2020 Installed Reserve Margin Study Results

PJM is recommending an installed reserve margin (IRM) of 14.4%, down from 14.8% required in 2019.

During the Sept. 1 Planning Committee meeting, PJM’s Patricio Rocha Garrido reviewed the 2020 reserve requirement study (RRS) results, which determine the RTO’s IRM and forecast pool requirement (FPR) for 2021/22 through 2023/24 and establishes the initial IRM and FPR for 2024/25. The results are based on the 2020 capacity model, load model and capacity benefit of ties (CBOT).

The 2020 capacity model is putting downward pressure on the IRM, with the average effective equivalent demand forced outage rate (EEFORd) of 5.78%, compared to 6.03% in the 2019 RRS.

Garrido said the lower average EEFORd was caused by the increased representation of combined cycle units and gas turbines.

The CBOT — the help PJM can expect from imports during peak loads — is estimated to increase pressure on the IRM. Garrido said imports from neighboring RTOs have decreased from 1.6% in 2019 to 1.5% in 2020.

The FPR is essentially the same as 2019, Garrido said, coming in at 1.0865 instead of 1.086 the previous year.

Garrido said the study results will also be used in the 2022/23, 2023/24 and 2024/25 Base Residual Auctions (BRA). He said delays in the 2019 BRA for 2022/23 necessitated the use of data from the 2020 study.

The PJM and world load models used are based on the 2002-2014 period that were approved at the August PC meeting. (See “Load Model Selection,” PJM PC/TEAC Briefs: July 7, 2020.) Analysis from the 2020 PJM Load Forecast Report released in January was also used.

The PC will vote on the study results at its next meeting, with final votes at the Markets and Reliability Committee and Members Committee meetings in November.

Preliminary 2021 Capital Budget

Jim Snow of PJM reviewed the RTO’s preliminary 2021 capital budget, which is set at $40 million, roughly the same amount as the 2020 budget.

The largest portion of the proposed budget is for current applications and systems reliability, Snow said, with $15 million earmarked for projects compared to $19 million in the 2020 budget.

Some of the proposed systems reliability projects include cybersecurity enhancements for monitoring and access of PJM’s computer systems, automation and efficiency improvements for markets, and operations-related applications. Money is also set aside for the integration of eDART into PJM’s standardized software tools and to provide enhancements to the application through upgrades.

Snow said the next largest budget expense is for facilities and technology infrastructure at $11 million. Projects include purchasing network, server and storage infrastructure equipment to replace obsolete equipment and replacing conference room equipment to enhance capabilities for on-site and remote participants at the PJM campus. Money is also allocated for the replacement of the Valley Forge, Pa., control center’s below-grade-level cooling units and to add a backup cooling method.

Application replacements and retrofitting are proposed to be increased to $9 million in 2021 from $6 million in 2020. Projects include implementation of updated architecture to allow for future expansion of PJM’s transmission network application system and the Next Generation Markets project, a multiyear partnership among PJM, PJM MIC Briefs: April 15, 2020.)

Snow said the replacement of aging backup diesel generators for the control center building was deferred until a future budget. That project is expected to cost $5.4 million.

State Agreement Approach

Mark Sims of PJM provided an informational discussion and update on the RTO’s “state agreement approach.” PJM Dusts off ‘State Agreement’ Tx Approach.)

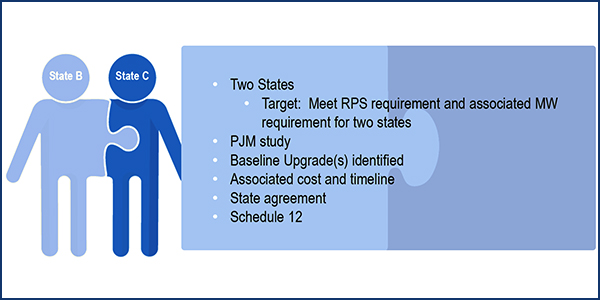

The approach allows individual states or groups of states to submit a transmission project for study by PJM, even if it does not qualify as a reliability or market efficiency initiative under the RTO’s Tariff. The project would be included in the Regional Transmission Expansion Plan (RTEP) as a supplemental project or baseline state public policy project — which could trigger a competitive solicitation — if the state(s) agree to pay for it.

Sims went through a theoretical example of a two-state solution under the approach. First a target project is identified that meets the renewable portfolio standards and associated megawatt requirements of the two states.

PJM would then model the generation in a study, and assumptions would be made to determine the best location for the generation and identify any needed baseline upgrades. Associated costs and a timeline for the baseline upgrades would then be created by PJM and would be documented in Schedule 12 of the Tariff.

Sims said a state can choose not to move forward with the approach at any time in the process.

Erik Heinle of the D.C. Office of the People’s Counsel asked if there is a scenario in which PJM will play a “matchmaker” between two states looking to find a solution through the approach and what role the RTO envisions playing in the process moving forward.

Sims said the process is totally driven by the states, but PJM is willing to play a part in conversations between government entities. He said a big part of the RTO’s role is education and instructing states on how the approach works.

PJM does not intend to find the optimal solution for states, he said. Instead, the RTO will work with states to identify the assumptions based on their needs and the RPS requirement.

“We are ready and willing to have conversations,” Sims said. “We’re here for any states who approach us.”

Transmission Expansion Advisory Committee

Market Efficiency Update

Nick Dumitriu of PJM presented the Transmission Expansion Advisory Committee with assumptions for the 2020/21 long-term market efficiency window, announcing that the RTO would post the preliminary base case on its website by the end of the week for stakeholders to examine.

Dumitriu said the base case is still not complete and some analysis has to be finished. He said the preliminary base case is being posted so that stakeholders can provide feedback to ensure the correct ratings and other data are included.

PJM will present the preliminary congestion drivers at the October TEAC meeting. The final base case and congestion drivers will be posted in December before the start of the 2020/21 long-term window in January.

Dumitriu said the base case power flow is consistent with the powerflow posted in the 2020 RTEP proposal window. The load forecast is based on the 2020 load forecast report, Dumitriu said, and the demand response is consistent with the same report.

The financial parameters for the preliminary base case are based on the Transmission Cost Information Center spreadsheet. The discount rate stands at 7.37%, Dumitriu said, and the levelized annual carrying charge rate is 11.82%.

Mark Ringhausen of Old Dominion Electric Cooperative asked how the annual carrying charge rate was determined. Ringhausen said that transmission owners with which his company interconnects have a “much higher” carrying charge.

Dumitriu said the number is tabulated from information contained in the Transmission Cost Information Center spreadsheet and is based on information from all TOs across PJM.

Hope Creek Line

Public Service Electric and Gas and Delmarva Power & Light presented solutions to help fix a line running from the Hope Creek Nuclear Station that continues to experience faults.

Esam Khadr of PSE&G presented needs and a solution for the supplemental project involving the 500-kV 5015 Red Lion line that runs from the nuclear plant in New Jersey to the Red Lion substation in Delaware. Khadr said the line has experienced nine faults in the last 10 years because of birds and lightning strikes, including two faults in April.

The line is currently protected using power line carrier relaying, additional simulation testing has revealed a more secure and reliable method for fault detection, and isolation is required to avoid potential overtrips, Khadr said.

Multiple towers on the line are only accessible by boat, Khadr said, so more accurate fault location methods are required. He said the 5015 line is critical to the operation of Hope Creek and the Salem Nuclear Power Plant.

The proposed solution calls for upgrading relaying of the 5015 line at Hope Creek and using existing fiber optic paths for primary and backup line protection. The estimated cost of the project is $1.2 million and is projected to be in service by March 2021.

Delaware Deputy Public Advocate Ruth Ann Price asked why the fault problem was not addressed when more than $250 million in stability upgrades to Artificial Island in New Jersey were planned in recent years. (See Artificial Island Cost Dispute is Over — Almost.) Price said it seemed “interesting” that when the Artificial Island upgrades were being discussed that the line failure issue was not brought up.

Alex Stern, director of RTO strategy for PSEG Services, explained that PJM originally chose an Artificial Island project that would have dealt with the fault issue, but the Board of Managers subsequently rescinded that decision and went with a different approach.

“It was still needed to be done at some point, and with two incidents during the pandemic, it elevated the concern,” Stern said.

Delmarva’s Steve Zelvis presented a proposed solution for his company’s portion of the project. It includes removing a wave trap at Red Lion and reconnecting communication over the existing fiber optic path. The estimated cost of the project is $200,000.

Price said the cost of Delmarva’s solution was fair. “The cost is within the scope of reasonableness,” she said.