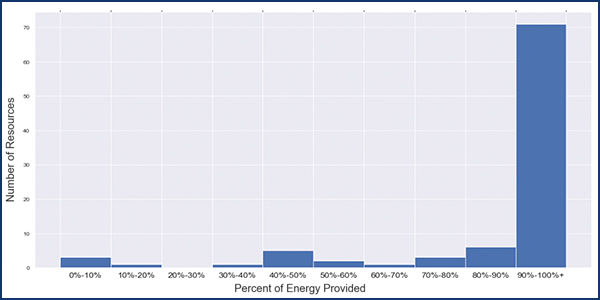

NYISO analysis of reserve pickup (RPU) performance for winter 2019/20 shows that 76% of the time, resources provided more than 90% of total energy expected.

Control Room Operations Manager Jon Sawyer told the Installed Capacity/Market Issues Working Group on Monday that from November 2019 to April 2020, 16 RPUs occurred, and there were 93 unique instances in which a resource was asked to convert reserves to energy.

For gas turbines, total energy provided was measured at the 11th minute after the start of the RPU. For all other resources, total energy provided was measured one minute after the end time of the RPU.

One stakeholder asked how aggregated data used in the analysis can account for single generating units that fail to perform adequately, and whether the ISO can provide such breakout data for the upcoming RPU report for summer 2020.

Sawyer said the ISO cannot divulge unit-specific data, but that it has a process for generators that do not pass a performance audit and is working through the same process for RPU performance.

The process involves the same tight tolerances used in an audit. As soon as a unit fails, there is immediate communication through the transmission owner to the generator that it did not pass, and the Market Mitigation and Analysis Department starts follow-up immediately, Sawyer said.

If a resource does not perform, or performs poorly, it will fail the audit, upon which NYISO may derate the resource’s response rates and possibly the resource’s upper operating limit. For a gas turbine that fails to start during the audit, there would be a derate down to 0 MW.

It’s expected that the generator would respond with the cause of the failure and what has been done to mitigate it, Sawyer said. The ISO would perform another audit of the same generator within 48 hours.

New Business

NYISO acknowledged that, as part of the ongoing demand curve reset, it has proposed a revision to the logic of the model used to estimate net energy and ancillary services revenue earnings for the hypothetical peaking plant. The revision addresses a misalignment of natural gas prices with actual delivery date associated with such prices.

One stakeholder asked if the ISO has looked back to see whether the same thing happened in the model in use for the past three and a half years.

Michael DeSocio, the ISO’s director for market design, said they are still investigating that issue and will have results in a week, or earlier if possible.

Another stakeholder asked about fast-start pricing revisions, which the ISO is supposed to be implementing by the end of this year.

DeSocio said that the software is in development and that the ISO expects to wrap it up in a couple weeks and move to testing, still on time for implementation by year-end.