Avangrid is poised to expand into the Southwest after announcing Wednesday that it will spend $4.3 billion in cash to acquire PNM Resources, which operates regulated utilities in New Mexico and Texas.

Connecticut-based Avangrid has agreed to pay $50.30/share for PNM, a 19.3% premium over its average closing price over the last 30 days, and will assume $4 billion in debt.

Avangrid’s parent company, Spanish energy giant Iberdrola, said the merged company would have assets worth $40 billion and generate around $2.5 billion in earnings and a net profit of $850 million.

PNM shareholders unanimously approved the transaction. Additional approval from state and federal regulators is needed, including FERC, the New Mexico Public Regulation Commission, the Public Utility Commission of Texas, the Federal Communications Commission and the Nuclear Regulatory Commission. The deal must also be cleared under the antitrust provisions of the Hart Scott Rodino Act and receive approval from the Committee on Foreign Investment in the United States. Regulatory approvals should take approximately 12 months.

Avangrid CEO Dennis Arriola will continue in that role for the combined company. In a statement, Arriola said the merger is “a strategic fit and helps us further our growth in both clean energy distribution and transmission, as well as helping to expand our growing leadership position in renewables.”

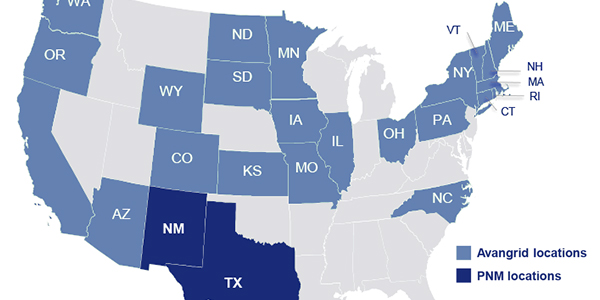

PNM’s utilities provide electricity to nearly 800,000 homes and businesses in New Mexico and Texas; Avangrid has 3.3 million customers in Connecticut, Maine, Massachusetts and New York. PNM also owns power plants and wind farms in New Mexico. Avangrid currently owns 1,900 MW of renewable energy in 22 states and has a pipeline of 1,400 MW of renewables assets in New Mexico and Texas.

Iberdrola CEO Ignacio Galán said during an earnings call Wednesday that the merger “fits our strategy and improves our position and growth potential significantly in the United States … one of our key geographies.”

It also creates one of the biggest clean energy companies in the U.S., with 10 regulated utilities in six states and renewable energy operations in 24 states. The enlarged company will be the third-biggest U.S. renewables operator, with about 7.4 GW of capacity, nearly all of which is onshore wind, and a growing pipeline of offshore projects including Vineyard Wind and Park City Wind in New England.

Vineyard is an 800-MW joint venture between Avangrid and Copenhagen Infrastructure Partners (CIP). The project’s expected in-service date has been pushed back to no earlier than 2023 because of delays from the U.S. Bureau of Ocean Energy Management in issuing its final environmental impact study and record of decision. (See BOEM Issues Revised EIS for Vineyard Wind.) Avangrid also partnered with CIP to develop the 804-MW Park City project, which has an expected in-service date of 2025.

“When nobody believes [that] the electricity can be produced with clean sources and everybody thought coal would remain for centuries, and the oil and gas are absolutely needed, we were already the only one saying that we can already generate and produce electricity with clean sources,” Galán said.

PNM has received regulatory approval to more than triple its renewable power capacity to 2 GW by the end of 2022, with a goal to be 100% emissions-free by 2040. There is also an approved exit plan for the 2022 retirement of the coal-fired San Juan Generating Station, of which PNM owns 66.3%, with securitization bonds used to recover the investment, a portion of decommissioning and other costs.

Pedro Azagra Blázquez, corporate development director for Iberdrola, said the company and its subsidiaries “will have no control of any coal asset” by 2022.