Markets and Reliability Committee

PMU Placement Endorsed

PJM stakeholders last week endorsed “quick-fix” manual revisions to expand the use of synchrophasors and make them a requirement for certain projects under the Regional Transmission Expansion Plan (RTEP).

The endorsement of the revisions at the Markets and Reliability Committee meeting Thursday came after members jockeyed to put friendly amendments in place. A friendly amendment by American Municipal Power (AMP) to proposed language in Manual 1 was ultimately endorsed, receiving a sector-weighted vote of 3.47 (69.4%), meeting the two-thirds threshold for passage.

AMP’s amendment added language giving PJM the ability to waive the phasor measurement unit (PMU) requirement on a “case-by-case basis.” The amended language also calls for the RTO to “evaluate the effectiveness of synchrophasor measurement on a periodic basis” and to work with stakeholders to modify requirements when necessary.

Steve Lieberman, assistant vice president of transmission and PJM affairs for AMP, said the addition of an evaluation by the RTO of the PMU installation in future years gave stakeholders who will be required to conduct the installation projects some security in the process.

“It gave us the comfort that we would be able to have some review of how these are going and what benefits PJM is seeing from them,” Lieberman said.

The vote came after several months of stakeholder debate over the requirement of installing synchrophasors — also known as PMUs — in new RTEP projects beginning June 1, 2021, to monitor bus voltage and line flows. (See PJM Stakeholders OK PMU Requirement.)

Shaun Murphy of PJM reviewed the language changes to Manual 1: Control Center and Data Exchange Requirements and Manual 14B: PJM Region Transmission Planning Process.

Murphy said adding PMUs will allow PJM to detect high-speed grid disturbances from oscillation events and equipment failures in real time while providing the ability for detailed analysis after a major outage. The installation of PMUs was a recommendation following the Northeast blackout of 2003, Murphy said, an event that lasted for four days, impacted 50 million people and carried an estimated cost of $6 billion.

For new substations with three or more non-radial transmission lines at 200 kV or above and four or more non-radial transmission lines between 100 and 200 kV, synchrophasor measurement signals will be required for:

- bus voltages at 100 kV and above;

- line-terminal voltage and current values for transmission lines at 100 kV and above;

- high-side/low-side voltage and current values for transformers at 100 kV and above; and

- dynamic reactive device power output (SVC, STATCOM and synchronous condensers).

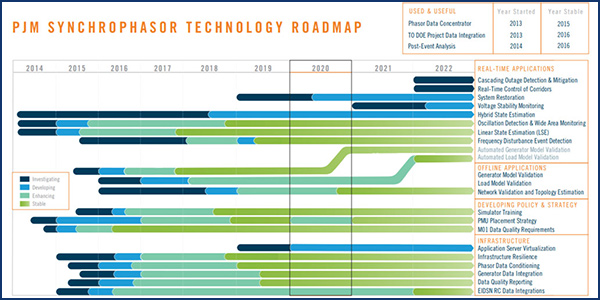

The manual language adds a PMU Placement Strategy (PPS), including placement targets and required operational dates.

PJM officials said making each substation “PMU ready” costs as much as $120,000 and each substation would have two or three PMUs that cost about $10,000 each.

Greg Poulos, executive director of the Consumer Advocates of the PJM States, said his group is supportive of the PMU installation concept but could not vote for the proposals. Poulos said the cost was the deciding factor because consumers will ultimately pay for the technology.

“There needs to be some level of cost-benefit analysis provided when a proposal like this is made,” Poulos said.

Cost Development Subcommittee Revisions

Stakeholders unanimously endorsed a revised charter for the Cost Development Subcommittee (CDS) despite an objection by the Independent Market Monitor over a change to its reporting structure.

Glen Boyle of PJM reviewed the proposed revisions to the CDS charter. He said the CDS, which was originally tasked with developing procedures for calculating the costs of products or services, has been dormant since 2013.

PJM and the Monitor have discussed the need to restart the CDS to address several issues, Boyle said, including Manual 15 clarifications, variable operations and maintenance (VOM), and fuel-cost policy clarifications and educational topics.

Under the new charter, the CDS will report to the Market Implementation Committee instead of the MRC, as most of the issues are handled at the MIC.

Monitor Joe Bowring said he opposed the reporting change, pointing to voting issues being brought to the MIC from the CDS.

“I don’t think it makes sense, and I don’t think there’s any good rationale provided for it,” Bowring said.

Calpine’s David “Scarp” Scarpignato said he agreed with PJM’s decision to have the subcommittee report to the MIC because it would give more time for issues to be vetted before they make their way to the MRC.

Susan Bruce of the PJM Industrial Customer Coalition said she was glad to see the CDS restarted, but she had “reservations” on the voting aspect of the MIC. Bruce said the concentration of asset owners in the affiliate voting of the MIC gives her concerns that some of the issues being discussed are “not getting a complete picture.”

But Bruce said she is comfortable with the change in reporting structure because a sector-weighted vote remains in place at the MRC for any issues coming out of the MIC. She said members should remember that it’s not a failure in the stakeholder process if an issue that comes from the MIC ultimately is voted down at the MRC.

“It should not be surprise if the sector-weighted vote at the MRC looks different than the vote coming out of the MIC because of the change in how the voting occurs,” Bruce said.

2020 Installed Reserve Margin Study Results

PJM is continuing to recommend an installed reserve margin (IRM) of 14.4%, down from 14.8% required in 2019.

Tom Falin, PJM’s director of resource adequacy planning, reviewed the 2020 reserve requirement study (RRS) results during a first read, which determine the RTO’s IRM and forecast pool requirement (FPR) for 2021/22 through 2023/24 and establishes the initial IRM and FPR for 2024/25. The results are based on the 2020 capacity model, load model and capacity benefit of ties (CBOT).

Falin said the 2020 capacity model is putting downward pressure on the IRM, with the average effective equivalent demand forced outage rate (EEFORd) of 5.78%, compared to 6.03% in the 2019 RRS. Falin said the lower average EEFORd was caused by the increased representation of combined cycle units and gas turbines.

The CBOT — the help PJM can expect from imports during peak loads — is estimated to increase pressure on the IRM. Falin said imports from neighboring RTOs have decreased from 1.6% in 2019 to 1.5% in 2020.

The FPR is essentially the same as 2019, Falin said, coming in at 1.0865 instead of 1.086 the previous year.

The PJM and world load models used are based on the 2002-2014 period and were approved at the August Planning Committee meeting. (See “Load Model Selection,” PJM PC/TEAC Briefs: July 7, 2020.) Analysis from the 2020 PJM Load Forecast Report released in January was also used.

Liquidation Process

Chief Risk Officer Nigeria Bloczynski reviewed proposed revisions to PJM’s rules for liquidating defaulted financial transmission rights positions.

Bloczynski said that through work being conducted at the Financial Risk Mitigation Senior Task Force, PJM has determined its desire to re-establish the ability to liquidate defaulted FTR open positions in a “prudent and practical manner.” Bloczynski said the RTO is also looking to provide flexibility in the way it exercises liquidation rights based on market liquidity, the size of the defaulted portfolio and market conditions.

Bloczynski said the liquidation process would include but is not limited to closing out, auctioning off portions of a portfolio across several regular auctions, and/or conducting one or more special FTR liquidation auctions.

In December 2018, PJM implemented changes to its Tariff and Operating Agreement ending the practice of liquidating a defaulting FTR participant’s open positions. This action followed the GreenHat Energy FTR portfolio default. (See FERC OKs Key PJM Changes to Address GreenHat Default.)

Stakeholders agreed to fast track the liquidation language into the Tariff and OA using a quick-fix approach, Bloczynski said, with endorsement of the proposed revisions being sought at the October MRC and MC meetings.

Members Committee

Schedule 9-2 Options

PJM CFO Lisa Drauschak reviewed for the Members Committee proposed near-term changes to the RTO’s administrative rates as recommended by the Finance Committee.

PJM recovers its operating expenses through Schedule 9 of the Tariff. Drauschak said 90% of Schedule 9 revenue is tied to actual load multiplied by a transmission factor, while the rest is connected to transactional activity.

The transactional FTR billing volume, which has increased 97% since 2011, is tied to Schedule 9-2, Drauschak said. The FTR administration service revenues have “significantly exceeded costs” because of an increase in the volume of FTR bidding activity, she said.

The Schedule 9-2 determinants are significantly higher than the assumptions used to build current stated rates, Drauschak said, which has led to the imbalance of revenues and expenses.

PJM is proposing to reset the refund percentages to allocate excess collections over a “rolling 12-month period, based on service category net revenue.” The RTO is recommending an amendment of the Schedule 9 refund mechanism to allocate the excess collections.

Members of the Finance Committee endorsed the recommendation at its Sept. 9 meeting. PJM will seek endorsement of the changes at the October MC meeting.