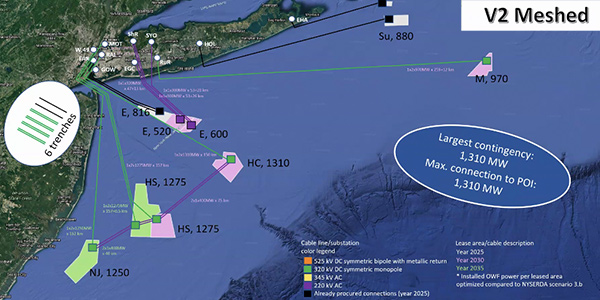

Preliminary analysis suggests that a mesh-and-backbone network design would be the best way to integrate offshore wind into the New York grid despite higher initial costs than a business-as-usual radial approach, likely offering more redundancy and potential savings down the line, state officials heard Monday.

“That redundancy is what we’re attempting to quantify with the project availability analysis, so if there is an outage, if you are operating in a mesh system, for example, that outage may not be as severe than it otherwise would be with a radial connection,” Jake Frye, senior project manager at DNV GL, said in delivering the findings at the second transmission technical conference hosted this fall by the state’s Department of Public Service and the New York State Energy Research and Development Authority. (See OSW Growth to Test New York’s Transmission Grid.)

“There are cost savings there; there’s a savings in megawatt-hours that were not lost,” Frye said, adding that additional cost and availability analysis is nearly complete and will be available in a written report by the end of the year.

Norway-based DNV is collaborating with engineering firms PowerGEM and WSP to complete an OSW integration study for New York, one of three studies informing grid investment plans to be established by the Public Service Commission for distribution and local transmission upgrades, as well as for bulk system transmission investments (Case No. 20-E-0197). (See NYPSC Launches Grid Study, Extends Solar Funding.)

Siemens presented its work on the zero-emission grid for the second study, which found that significant local transmission upgrades will be necessary to incorporate all planned renewables in New York. Siemens Consulting Manager Yan Du said his group identified 63% of the state’s total congestion constraints in New York City (Zone J), 12% in Westchester County (Zone I) and 8% on Long Island (Zone K).

Further study will be required at every level, from the impacts of OSW on the downstate grid, to the exact cost and size of transmission upgrades, Siemens said.

“We are committed and seek the best input in achieving the most sensible, risk-minimizing and cost-effective path to achieving our goals quickly and reliably,” PSC Chair John B. Rhodes said.

Utility Local Transmission Studies

While every utility in the state has plans to upgrade its transmission system, all eyes tend to move southeast, as 6 GW of OSW will interconnect into New York City and 3 GW into Long Island. The state’s Climate Leadership and Community Protection Act (CLCPA) mandates procuring 9 GW of offshore wind energy by 2035.

The state’s investor-owned utilities on Nov. 2 jointly filed a report on transmission and distribution investment, and representatives from each company joined the technical conference to outline their policy recommendations and proposed projects.

The IOUs include Avangrid subsidiaries New York State Electric and Gas and Rochester Gas & Electric; Central Hudson Electric and Gas; Consolidated Edison and Orange and Rockland Utilities; and National Grid subsidiary Niagara Mohawk Power. They collectively proposed to undertake about $7 billion in transmission and distribution upgrades by 2025 and another $10 billion in projects for the following five years to 2030.

Con Ed has identified three immediately actionable projects to give renewable resources access to the load and unbottle load currently served by fossil generation, the utility’s Section Manager Martin Paszek said. The projects will also enable compliance with the state Department of Environmental Conservation’s “Peaker Rule,” new NOx regulations that go into effect May 1, 2023. (See NY DEC Kicks off Peaker Emissions Limits Hearings.)

The projects’ total estimated cost is $860 million for new 345/138-kV phase angle regulator-controlled feeders for the second Rainey-Corona, third Gowanus-Greenwood and Goethals-Fox Hills feeders, and a substation rebuild for the last, allowing an estimated 900 MW of renewables access to load.

Con Ed plans to file a petition with the PSC by the end of the year seeking approval to recover the costs and will provide each individual project’s cost estimate for inclusion in the petition. Further, the company asked that the PSC “consider the significant regional environmental benefits these three immediately actionable projects provide.”

The utility is also asking the commission to approve up to $4 billion for the second phase of six projects to create points of interconnection, including two new “NYC Clean Energy Hubs,” several new feeders and two rebuilt area stations, and that the PSC allocate the costs statewide on a load-ratio-share basis.

The Long Island Power Authority (LIPA) and PSEG Long Island submitted a list of projects through 2025 and another list of Phase Two “conceptual” projects specifically identified to deliver 3,000 MW of OSW into Long Island. They were considered for their ability to increase the transmission transfer capability on LIPA’s system, said Hao Fu, PSEG transmission planning engineer.

“Under peak-load conditions, transmission headroom is available to deliver offshore wind power to load centers, and under light-load conditions, total load demand will be much less than total offshore wind output,” Fu said. “As a result, more power will flow in the east-to-west direction on the transmission system, which will create thermal constraints.”

Written comments on the overall plan are due at DPS by Jan. 18.