More than 150 industry representatives, state officials, legal scholars and analysts attended the 35th annual Independent Power Producers of New York (IPPNY) Fall Conference on Tuesday to discuss resource adequacy, carbon pricing and emissions limits, as well as the broader need to address social and environmental justice.

IPPNY President and CEO Gavin Donohue released a set of six principles to guide members on their varied approaches to the transition to renewable energy resources. Reliability comes first, followed by the need to use markets to achieve decarbonization, electrify the transportation and heating sectors, develop needed transmission infrastructure, diversify fuels and technologies, and examine economic impacts.

“At some point in the near future, the question of New York’s reliability — generators’ ability to perform with quick, fast-starting, environmentally responsible units — is going to collide with the state’s public policy goals,” Donohue said.

Following is some of what we heard at the virtual meeting.

State Leadership

Ali Zaidi, chair of climate policy and finance in the office of Gov. Andrew Cuomo, highlighted three new initiatives this year to improve administrative efficiency and speed up the pace of the clean energy transition.

“The first is significant reform to our approach to permitting renewables within the state. You will be seeing soon proposals for how those changes get made here just a few months after the passage of the [siting] law,” Zaidi said.

The Office of Renewable Energy Siting the following day proposed draft regulations for permitting new wind and solar energy projects, as directed by the Accelerated Renewable Energy Growth and Community Benefits Act included as part of this year’s state budget.

Second is the governor’s “build-ready” initiative whereby the New York State Energy Research and Development Authority (NYSERDA) will prepare existing or abandoned commercial sites and brownfields to bundle with renewable energy contracts to provide de-risked package deals for private developers.

And third is the effort to speed up transmission infrastructure permitting and construction under the Public Service Commission’s grid study program, Zaidi said. (See NYPSC Launches Grid Study, Extends Solar Funding.)

“We know that if we want to decarbonize the entire economy, we need to help the grid reach further and deeper into the economy; specifically that means electrifying a greater share of the economy year over year,” he said. To that end, the governor this year launched an initiative to invest $1.5 billion in preparing the infrastructure to support electric vehicle charging stations, he said. (See NYPSC Approves $700 Million for EV Chargers.)

Asked what the administration’s thinking is on the upcoming carbon pricing conference at FERC and how it fits in with the state’s future, Zaidi said the technical conference would focus on state-of-the-art methods for evaluating the social costs of carbon and the implications for the power sector.

“Those are important conversations to have … and over the summer, we have proposed draft regulations on the social cost of carbon, which is going to be important in thinking about how those social costs are shaping decisions within state agencies,” Zaidi said.

Social Justice

The Climate Leadership and Community Protection Act (CLCPA), signed by Cuomo in July 2019 and enacted this year, calls for 70% of New York’s electricity to come from renewable energy resources by 2030 and for electricity to be 100% carbon-free by 2040.

“This landmark climate legislation has really shaken the ground and reset the table for the environmental conversation in New York state,” said Raya Salter, member of the New York Climate Action Council and lead policy organizer for NY Renews, a coalition of more than 200 environmental, justice, faith, labor and community groups.

Climate justice emanated from environmental justice as people became more aware of the climate crisis, and the concept eventually assumed economic aspects with the idea of a Green New Deal, she said.

“People are gravitating toward this idea of how can we make sure that we address the climate crisis yet make sure that folks get jobs [and] health care,” Salter said. “The origins of the term, however, are not as lefty as people may think. It still comes from a central-left, neoliberal or neoclassical economic idea that Milton Friedman came up with: … make these investments, and market-based mechanisms will help us drive our economy and address the climate crisis.”

The CLCPA is unique in terms of renewable portfolio standards, not only edging out California as being the most aggressive, but it includes justice provisions, she said. For example, no less than 35% of state spending on climate change will be directed toward disadvantaged communities.

Donohue asked whether NY Renews would be open to amending the CLCPA to open the industry up to more innovation and allow, for example, carbon capture and sequestration as an offset for IPPNY members, and allow them to use other technologies.

“Because NY Renews is a coalition, I can’t speak on behalf of it unless we have an official position. … However, I think innovation is opened up rather than constrained by the CLCPA,” Salter said.

On carbon pricing, the effort needs a revenue stream.

IPPNY Chairman Chris LaRoe, senior director for regulatory affairs at Brookfield Renewable, asked what initiatives or policies do Salter or NY Renews support to help existing renewable resources across the state benefit those communities in need of environmental justice: Is there a way for them to support each other, such as increased delivery into those areas?

“I think that’s right,” she said. “Certainly NY Renews has been a part of the large-scale renewable clean energy standard docket before the Public Service Commission. … Yes, we want to alleviate transmission constraints; yes, we want to see more in-city and in-state development of clean and resilient power.”

Investing in Reliability

NYISO Executive Vice President Emilie Nelson moderated a panel on capacity markets, public policy and the age of intermittency.

“When we think about New York specifically, we see the energy and ancillary services markets working together to provide sufficient revenues for the resources needed for reliability,” Nelson said. “With that idea, and considering that we’re working on a transitioning grid and there are significant environmental mandates that need to be satisfied … where do we start?”

Pallas LeeVanSchaik, vice president of Potomac Economics, which serves as the ISO’s Market Monitoring Unit, urged policymakers to retain the existing capacity market framework as “indispensable” for achieving the CLCPA’s goals.

“In our comments earlier this year in the [resource adequacy model] proceeding, we calculated just the outstanding obligations for capacity would reach $25 billion by 2040, so [leaving the organized capacity market] would involve huge risks to ratepayers and would also greatly increase market risk for suppliers,” he said.

Considering the reduction in capacity value since state renewable energy contracts were signed up to the summer of 2020, “our estimate is in the hundreds of millions of dollars of additional capacity costs to cover this shortfall … and that’s just in 2020 alone,” LeeVanSchaik said.

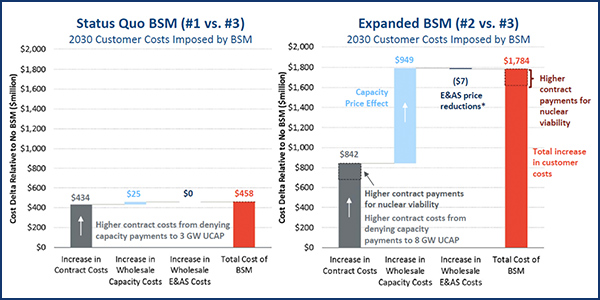

Kathleen Spees, principal at The Brattle Group, said that markets can play the main role in achieving state clean energy goals, rather than a secondary, supporting role, with buyer-side mitigation central to the discussion.

NYSERDA and the Department of Public Service this year engaged Brattle to explore alternatives to the existing capacity markets under the resource adequacy proceeding (Case No. 19-E-0530). Brattle provided qualitative analysis in May and updated quantitative analysis in July.

“Not just New York, but many of the states are concerned about buyer-side mitigation rules resulting, as they’re intended to do, in excluding policy resources from clearing in the capacity market,” Spees said. “The outcome of that is to keep capacity market prices higher than they otherwise would be.”

Carbon pricing would be “way better” if applied economywide, across regions, but Brattle prefers the Forward Clean Energy Market as it put forth in a paper last September, she said.

William Hogan, research director of the Harvard Electricity Policy Group (HEPG), which examines alternative strategies for competitive electricity markets, recommended increasing the importance of scarcity pricing.

“What I am trying to do is dispel the notion that the arrival of intermittent renewables with zero variable costs means that the energy market becomes unimportant, which is wrong; but what it does mean is that scarcity pricing becomes much more important,” Hogan said.

ERCOT is implementing much more aggressive scarcity pricing than what New York is doing, he said.

Examining ERCOT performance for summer 2019, Hogan said that “the tightest conditions frequently occurred earlier than the time of peak demand, so intuitively you would expect that net demand matters more than peak demand.”

Nelson asked panelists for an alternative to carbon pricing.

“I’m a hawk on this subject, so I think carbon pricing is necessary but not sufficient,” Hogan said. “We should be focusing our research and development on new technologies and innovation, not deploying the ones we currently have. We need something way better and that’s going to be transferrable to India.”

LeeVanSchaik agreed, but with a twist: “Even if [carbon pricing] by itself doesn’t achieve the goals of the CLCPA, in concert with other things, it certainly will allow the state to achieve those goals at a significantly lower cost.”