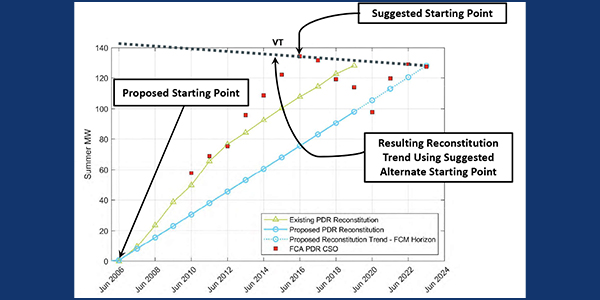

The RTO said the change is needed to ensure gross load forecasts reflect the amount of EE that will clear in the Forward Capacity Auction and avoid counting EE resources with capacity supply obligations (CSOs) as both supply and demand. In the last several capacity auctions, it says, it has cleared less EE than was reconstituted.

The change, which was approved by the Reliability Committee in July, would set the quantity of load reconstitution based on a trend line reflecting historical measures of EE CSOs compared to the level of installed EE. (See “Wholesale Market Consequences of Gross Load Reconstitution Proposal,” NEPOOL Markets Committee Briefs: Aug. 11-13, 2020.)

The change received a 68% sector-weighted vote of the PC, with unanimous support from the Transmission, Publicly Owned Entity and End User sectors. The change also was supported by about 55% of the Supplier sector, but only one-third of the Alternative Resources sector and only 20% of the Generation sector.

The PC had deferred action on the proposal in August following objections by the New England Power Generators Association (NEPGA), which contended that limiting reconstitution to the trend line based on the forecast could result in EE megawatts clearing in the FCA exceeding the level of forecast EE megawatts reconstituted for that auction.

The generators said capacity market prices could be suppressed if EE and other passive demand resources (PDRs) begin to clear more CSOs than reconstituted on the demand side.

NEPGA asked ISO-NE to not qualify EE as capacity supply above the level of EE reflected in the reconstituted peak load forecast, or add a constraint to prevent EE from clearing beyond the level reflected in the peak load forecast.

The RTO declined to endorse NEPGA’s proposal.

“The objective of the proposed PDR reconstitution methodology is to produce a reasonably accurate forecast of future PDR CSOs that will be correct on average, over time,” Robert Ethier, vice president of system planning, wrote in an Aug. 27 memo. “The ISO believes its proposal achieves that objective. The ISO will continue to observe the clearing of PDRs in the FCM [Forward Capacity Market] and, if it becomes apparent that modifications to the participation of PDRs in the FCM are necessary, then the ISO will return to the stakeholder process.”

The RTO hopes to implement the rule change for FCA 16.

‘Challenging’ August

ISO-NE Chief Operating Officer Vamsi Chadalavada briefed the committee on what he called a “challenging” August for RTO operations, a month that included Tropical Storm Isaias, which clobbered Connecticut and Western Massachusetts on Aug. 4, leaving 1.2 million customers without power following 32 transmission outages.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, Chadalavada approved his remarks afterward to clarify his presentation.]

ISO-NE declared an M/LCC 2 abnormal conditions alert at 3:40 p.m. on Aug. 4, which continued until 9 p.m. on Aug. 10. Scheduled generation and transmission outages were postponed where possible, and 1,200 MW of capacity was locked in Connecticut because of line outages.

The RTO also saw loads 1,000 to 2,000 MW above forecast during hot weather on Aug. 1, 9 and 10, requiring it to commit fast-start resources to maintain its operating reserves, Chadalavada said.

Aug. 9 presented an additional challenge because of an unplanned transmission outage in the Northeast Massachusetts (NEMA)/Boston area, high loads, the scheduled outage of lines 3163 and 3164 into Boston and resources that normally clear in merit in the day-ahead market not doing so.

The RTO was able to maintain all reliability standards by committing some resources and backing off others in the NEMA/Boston zone, Chadalavada said.

Daily net commitment period compensation (NCPC) for August was $2.9 million, up $1.2 million from July and up $1.3 million from August 2019.

First contingency payments totaled $2 million, up $500,000 from July, including $1.9 million paid to internal resources and $112,000 paid to external resources. Dispatch lost opportunity cost was $158,000, and rapid response pricing opportunity cost was $297,000.

Chadalavada said operators were performing “a balancing act” in deciding not to recall the outage of lines 3163 and 3164, saying that delaying too many scheduled outages would push more maintenance work into the peak maintenance season in the fall.

ISO-NE Proposes 2.5% Budget Increase

ISO-NE is proposing a $178.6 million operating budget for 2021, a $4.4 million (2.5%) increase excluding FERC Order 1000 funding and before depreciation.

Including depreciation and FERC Order 1000 funding, the increase is $3.2 million (1.6%).

The budgets include no increase to the full-time-equivalent employee headcount of 587.

Robert Ludlow, the RTO’s chief financial and compliance officer, said in a memo that the increase included inflation adjustments to compensation costs; implementation of the Energy Security Improvements (ESI) initiative; work related to renewable resources and emerging technologies; and cybersecurity and NERC Critical Infrastructure Protection (CIP) compliance.

The 2021 operating budget does not include funding for FERC Order 1000 costs because the RTO expects to underspend its Order 1000 budget by about $600,000 in 2020. Most spending on the issue in 2021 will be for legal expenses for protests and other filings.

The committee approved a modification to the ISO-NE Tariff’s true-up provision to allow the RTO to carry such unspent “special purpose” funding over to 2021 rather than having to return it.

The capital budget — which will fund ESI, the nGEM market clearing engine, nGEM software development (part II), cybersecurity improvements and a redesign of the CIP electronic security perimeter — will be unchanged from 2020 at $28 million.

Ludlow noted concerns of state officials that the RTO would not have enough internal resources to support the Future of the Grid initiative and that freezing the FTE headcount could have a negative impact on the Markets Development and System Planning departments.

“We shared that there was too much uncertainty regarding work related to the ‘Future of the Grid/Markets’ discussions to build in budgeted dollars and, to the extent additional resources or analyses are necessary, they will be funded through the contingency,” Ludlow wrote.

The New England States Committee on Electricity (NESCOE) also presented its proposed $2.4 million budget for next year, a $7,200 increase over 2020 and $113,000 below the $2.5 million projected in its five-year pro forma budget.

NESCOE said the reduction reflected “continued rebalance” of technical and legal spending and reductions in travel and professional services costs.

The PC will vote on the budgets at its October meeting.