NERC will need to “scour through” its standards to keep up with the rapidly shifting generation mix in the North American bulk power system, particularly the spread of renewable energy resources like wind and solar, Chief Engineer Mark Lauby said at this week’s EnVision Forum, sponsored by FERC and Virginia Tech.

Lauby said the February winter storms and resulting mass outages in Texas and the Midwest had exposed pitfalls for which the system was not designed. (See ERCOT was ‘Seconds and Minutes’ from Total Collapse.) While many critics have focused on inadequate weatherization at generation facilities, Lauby observed that the cascading failures had also shown that the electric grid relies on other systems to a degree that operators and planners hadn’t realized.

“What we saw in Texas was gas alone becoming a critical asset … [a] facility, system or equipment which, when destroyed, degraded or otherwise rendered unavailable, would affect the reliable operation of our system,” Lauby said. “This is a very serious matter for us. … The two critical infrastructures were so interdependent that if one fails, the other fails, and we need to be able to build that into our scenario analysis.”

Lauby emphasized that he is “quite excited about the future,” pointing to emerging technologies such as battery energy storage systems, smart grids and microgrids that may help provide a measure of local resilience when the larger grid is facing challenges. But incorporating these advances into the BPS will require “a new design basis” for NERC that recognizes the interdependencies between the electric grid and other systems, and the vulnerability of a BPS that relies on a much wider range of generation resources.

ISO-NE CEO Gordon van Welie agreed, noting that with once-in-a-generation extreme weather events likely to become more frequent in the future, traditional methods of planning for reliability may not suffice. He urged utilities to take these spikes into account in their planning when considering whether backup solutions are worth the investment.

“As Texas showed, reliability on average is not enough. You need to deal with reliability under more stressful scenarios,” van Welie said. “I think that’s where ancillary services comes in. … That’s when we can specify we’re going to have enough energy stored in the system somewhere in some form, whether it be LNG, clean hydrogen or long-duration batteries; that when the wind doesn’t give us the output we need, we can turn on this other stuff.”

However, while these investments may be extremely helpful, van Welie also acknowledged they are often a big ask, especially for small utilities. He suggested that FERC can do more to incentivize these measures. Patricia Hoffman, acting assistant secretary at the Department of Energy, echoed this sentiment, calling for utilities and regulators to move their thinking out of the cycles in which they have been stuck for years — particularly with regard to storage, which she called a valuable tool to “complement the variable generation.”

“Storage may not be the total game changer, but it will be critical to providing important services to the grid. I do believe that storage needs to be looked at from a grid asset point of view,” Hoffman said. “We’ve spent … greater than 10 years talking about how to value energy storage, and we need to get beyond that conversation.”

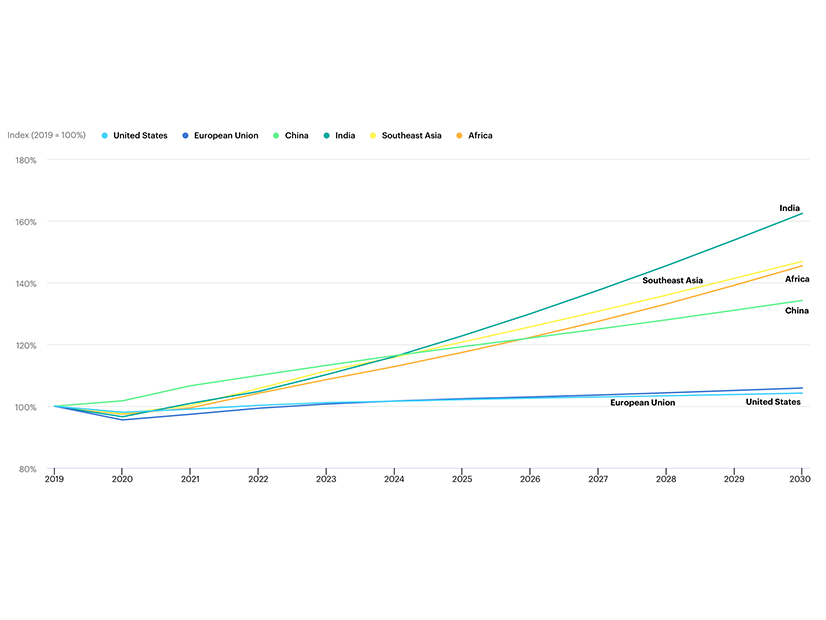

Brent Wanner, senior energy analyst at the International Energy Agency, reminded participants that the changing energy mix is an international story as well. With developing nations expanding their use of electricity, particularly in Asia, traditional energy sources will likely come under increasing pressure. That means that governments worldwide will look to diversify their energy mix, leading many countries to face similar questions of how to integrate the new resources.

“Over the next 20 years … we see steady growth in China, and you’re doubling over that period. But the strongest growth is actually [in] India, [which becomes] the third largest market in the world,” Wanner said. “Already this growth means that globally, we’re talking about a 50% increase in electricity demand over that 20-year period. … [So] you can already see that those decisions in Beijing … Washington, D.C. … [and] also in India” will have outside impacts.