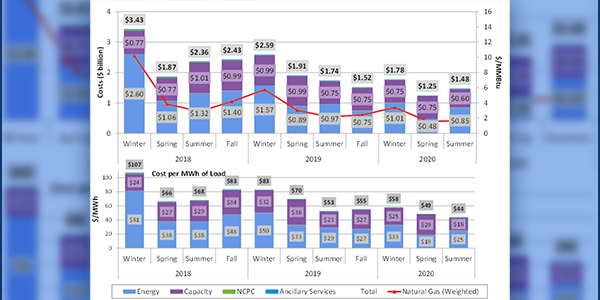

ISO-NE’s summer wholesale market costs totaled $1.48 billion, a 15% decrease from a year earlier because of lower energy and capacity costs, according to the quarterly markets report released by the RTO’s Internal Market Monitor.

Average day-ahead and real-time Hub LMPs were $22.50 and $22.52/MWh, respectively, coinciding with lower natural gas prices. The average natural gas price was $1.62/MMBtu (or $12.64/MWh assuming a 7,800 Btu/kWh heat rate), 25% lower than the summer 2019 price of $2.17/MMBtu (or $16.93/MWh).

Capacity market costs decreased by 19% to $603 million, down by $143 million from last summer. The first quarter of the FCA 11 capacity commitment period saw clearing prices of $5.30/kW-month for Rest-of-System, compared to the higher FCA 10 price of $7.03/kW-month.

Gross real-time reserve payments totaled $4.4 million, a 67% increase from the same period a year ago, driven by redispatch to maintain reserves during tight system conditions. That led to larger 10-minute non-spinning reserve and 30-minute operating reserve payments, which respectively rose by $847,000 and $437,000. The average non-zero spinning reserve price decreased relative to summer 2019 from $9.81 to $6.96/MWh. The frequency of non-zero spinning reserve prices increased to 506 hours from 365 hours.

Total regulation payments were up 11% to $6.4 million compared to the previous summer with the increase reflecting higher regulation capacity requirements, along with an increase in service-offer costs. Net commitment period compensation (NCPC) costs totaled $7 million, up by 4% over last summer, but still represented less than 1% of the total energy costs, consistent with the historical range.

Economic payments made up 81% ($5.6 million) of the total, a 46% increase from 2019 steered by real-time commitments made because of generator trips and load forecast error. Local reliability payments fell by 60% to $900,000, with most occurring in the day-ahead market and going to generators in Maine and northeastern Massachusetts to support planned transmission outages.

DNE Wind Generator Must Offer Compliance

As a special topic, the IMM also reviewed day-ahead offers and clearing of wind generators affected by the June 2019 must-offer requirements for do-not-exceed (DNE) dispatchable capacity market resources. ISO-NE now requires DNE dispatchable generators with capacity supply obligations to offer the full hourly amount of expected real-time generation into the day-ahead market.

A rise in day-ahead offers from DNE resources has translated to increased clearing for those generators, leading to the “small impact” of virtual supply clearing at wind generator nodes as virtual offers have historically filled the gap left by under-clearing wind generators in the day-ahead market.

Overall, wind generation offer behavior is consistent with Tariff requirements, the Monitor found. DNE wind generators increased the quantity of energy offered in the day-ahead market and offers reasonably reflected the expected level of peak real-time production but overestimate potential output in off-peak hours.

Since June 2019, cleared offers have averaged 70% of real-time production compared with 41% previously. Cleared virtual supply at wind nodes has decreased from 25% to 18% of real-time wind production, the Monitor said.

Order 2222 Compliance Discussion Begins

In September, FERC issued a long-awaited order requiring RTOs and ISOs to open their markets to distributed energy resource aggregations. (See FERC Open RTO Markets to DER Aggregation.) ISO-NE has now started the discussion on compliance with Order 2222.

The RTO’s Henry Yoshimura presented the 11 key compliance directives outlined in the order and the process schedule that concludes with a FERC filing on July 19, 2021.

The first order of business is collecting perspectives and feedback from stakeholders by Dec. 22, which ISO-NE will review and discuss early next year with interested entities directly affected by compliance requirements. The RTO will then develop a high-level proposed approach vetted through the NEPOOL process, including drafting and discussing Tariff changes and conceptual amendments and concluding with votes in various committees starting in June.

MC Actions

The committee voted to adopt changes to the NEPOOL Generation Information System (GIS) and GIS Operating Rules related to improvements to third-party meter reader uploads and reflect the addition of “Clean Existing Generation” to the Massachusetts Clean Energy Standard.

At its October meeting, the MC agreed to direct the GIS Operating Rules Working Group to consider changes requested by the Massachusetts Department of Environmental Protection, which revised its regulations to include a requirement that retail load-serving entities subject to the standard have a certain percentage of energy from “clean existing generation units.” (See “GIS Working Group to Consider Massachusetts ‘Clean Generation’ Changes” in NEPOOL Markets Committee Briefs: Oct. 6-8, 2020.)

The committee also re-elected Vice Chair Bill Fowler, president of Sigma Consultants, to continue his role in 2021.