ERCOT task forces working on market improvements and integrating energy storage resources (ESRs) brought the results of more than a year’s worth of work to last week’s Technical Advisory Committee, resulting in a “mountain” of change requests for its approval.

“We have a skinny upfront update, but a fat appendix,” said ERCOT’s Matt Mereness, chair of the Real-Time Co-optimization Task Force (RTCTF), referring to seven Nodal Protocol revision requests (NPRRs) and two other changes the team brought forward.

The changes represent two years of work encompassing 33 meetings. Underscoring the task force’s effectiveness, the change requests engendered little discussion at the Protocol Revision Subcommittee, where they were easily approved before being sent on to the TAC.

“There was no real discussion at PRS because the task force did such a great job of reaching consensus,” said the subcommittee’s chair, Oncor’s Martha Henson.

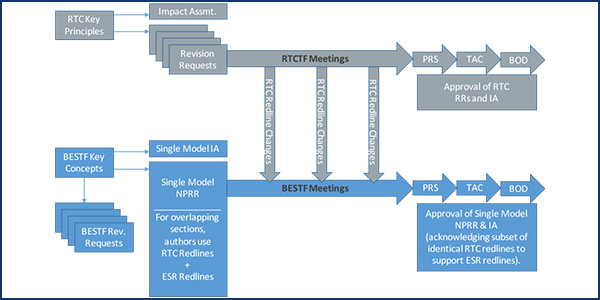

The RTCTF drafted the change requests after first developing the key principles for adding the real-time co-optimization (RTC) tool, which procures both energy and ancillary services every five minutes, to the market. ERCOT is still projecting it will cost $50 million to $55 million to add RTC. (See ERCOT Stakeholders Dig into Real-Time Co-optimization.)

The TAC also considered a pair of NPRRs from the Battery Energy Storage Task Force (BESTF), which has been working to integrate ESRs and distribution generation resources into ERCOT’s systems. The changes, along with the RTCTF’s, were placed on the combination ballot, which was approved unanimously in a single vote. The measures will now go before the Board of Directors on Dec. 8 for final approval.

The BESTF has settled on a “single-model” approach to energy storage, where the battery is represented as a single resource. ERCOT currently uses a “combo model,” with the battery represented as a generation resource and a controllable load resource.

The task forces’ work has been combined with a third major project, ERCOT’s upgrade of its energy management system (EMS), as part of the grid operator’s Passport Program. ERCOT is aligning the three initiatives to be finalized in 2024, transforming the market into one of the “most sophisticated market designs in the world.”

Mereness said the RTCTF will continue the support Passport’s next phase in 2021, engaging TAC members on policy and analysis items, supporting details and market participant needs. Updates will be provided to the committee before every board meeting.

REPs, NOIEs Debate Revision Change

Stakeholder discussion of an NPRR related to the wholesale market laid open a bit of friction between retail electric providers (REPs) and non-opt-in entities (NOIEs), those municipalities, cooperatives and river authorities that do not offer customer choice in the competitive retail market.

NPRR1055 would give ERCOT the discretion to accept for good cause late submissions of NOIEs’ attestations that they own or control their generation resources serving as a source resource node, or that the resource has a contractual commitment for capacity and/or energy with the NOIE. The attestation allows ERCOT to certify congestion-hedging instruments granted to NOIEs.

The change also requires ERCOT to post a market notice by Sept. 1 of each year, reminding NOIEs of the annual deadline.

The NPRR would amend portions of NPRR929 by requiring ERCOT to post a market notice by Sept. 1 each year that reminds NOIEs of the annual deadline. NPRR929 was approved last year and added new criteria for determining whether a point-to-point (PTP) obligation with links to an option bid is eligible to be awarded based on the resource’s current operating plan status at the bid source’s node. It also required the NOIEs to submit their attestations by Oct. 1 to offer their PTP obligations in the day-ahead market.

The TAC failed to approve a motion to deny NPRR1055 by a vote of 5-18 with six abstentions. The motion to approve passed 19-6 with four abstentions.

At issue is that a number of NOIEs missed this year’s attestation deadline, prompting staff to draft NPRR1055. That raised hackles among the REPs, which noted that it is rare for stakeholders to consider protocol language to accommodate a missed deadline.

“I don’t quite understand ERCOT filing a protocol change for someone missing a market deadline,” said Direct Energy’s Sandy Morris, using an example of her company being denied a waiver to file digital certificates late following Hurricane Harvey.

“This brings big questions in my mind about why the affected NOIEs would have filed their own NPRR,” Demand Control 2’s Shannon McClendon said. “Obviously, [an NPRR] has a lot more weight when it comes from ERCOT.”

Kenan Ögelman, ERCOT’s vice president of commercial operations, said the protocols do not allow good-cause exemptions for late submissions, but that in reviewing NPRR929’s functional merits, dates and the circumstances, staff realized they could write an NPRR “giving us discretion.”

“We would not want to exercise that without consulting with the stakeholder process and TAC,” Ögelman said. “The Oct. 1 date, from my reading and understanding of 929, was in there for ERCOT to finish some work, which we realized we could still complete in time for the 2021 auction. We wanted to communicate to the market we could still meet all the obligations described in 929 and take these late submittals. When I read 929, I do not see any intent that the Oct. 1 date was supposed to be some kind of a barrier, other than to allow ERCOT time to work through this.”

Asked by a market participant to name the NOIEs that missed the deadline, Ögelman demurred.

“I’ll describe it this way: Both numerically and by volume, 50% of the NOIES got the things in on time. Approximately 50% did not,” he said. “The composition of the NOIEs unable to submit on time were both large and small NOIEs.”

Saying he was sympathetic to REPs “not getting their mulligan” and issues of fairness, CPS Energy’s David Kee brought up the Public Utility Commission’s COVID-19 Electricity Relief Program, which allowed retailers to recover the cost of suspending disconnections for residential customers.

“The REPs did get pretty good help from the PUC with the COVID relief program. I didn’t hear from REPs saying anything when the NOIEs didn’t get help,” he said. “I hope we as stakeholders can support NOIEs in this request so we can all work together on this moving forward.”

“We are comfortable with doing so, assuming it is limited,” Reliant Energy Retail Services’ Bill Barnes said. “We do remain concerned and ask that ERCOT and all stakeholders assure this is a one-off event and will be scrutinized in the future.”

ERCOT to Stay Virtual Through January

ERCOT’s Kristi Hobbs, who is responsible for enterprise risk management, told the committee that large, in-person meetings at the grid operator’s facilities will be restricted “for some portion” of 2021.

“Given current trends, we’ll definitely remain virtual for January, and we don’t expect a shift for February either,” she said.

Speaking on the eight-month anniversary of staff’s mandatory work-at-home order, Hobbs said that order has been extended to January and likely February.

“Some days, it feels like forever,” Hobbs said, “but we’ve all been so busy, it’s gone by quickly.”

She said Austin, Texas-based ERCOT is working with an epidemiologist and continues to monitor local and state trends. The grid operator hasn’t issued an official COVID-19 notice since a market advisory in May, but Hobbs said the next check-in will take place in January.

Local health officials on Thursday raised Austin’s risk-based guidelines for the coronavirus based on an increase in new cases and a 7% positivity rate.

New Interconnection Process for Sub-10-MW Generators

Members endorsed a change to the Planning Guide (PGRR082) that creates a new interconnection process for generators and modifications less than 10 MW, despite an initial investment of $700,000 to 900,000 and annual operations and maintenance costs of about $500,000.

Barnes, the PGRR’s sponsor, said, “We think this process is extremely important.”

PGRR082 will enable ERCOT to track the small generators through the interconnection process and perform any needed studies before the projects are included in the network operations model. The change extends the interconnection process to distribution-connected resources and settlement-only generators (SOGs) and clarifies the roles of ERCOT and transmission and/or distribution service providers.

The measure was voted on separately from the combination ballot because a pair of industrial consumers said they would abstain. It passed 27-0.

The TAC unanimously approved the combination ballot, which included a white paper related to Southern Cross Transmission, a proposed HVDC line in East Texas that would ship more than 2 GW of energy between the Texas grid and Southeastern markets. (See “Members Debate Southern Cross’ Bid to be Merchant DC Tie Operator,” ERCOT Technical Advisory Committee Briefs: Feb. 22, 2018.)

In the document, staff determined they will need to impose restrictions on DC tie flows when ERCOT determines that system conditions in near or real time cannot accommodate the ties’ scheduled ramp. The board last month approved NPRR999, which will revise the protocols by creating a section related to ramp limitations on DC ties. The revision is intended to clarify that when the grid operator determines system conditions show insufficient ramp capability to meet the sum of all DC ties’ scheduled ramp, it will curtail schedules on a last-in, first-out basis.

The ballot’s approval resulted in TAC’s endorsement of staff’s proposal to change the minimum responsive reserve service’s primary frequency response limit next year based on updates to NERC’s BAL-003 Interconnection Frequency Response Obligation assessment for 2021. Staff also recommended a change in each of the methodologies used for computing non-spinning and regulation reserves to account for installed solar capacity’s growth.

The combination ballot also included 16 NPRRs, a change to the Commercial Operations Market Guide (COPMGRR), four revisions to the Nodal Operating Guide (NOGRRs), an Other Binding Document (OBDRR) modification, two PGRRs and single changes to the Resource Registration Guide (RRGRR) and Verifiable Cost Manual (VCMRR):

- NPRR1001: clarifies that ERCOT will issue an “emergency notice” when it is operating in an “emergency condition,” but issuing an “operating condition notice,” advisory” or “watch” does not mean that ERCOT is operating in an “emergency condition.”

- NPRR1007: updates the ERCOT system’s management activities in the protocols to address changes associated with RTC’s implementation.

- NPRR1008: Updates day-ahead operations in the protocols to address changes associated with RTC’s implementation.

- NPRR1009: updates transmission security analysis and reliability unit commitment to address changes associated with RTC’s implementation.

- NPRR1010: updates the adjustment period and real-time operations in the protocols to address changes associated with RTC’s implementation.

- NPRR1011: updates performance monitoring in the protocols to address changes associated with RTC’s implementation.

- NPRR1012: updates settlement and billing in the protocols to address changes associated with RTC’s implementation.

- NPRR1013: updates the protected information provisions, definitions and acronyms, market participants’ registration and qualification, and market suspension and restart in the protocols to address changes associated with RTC’s implementation.

- NPRR1014: enables ESRs’ integration into the ERCOT core systems as a single-model resource, replacing the existing “combination model” paradigm where ESRs are treated as two resources: a generation resource and a controllable-load resource. This NPRR will be implemented simultaneously with other RTC-related changes and with the upgrade to the ERCOT EMS in 2024.

- NPRR1026: establishes rules for and enables self-limiting facilities’ integration into the ERCOT markets and core systems.

- NPRR1029: enables DC-coupled resources’ (defined as an ESR type required to follow all rules associated with ESRs in addition to meeting this change’s requirement) integration into ERCOT’s core systems. The NPRR applies to both the current combo model era and the future single model era.

- NPRR1039: removes the defined term “market information system public area” from the protocols and replaces it with “ERCOT website.”

- NPRR1042: adjusts the planned capacity in the Capacity, Demand and Reserves report to remove previously mothballed or retired generation resources that may be repowered but do not have an owner that intends to operate them.

- NPRR1043: clarifies that ESRs’ withdrawn charging load (excluding auxiliary load) will be settled based on the nodal price similar to its injections, even if the ESR does not seek or cannot qualify for wholesale storage load (WSL) treatment by replacing the term “ESR load that is not WSL” with the defined term, “non-WSL ESR charging load.” The latter load will be priced at nodal but, unlike ESRs receiving WSL treatment, will be subject to applicable load ratio share-based charges.

- NPRR1046: removes additional uses of “dynamically scheduled resource” to align with NPRR1000.

- NPRR1047: consolidates gray-box language related to NPRR973 and NPRR1016.

- COPMGRR048: removes the defined term “market information system public area” in the protocols and replaces it with “ERCOT website” and removes references to the “ERCOT market information list.”

- NOGRR207: clarifies that ERCOT’s issuance of an “operating condition notice,” “advisory” or “watch” does not mean that ERCOT is operating in an emergency condition.

- NOGRR211: updates language related to supplemental ancillary service markets, ancillary service deployment, and ancillary service responsibilities and obligations to address changes associated with RTC’s implementation.

- NOGRR217: removes the defined term “market information system public area” in the protocols and replaces it with “ERCOT website.”

- NOGRR220: replaces existing gray-box language with NOGRR212’s revisions.

- OBDRR020: updates the methodology for setting maximum shadow prices for network and power balance constraints to address changes associated with RTC’s implementation.

- PGRR081: describes how self-limiting facilities will be evaluated in the generation resource interconnection or change request process.

- PGRR084: removes the defined term “market information system public area” in the protocols and replaces it with “ERCOT website.”

- RRGRR023: establishes provisions and requirements in the guide for ESRs that are identical to those already in place for generation resources and SOGs.

- VCMRR030: removes the defined term “market information system public area” in the protocols and replaces it with “ERCOT website.”