FERC last week denied LG&E and KU’s request for rehearing of its order rejecting the company’s proposed transition for exiting from market power mitigation measures, though it did alter the terms of its exit (ER19-2396, ER19-2397).

The commission imposed rate de-pancaking provisions to resolve horizontal market power concerns after Louisville Gas & Electric and Kentucky Utilities merged into a single company in 1998 and left MISO in 2006. In March 2019, the commission agreed the provisions could be removed because loads located in the LG&E/KU market would have access to enough competitive suppliers.

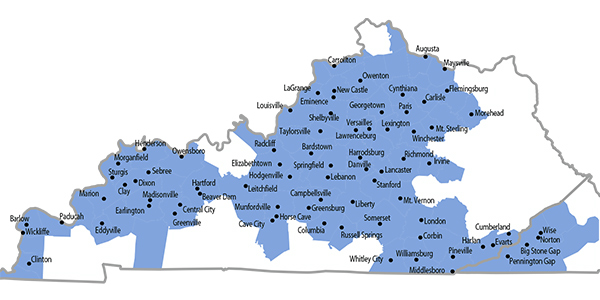

FERC conditioned the removal on a transition mechanism to protect Kentucky municipal customers that had relied on MISO transmission service. In its original September 2019 rejection, it identified several of these customers, including the city of Falmouth, located in the north of the state near its border with Ohio. (See FERC Orders Expanded Mitigation for LGE-KU.)

LG&E/KU, however, argued that Falmouth had joined East Kentucky Power Cooperative, a PJM member, in 2018 and thus should not be included in the transition mechanism. FERC acknowledged that it had erred and ruled that the city “should not be a transition customer.”

The commission otherwise rejected all of LG&E/KU’s numerous arguments, including that it ignored evidence that charges under certain MISO schedules are not pancaked charges, and that it erred by rejecting the company’s proposal to eliminate de-pancaking for exports to MISO.

“We find that LG&E/KU’s arguments overly simplify the context of this proceeding,” FERC wrote in its ruling.

In a separate but related ruling on rehearing, the commission also clarified its use of the “initial term” framework regarding the transition mechanism to Kentucky Municipal Power Agency’s (KMPA) ownership in the Prairie State Energy Campus project and the “take or pay” power sales agreements between it and its members (EC98-2-002, ER18-2162-001).

FERC had ruled that the transition mechanism would be “limited to the initial term of the power purchase agreements entered into by customers in the LG&E/KU market in reliance on the de-pancaking mitigation prior to the issuance of the March order.” But it said the agreements between KMPA and its members have no readily apparent “term” in the “same sense as the power purchase agreements discussed by the commission in the September rehearing order.”

It determined that the Prairie State agreements will be subject to the transition mechanism for a period of 10 years.

“We find a 10-year framework to be appropriate for the transition mechanism for power purchase or sales agreements with no initial term because, otherwise, the de-pancaking mitigation would continue in perpetuity in contrast to the March order, which directed that the de-pancaking mitigation can terminate,” the commission said. “We find that 10 years from the date of the issuance of the March order is a reasonable period of time to allow KMPA to plan for alternative supply choices before its power supply agreement is no longer subject to the transition mechanism.”