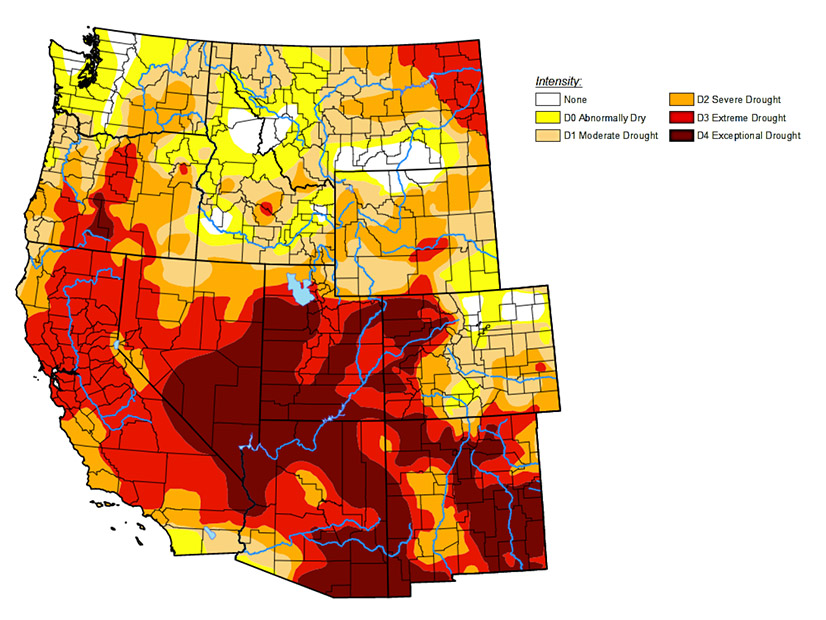

Extreme heat and drought conditions are once again a major cause for concern in the Western Interconnection, while the ongoing COVID-19 pandemic is likely to drive uncertainty across the North American electric grid, according to FERC’s 2021 Summer Energy Market and Reliability Assessment.

In the report issued Thursday during the commission’s monthly open meeting, FERC staff noted that “resource availability has improved for this summer” compared to last year, when the organization warned that Emergency Measures Possible for ERCOT, FERC Warns.) But while reserve margins are “expected to be adequate in all regions under normal conditions,” six out of 13 NERC subregions may experience energy emergencies during “extreme environmental conditions.”

Temperatures up Continent-wide

FERC’s assessment partially draws on NERC’s not yet released Summer Reliability Assessment, which NERC staff previewed at last week’s Board of Trustees meeting. (See “Reliability Assessment Preview,” NERC Board of Trustees/MRC Briefs: May 13, 2021.) In that presentation Mark Olson, NERC’s manager of reliability assessments, explained that the above-normal temperatures expected across much of North America this summer are likely to drive up electricity demand, leading to elevated risk of energy shortfalls across the Western Interconnection, Texas, MISO and New England.

FERC’s report expands on these projections, noting that the elevated temperatures could also limit supply “by affecting power plant heat rates and transmission line carrying capacity.” In addition, the hot and dry weather is likely to contribute to the Western Interconnection’s ongoing drought, raising the threat of wildfires as warned in a Western Drought Increases Wildfire Risks.)

“Wildfires pose major operational risks as they can threaten major transmission lines, strand generation and compromise the delivery of electricity to customers,” the report said. “Transmission lines also pose a liability risk as high winds or lightning, along with dry conditions, could damage equipment and potentially trigger wildfires.”

Last year saw five of the six largest fires in California history, according to the state’s Department of Forestry and Fire Protection, while Colorado experienced multiple fires in 2020 that exceeded the previous acreage record set in 2002. The year was also one of the most destructive fire seasons ever recorded in Oregon. With the threat continuing to mount, FERC warned that California utilities are likely to use public safety power shutoffs to mitigate the risk of wildfires, potentially impacting thousands of customers.

Grave Conditions for California Hydro

Another potential victim of the drought in California is hydropower because of ongoing shortfalls in the snowpack in the Sierra Nevada and other mountains that provide water to the state during its dry season from May to October. The melting snow also feeds into reservoirs for hydroelectric dams and supplies cooling water for thermal generation, but the lack of snowfall in recent years is contributing to major issues for these facilities.

“California’s snowpack is critically low, at 6% of normal levels as of May 11,” FERC’s Gilberto Gil told commissioners. “According to the California Department of Water Resources, this has resulted in two consecutive years of below-average levels; last year during the same period, snowpack level was 16% of normal levels.”

The supply of water is likely to run out even earlier than one might first assume, as small snowpack melts faster than usual. This means California’s hydropower generation could peak early in the year, with less generation available for mid- to late-summer.

There are bright spots in Western hydropower, however. Washington’s Columbia river basin is near normal levels with 86% of normal snowpack, while the snowpack of the state as a whole is at 125% of normal. As a result, hydropower generation in this area may be higher than normal, helping to “mitigate upward pressure on electricity prices” in California and other Western states.

Capacity Additions Help Regions Meet Margins

Aside from the issues in the West, FERC’s report notes that more than 10 GW of electric capacity is scheduled to enter operation during summer 2021. Solar, wind and battery resources make up the majority of these additions, with CAISO projected to add about 1 GW of battery storage capacity and 500 MW of solar and ERCOT adding 4.5 GW in wind, solar and batteries.

PJM is the only region predicting a net loss of capacity, with 3 GW to be retired against 2.5 GW coming online. The biggest retirement is the 2.3-GW Byron nuclear plant in northern Illinois, but 700 MW of coal-fired generation is expected to retire as well. The additions comprise natural gas, solar and wind resources.

But all regions are positioned to meet reserve margins, according to NERC’s preliminary figures. PJM even looks to have the biggest cushion, with its nearly 35% anticipated reserve margin more than double its reference margin level of 15%. ERCOT, with a 15.3% reserve margin and 13.8% reference margin, has the lowest.

While these levels mean all regions should have adequate resources for normal conditions, extreme weather events, such as last year’s Western heat wave or hurricanes in the SERC Reliability footprint, could create difficulties for utilities on either the demand or supply side. The COVID-19 pandemic also represents a major unknown in entities’ planning: With many employers planning to end their remote work postures, the changes in commercial and residential loads will be hard to predict.

Natural Gas Findings

FERC staff also presented forecasts of summer natural gas markets during Thursday’s presentation:

- Natural gas demand is expected to increase over last year, with demand — including net exports — up 2.6% to 82.9 Bcfd. This increase is attributed to a rebound in natural gas exports, up 4.6 Bcfd, or 85%, over 2020 levels. Total domestic demand is expected to decrease by 2.5 Bcfd, with the biggest decline — 4.6 Bcfd — in electricity generation because of higher gas prices relative to last year.

- Production is projected to increase 2.2% above summer 2020 levels to 91.4 Bcfd, resuming a pattern of growth every year since 2017 that was broken last year because of the pandemic. The 2021 rise is largely attributed to an increase in crude oil costs, with WTI crude spot prices up nearly $20 on average over last summer.

- Inventories are projected to be 3,700 Bcf at the end of the injection season in October, down 200 Bcf from last year. The injection season began at 1,750 Bcf, 240 Bcf lower than at the start of the 2020 season. However, the weakened demand because of the pandemic means natural gas volumes added to storage during this year’s injection season should be higher than both last year’s total and the five-year average.