SPP stakeholders last week endorsed a 10-year assessment of reliability and economic transmission projects that will likely continue to struggle to stay abreast of wind energy development.

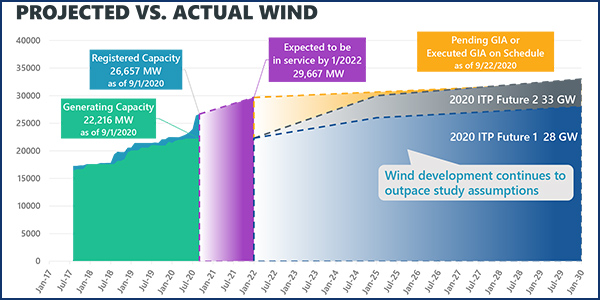

“Actual wind in the ground outstrips our projections almost every time,” ITC Holdings’ Alan Myers, who chairs the Economic Studies Working Group responsible for the study, said during the Markets and Operations Policy Committee meeting, held Oct. 13 to 14.

The 2020 Integrated Transmission Planning (ITP) study comprises 54 projects at an estimated cost of $532 million, with a projected 4.0- to 5.2-to-1 benefit-to-cost ratio. The portfolio includes 92 miles of 345-kV transmission lines and 141 miles of rebuilt high-voltage infrastructure.

The two-year assessment’s business-as-usual reference case future projects 26 GW of wind energy by 2025 and 28 GW by 2030. The more aggressive “emerging technologies” future foresees 30 GW of wind by 2025 and 33 GW by 2030.

Meanwhile, SPP had 26.7 GW of registered wind capacity as of Sept. 1 and expects to have 29.7 GW in service by 2022.

“We are getting better. The projections for this study are a little further out,” Myers said. “You can draw the conclusion that we could have added more wind than we did.”

“If you look at ITPs in the past, most of the [reference case] Year 10 assumptions came to reality in two years,” SPP Director of System Planning Casey Cathey said. “Our wind assumptions … are becoming a reality a lot faster than Year 10.”

Casey called the ITP portfolio “fairly strong,” citing its B/C ratio. The study also took into account fossil fuel retirements and a 4- to 9-GW increase in solar generation.

The ITP assessment drew the usual criticism from transmission owners wary of building more 40-year facilities on top of the $10 billion or so in recently constructed SPP infrastructure.

“One of the questions we’ve asked for a long time is at what point do you quit building? At what point do you quit asking customers to be paying for these facilities?” Oklahoma Gas & Electric’s Greg McAuley asked. “We question the long-term viability of those benefits. We have no idea what the industry will look like in 40 years, much less in 10 years. The right transmission needs to be built. It’s these economic projects that we have the most concern about because those costs don’t go away.”

“These 40-year investments we’re making are actually fixed costs to the customers,” Golden Spread Electric Cooperative’s Mike Wise said. “SPP is showing variable costs with the B/C ratios. We’re trying to say the fixed costs are substantially risky because 40 years of fixed costs reduce some variable costs. Enough is enough. You can go broke to save money.”

The TOs approved the ITP study by a 12-2 margin, with three abstentions, as the measure passed with 88% overall approval.

Center Stage for Electric Storage Proposals

Members began to address the footprint’s growing wave of energy storage resources (ESRs) by endorsing six recommendations from a white paper calling for SPP to capitalize on ESRs’ flexibility, reliability and economic benefits by developing cost-recovery mechanisms and determining whether they are used as generation and/or transmission assets. (See SPP Planning Approach to Battery Storage.)

“And many more to come,” said Evergy’s Allen Klassen, chair of the Operating Reliability Working Group (ORWG), referencing the document’s 37 proposals.

The ORWG worked with the Supply Adequacy Working Group (SAWG) in agreeing with the white paper’s recommendation to support use of the available effective load-carrying capability (ELCC) for ESR accreditation. The groups also urged adopting a four-hour minimum duration for capacity accreditation and no additional real-time ESR availability criteria.

Both recommendations passed unanimously. However, the two groups were unable to agree on the number of ESRs that can be aggregated in a resource adequacy portfolio. The ORWG recommended a maximum ESR participation limitation for each load-responsible entity, based on load and resource capacity calculations, while the SAWG argued against a participation limit “at this time.”

“We don’t feel the need to take action right now until we see the penetration and how batteries are used,” said Golden Spread’s Natasha Henderson, the SAWG’s chair. “We just don’t think we have the data to know what that limit is right now.”

SPP COO Lanny Nickell said staff will work on a scope document for a task force that further studies the issue related to FERC Order 2222. Staff have already suggested a name for the task force: The 2×4.

Separately, the SAWG produced a white paper proposing a methodology for prioritizing and allocating the available ELCC from capacity-qualifying ESRs in SPP. The group contracted an outside consultant to analyze an ESR’s capacity credit on the SPP system using ELCC and capacity value and two dispatch strategies: preserving reliability and economic arbitrage. The study also evaluated the capacity credit of batteries using two-, four-, six- and eight-hour equipment.

The MOPC also approved a Market Working Group (MWG) proposal for modeling and controlling ESRs’ hybrid configurations, passing the measure against a single opposing vote.

The MWG and other stakeholders and staff chose a market storage resource (MSR) model among three other alternatives. The MSR market-registration model was created for FERC Order 841, which directed RTOs and ISOs to eliminate barriers to ESR participation in their markets. The model allows generating and storage resources to be represented as a single resource in the market model with one set of offers.

“To the market, it looks like one resource,” SPP’s Gary Cate said. “The less resources the market-clearing engine has in its matrix, the less time it takes to solve. This model could apply more broadly to anything that has storage.”

The ESRs will still be modeled separately for reliability purposes, with offer parameters consisting of all those associated with MSRs. A single offer curve would be submitted, but SPP said this could prove challenging for mitigated offer-curve development because the generating costs represent a blended opportunity cost of injecting and/or self-charging. Staff said the MSR option will allow market participants to manage the co-located resources’ interactions as long as their total injection or withdrawal meet the combined dispatch.

Cate said SPP has looked at how other RTOs are addressing battery storage “because everyone is going through this at the same time.” (See RTOs/ISOs File FERC Order 841 Compliance Plans.)

The committee also endorsed:

- the Regional Tariff Working Group (RTWG) and MWG’s recommendation that transmission-only ESRs should not pay transmission service and/or ancillary charges related to their charging activity. Stakeholders said this would put ESRs on the same level with other transmission assets providing similar services for which they do not pay service charges.

- An ORWG white paper that urges development of a policy requiring fast-responding ESR owners and operators to clearly define the resource’s ramping capability during the registration process; the definition of acceptable response-rate ranges for each ancillary service and ensure coordination of energy deployment across all participating resources; and governing policies that require resources to perform within their registered capability as dispatched by SPP. The MWG will take the lead on the work.

Interconnection Improvements

A cross-functional MOPC stakeholder group directed to develop policies creating a balance between energy resource interconnection service (ERIS), network resource interconnection service (NRIS), generator-interconnection products and long-term firm transmission service secured approval for a 72-page white paper and a recommendation to replace NRIS with a new capacity resource interconnection service (CRIS).

The NRIS/ERIS Deliverability Task Force (NEDTF) said CRIS would add deliverability to the existing NRIS product and provide a clearer distinction between the two services.

CRIS provides capacity deliverability from a single resource to any load within a control area, balancing authority or other designated region that contains more than a single load. NRIS provides the interconnection customer with a sufficient interconnection that allows the generator to qualify as a designated network resource on the transmission provider’s system without additional network upgrades.

NEDTF Chair Rob Janssen, with Dogwood Energy, said the task force, which evolved from a Holistic Integrated Tariff Team (HITT) recommendation, engaged with several other working groups, gaining generally favorable feedback. He said there was general agreement that larger deliverability areas are preferable.

The NEDTF received a little bit more pushback on its proposal to tighten thresholds for mitigating ERIS system impacts, picking up on work by a previous task force. The proposed revision request would address stakeholder conclusions that too many unmitigated constraints lead to undesirable effects in the SPP market.

Committee members expressed concern over the $400,000 cost, but staff noted most congestion studies require building a generation and portfolio modeling system. In the end, the MOPC gave the threshold-tightening recommendation against just four opposing votes.

Members also endorsed the NEDTF’s white paper, which Janssen said would “lay the foundation” for whatever work will follow.

More White Papers Approved

The MOPC overwhelmingly signed off on several white papers related to the HITT’s recommendations:

- the Transmission Work Group’s paper documenting modifications to Tariff Attachment AQ limiting its application to new load, revisions to loads and load retirements that need to be addressed outside of the ITP because of timing or some other “significant” reason. The paper, approved unanimously, was produced to increase transparency and shorten the turnaround time to facilitate load growth.

- a joint report from the ORWG and MWG demonstrating the economic benefits of topology optimization by using existing transmission assets to increase grid flexibility and efficiency. According to the report, while transmission elements are traditionally viewed as static elements, their topology reconfigurations may provide a means to reliably reroute power around congested facilities without causing additional burden on the system.

- The ORWG and MWG also produced a second white paper on economic outage coordination that was part of the consent agenda. The paper explored other RTOs’ outage coordination processes and criteria thresholds before concluding SPP will need to invest time and money fully integrating and streamlining the process to take full advantage of the economic benefits.

Staff will use the white papers to develop policy and Tariff language to implement the changes.

$91M Increase for NPPD’s R-Project

Members approved a nearly $91 million increase for Nebraska Public Power District’s R-Project, raising the controversial 345-kV initiative’s price tag to $463.4 million. The measure passed with 83.5% approval.

NPPD warned the Project Cost Working Group in September that it expected the project to be out of bandwidth in the near term. The publicly owned utility has already sunk $100 million into the project and said its original estimate “significantly underestimated” the environmental cost, which was based on typical environmental tasks in previous efforts.

The project comprises 225 miles of 345-kV transmission line running through the environmentally sensitive Nebraska Sandhills and two new substations. It was approved as part of the ITP 10-year assessment in 2012 and received a notification to construct with conditions the following year.

In June, a federal district judge revoked a federal permit that would have allowed NPPD to kill or severely disturb the endangered American burying beetle during construction. The utility has said the ruling will delay but not stop the project, which has a 2024 in-service date.

Several TOs called for the project to be suspended and re-evaluated over cost concerns. That motion failed with only 30% approval.

“Is this still the right project?” asked Bill Grant, of Xcel Energy’s Southwestern Public Service. “This has been re-baselined several times, and I have huge concerns we’re not doing our due diligence. I have to ask whether this project is prudent or not.”

“This is a significant overrun here, and it’s been going on for a long time. At some point, we have to take another look at it,” McAuley said. “That’s why those of us who build transmission are very cautious. There’s always uncertainty. You can wind up in this situation four or five years down the road, but it’s too late. Customers are already paying for it.”

SPP staff said several generator interconnection agreements are dependent on the project, which has been framed as enabling renewable power, reducing congestion and strengthening system reliability.

“We have to continue to honor the [transmission] service in those agreements,” said Antoine Lucas, SPP’s vice president of engineering.

“The assumptions on this line going in are not the same as they were years ago,” said Advanced Power Alliance’s Steve Gaw, noting the project was originally approved as a reliability solution. “To evaluate and further delay this project has the potential to significantly increase costs.”

Carias Governs Last Meeting as Chair

MOPC members honored their chair, NextEra Energy Resources’ Holly Carias, with a virtual happy hour following the end of her two-year term and treated her to a parade of compliments.

“I couldn’t have done it without the entire membership. We had some challenges with COVID, but I think we responded pretty well,” she said. The full committee met virtually three times during the year, aided by staff’s development of an efficient e-voting system.

SPP COO Lanny Nickell, the committee’s staff secretary, noted that it will soon complete a structural reorganization of its stakeholder groups, an effort that began shortly after Carias took the gavel in January 2019.

“Holly led the group with poise and tact,” SPP Board of Directors Chairman Larry Altenbaumer said.

Evergy’s Denise Buffington, who served as Carias’ vice chair, shared an Albert Einstein quote translated from the original German: “Life is like riding a bicycle. To keep your balance, you must keep moving.”

Carias will continue as MOPC chair until November. She is leaving NextEra for Avangrid Renewables, where she will be vice president of origination. Buffington will serve as acting chair for the remainder of the term, which ends Dec. 31.

“We’re not [an SPP] member, but hopefully we will be soon,” Carias said.

Avangrid Renewables is a subsidiary of Spain’s Iberdrola Group, a renewable energy pioneer with more than 32 GW of projects spread across a dozen countries. Portland, Ore.-based Avangrid has more than 7.3 GW of wind and solar generation in more than 20 states.

Some Byway Costs to be Allocated Regionally

The MOPC endorsed the RTWG’s recommendation to implement previously approved language that creates a narrow process through which costs for transmission projects between 100 and 300 kV primarily used to move power out of the local transmission pricing zones can be fully allocated prospectively on a regionwide basis.

TOs opposed the measure (RTWG RR422) over what they said was a shift of byway cost responsibility from wind-rich areas to others. The change cleared TOs by 10-5 but enjoyed a 31-7 approval from transmission users in gaining an overall approval of 72.12%.

The board and the Regional State Committee both approved the white paper in July. (See “Board OKs 4 HITT Recommendations,” SPP Board of Directors/MC Briefs: July 28, 2020.)

The MOPC’s consent agenda, which passed unanimously, included nine additional revision requests:

- ESWG RR403: updates the ITP manual language to support current capabilities, as software revisions prevent building models on historic time periods.

- MWG RR420: adds clarifying language to ensure SPP’s fast-start pricing practices are in FERC compliance. (See “Directs Further Compliance Filing on Fast-start Resources,” FERC OKs 2 Changes from SPP’s HITT Work.)

- MWG RR421: removes registration provisions requiring energy storage resources to provide certification that its participation in the market is not precluded by the relevant electric retail regulatory authority, as required to FERC to be in compliance. (See RTOs Move Closer to Full Order 841 Implementation.)

- MWG RR425: adjusts the day-ahead make-whole payment charge type’s calculations and changes the real-time out-of-merit charge type and the reliability unit commitment make-whole payment calculations.

- PCWG RR415: clarifies and updates existing language in Business Practice 7060 (Notification to Construct and Project Cost-Estimating Processes).

- RTWG RR423: removes expired or terminated grandfathered agreements from a Tariff attachment’s index and updates any termination dates that have changed or any changes in buying or selling party terminology.

- SAWG RR412: allows both new and upgraded capacity from existing generators to be treated equally in qualifying as accredited capacity during the first peak season that each is available, thereby preserving the members’ expected generation investment value.

- TWG/ESWG RR427: removes some of the detailed project proposal form’s requirements to reduce its size and scope.

- Staff RR416: brings more accurate reporting and communication of RRs. Clarifies when an RR exploder is required to be used; requires summaries and notices of FERC rulings on RRs; and adds a section that documents the purpose of what is to be included in the RR master list.

The consent agenda also included approval of a $14.67 million increase above the $32.46 million original estimate for Empire District and Evergy Kansas Central’s 161-kV rebuild in eastern Kansas; an additional 161/69-kV transformer for Apex Clean Energy’s Jayhawk Wind project in eastern Kansas; scope revisions for the MOPC’s reorganized stakeholder groups; and the 2019-2020 annual violation relaxation limits report.