Unlike spring, when New York City was the epicenter of the COVID-19 pandemic, health indicators are now pointing in the right direction for the city, but its unemployment rate is still about double the national average, according to Moody’s Analytics.

Moody’s expects the recovery of the U.S. economy to extend over one to two years, given the unlikelihood of an effective vaccine becoming available before spring 2021. But after national GDP fell more than 10% last spring, the economy is slightly more than halfway back, Adam Kamins, a director at Moody’s, said Wednesday at the NYISO Fall Economic Conference.

The economy was technically in recession for only two or three months before it began to recover, but the hit was “extraordinarily deep,” he said.

“A lot of the lower hanging fruit was plucked, because firms reopened; people started to re-engage with the economy; you started to see a little bit more restaurant reopenings and stores starting to reopen and a return to something resembling normalcy,” Kamins said. “For sports fans like me, it’s almost a microcosm of what you saw over the course of the summer; you saw sports return, but in a weird and different way, with no fans. That’s how you can think of the economy too.”

Moody’s calls the current period “the pre-vaccine recovery” phase, with a “pretty stagnant economy” projected through 2021, Kamins said.

“First, the fiscal stimulus has expired, and our baseline expectation is that there won’t be more stimulus coming from the federal government until probably after the next inauguration in January,” Kamins said. “The other factor is that COVID-19 cases are rising, and they are starting to rise pretty rapidly in a lot of the country,” especially in the Sunbelt states and in the Upper Midwest.

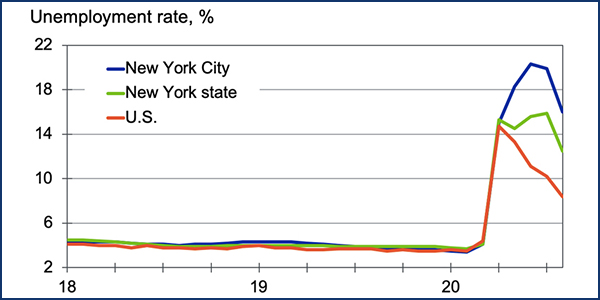

New York’s economic outlook is “still pretty bleak,” he said. The shock from being the national epicenter of the pandemic was so severe that the city’s unemployment rate shot up to 20%, easily an all-time high since statisticians started keeping records 50 years ago.

The gaps are starting to narrow between the city, the rest of the state and the rest of the country. But the state was the second-worst performing in terms of three-month annualized growth through August, after Hawaii, he said.

State Handling COVID

In terms of its handling of the pandemic, while infection and death rates are rising everywhere in the U.S., New York is actually better off than most of the country, he said.

“We have an alarming trend here where cases are starting to spread out from the middle of the country,” Kamins said. All but two states are experiencing an increase in daily per capita cases, so the country is in “a pretty tough spot” while it waits for a dependable, widely available vaccine, he said.

Western New York and the capital region have fared particularly well in terms of infection rates, and “two relatively large metro areas are at the top of the list in terms of best performance with respect to COVID-19. … We have fewer than one out of 1,000 residents in both Rochester and Albany that have tested positive, and those are the lowest numbers in the U.S.,” Kamins said.

This fact is all the more impressive considering that New York’s testing capacity is as high if not higher than that of any other state, so it is well positioned to ride out a second wave of COVID infections, he said.

Election Outcomes

Kamins closed out his national presentation with a one-page summary of the policy differences between former Vice President Joe Biden and President Trump.

“Generally, in terms of governing and COVID-19 response, a Biden administration would be looking at a federally led approach, would be looking to strengthen institutions and the federal government,” he said. “The Trump administration’s approach has been more state-led; they’ve taken more proactive steps to weaken government oversight in some ways, weaken some institutions.”

A Democratic-controlled Senate with Biden in the White House would likely pass a hefty fiscal stimulus package, which would create more jobs, he said, noting that the Biden campaign had cited Moody’s numbers. (See ‘Massive’ Clean Energy Stimulus Under Biden Likely)

“Take that for what it’s worth, but our point of view is pretty clear: that that would be the most beneficial outcome for the economy,” Kamins said.

Moody’s model indicates a narrow win for Biden, but “I still remember vividly telling you four years ago that our model predicted a pretty decisive win for [Hillary] Clinton, and then I was sitting in the airport that night flying home, and that’s when,” on Oct. 28, 2016, FBI Director James Comey told Congress the bureau had discovered more of the former secretary of state’s emails sent from a private server. Comey’s letter was “possibly one of the most consequential turning points in the election,” Kamins said.

No one can really diagnose why some of the predictions in 2016 were as off as they were, he said.

“We changed our model a bit to control more for turnout, because that’s what we found was missing. Ultimately, Trump was much more successful in turning out his base than Hillary Clinton was,” Kamins said.