ERCOT staff last week promised to reduce price corrections before asking the Board of Directors to approve a pair of them for two unrelated events.

“Our goal is always to have zero errors,” Kenan Ögelman, ERCOT’s vice president of commercial operations, told directors during their meeting Oct. 13. “We’re kind of redoubling our efforts to get to that point, because errors that lead to price corrections are disruptive.”

Ögelman said a staff monitoring group will review system design changes, “the last line of defense to make sure we’ve got this right,” and staff will ensure business practices are in line with industry best practices. Manual processes will go through a “more rigorous change-control process” and external data will be validated, he said.

ERCOT will also work with stakeholders to reduce price-correction requests to the board by “better defining ‘significance,’” the only threshold for determining which market errors require board-approved corrections. Ögelman said staff will likely bring to the board protocol language that tightens the threshold on what level of errors require price corrections in the future.

“We know how disruptive changes to the day-ahead market might be,” he said.

At issue are two unrelated events that affected 25 operating days. A staffer incorrectly applied dynamic ratings to three transmission transformers in the system model that affected 21 day-ahead operating days and one real-time operating day. Another modeling error affected three operating days in August. (See “Staff Promise Action to Reduce Errors Causing Price Corrections,” ERCOT Technical Advisory Comm. Briefs: Sept. 23, 2020.)

The board unanimously approved all of the price corrections, agreeing with staff’s recommendation that the prices had been “significantly affected by an error.”

“If we want to change the policy on a forward basis, that’s fine,” said Oncor’s Mark Carpenter, representing the Investor-Owned Utilities segment. “There’s no reason to go against ERCOT’s recommendation.”

Unaffiliated Director Peter Cramton agreed with the need for a strong policy, saying price corrections are not good, but that “the reality is there will be errors occasionally.”

“Think about glassware. There are times you drop the glass and it shatters into a million pieces. Too bad, but the reaction shouldn’t be, ‘Let’s reassemble the glass.’ No, you clean it up,” Cramton said. “The reality is, you can’t turn the clock back … minimize the presentation of the broken glass on the floor to the board.”

Directors Reject DC Tie Appeal

The board rejected an appeal of a previous revision to the Planning Guide clarifying that the transmission planning analysis will assume DC tie flows are curtailed when necessary to meet reliability criteria (PGRR077). (See “TAC Adds 10 Change Requests to List,” ERCOT Technical Advisory Comm. Briefs: Sept. 23, 2020.)

Rainbow Energy Marketing’s Shams Siddiqi appealed the decision for fairness and equity reasons, saying DC tie loads pay more than their fair share of transmission cost of service (TCOS) charges. The current $23/MWh TCOS for exports during summer off-peak hours is a significant barrier to exporting energy and suppresses the market’s opportunity to address the allocation of sunk costs, he said.

“This only makes sense if DC tie load is not allocated any TCOS,” Siddiqi said.

The directors were unswayed and voted unanimously to reject the appeal.

The board also unanimously approved a Nodal Protocol revision request (NPRR) and an Other Binding Document revision request (OBDRR) brought forward by the Technical Advisory Committee:

Summer Demand Short of Record Peak

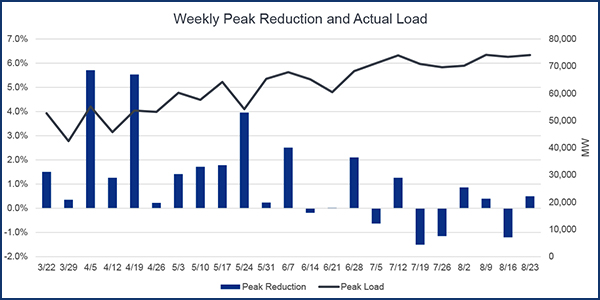

ERCOT sailed through the summer without setting a new systemwide peak or declaring energy emergency alerts, staff said, despite Texas undergoing its seventh-hottest summer on record since 1895.

The grid operator reached its peak of 74.4 GW on Aug. 13, falling short of its pre-summer expectations of 75.2 GW and its all-time mark of 74.8 GW, set last August. The grid did set a new peak for July when demand hit 74.3 GW on July 13.

Dan Woodfin, senior director of system operations, said the pandemic’s effects on demand were most noticeable in April, but demand had returned to normal by the end of summer.

The Texas grid operator had about 4 GW of additional installed wind capacity and 2.1 GW of additional solar capacity going into the summer than it did in 2019. Wind energy accounted for 23.3% of its fuel mix in June but dropped down to 15.8% in August, as typically occurs.

The Independent Market Monitor’s executive director, Carrie Bivens, said real-time settlement prices peaked at nearly $120/MWh in August. The operating reserve demand curve, which provides a price adder during tight conditions, was responsible for about 9% of the increase. Real-time prices stayed below $30/MWh in June and July, she said.

Con Ed CEO Nominated to Board

Former Consolidated Edison CEO Craig Ivey has been nominated for the third vacant seat on the ERCOT board, Chair Craven Crowell said. His nomination will be presented to members during their virtual annual meeting in December.

Members in June approved the nominations of Michigan Public Service Commission Chair Sally Talberg and retired ERCOT Briefs: Week of July 6, 2020.)

“Chair Crowell has told me several times [that] getting this done was the job he really wanted to complete before leaving … to put us in good stead for the future,” ERCOT CEO Bill Magness said.

Crowell is stepping away from the board in January after eight years at its helm.

Near Unanimous Consent Agenda

The board came close to unanimously approving its consent agenda, which included seven NPRRs and a system change request. The city of Dallas’ Nick Fehrenbach, representing the Consumers segment, voted against NPRR1038.

-

-

- NPRR999: revises protocol language on DC tie schedules and creates a section related to ramp limitations on DC ties. It is intended to clarify that when ERCOT determines system conditions show insufficient ramp capability to meet the sum of all DC ties’ scheduled ramp, it will curtail schedules on a last-in, first-out basis. Before curtailing DC tie schedules, ERCOT, with enough time, may request one or more qualified scheduling entities to voluntarily resubmit e-tags with an adjusted ramp duration.

- NPRR1027: removes gray-boxed language from the protocols related to NPRR702 (Flexible Accounts, Payment of Invoices, and Disposition of Interest on Cash Collateral) following the elimination of prepay accounts.

- NPRR1033: specifies that ERCOT does not have an obligation to pay interest on former market participants’ cash collateral balances upon its determination that financial security is no longer needed to cover the terminated participant’s potential future obligations.

- NPRR1035: requires ERCOT to publish all DC tie schedules 60 days after the operating day.

- NPRR1036: clarifies some processes associated with late payments and payment breaches and aligns protocol language on market participants’ registration and qualification with language in the standard form market participant agreements.

- NPRR1037: corrects switchable generation resources’ (SWGRs) settlement when instructed to switch from a non-ERCOT control area to the ERCOT control area.

- NPRR1038: establishes a limited exemption from reactive power requirements for some energy storage resources (ESRs). The exemption is available only to an ESR that achieved initial synchronization before Dec. 16, 2019, and applies only to the extent the resource is unable to comply with the reactive power requirements when it is charging. To qualify, the ESR’s operator must submit a notarized attestation to ERCOT that says the ESR would be unable to comply with the requirements without making physical or software changes.

- SCR811: adds a predicted five-minute solar ramp to the resource-limit calculator’s formula for calculating the generation-to-be-dispatched value. The solar ramp rate will be calculated from the intra-hour PV power forecast and the short-term PV power forecast.

-