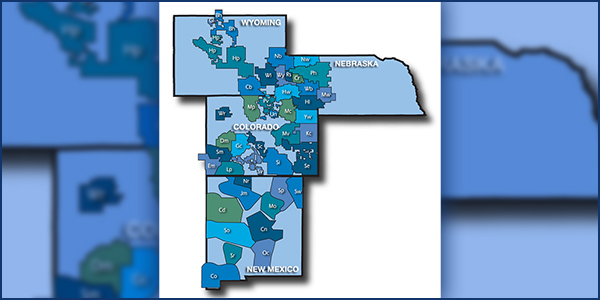

FERC last week approved Basin Electric Power Cooperative’s revised market-based rate tariff, allowing it to make wholesale sales of energy, capacity and ancillary services at market rates in its Southwest, Southeast, Northeast and Northwest regions, effective Sept. 30, 2020 (ER20-2590).

The order expands Basin Electric’s authority to make sales at market-based rates beyond the SPP and Central regions. The commission found the cooperative’s lack of horizontal or vertical market power in the requested regions satisfied its requirements for market-based rate authority.

FERC designated Basin Electric, which became commission jurisdictional in November 2019, as a category 1 seller in the Southwest, Southeast and Northeast regions and as a category 2 seller in the Northwest.

Under FERC Order 697, category 1 status applies to wholesale marketers and producers that own or control 500 MW or less of generation per region; do not own, operate or control transmission facilities other than that necessary to connect individual resources to the grid; are not affiliated with anyone that owns, operates or controls transmission facilities in the same region as the seller’s generation assets; are not affiliated with a franchised public utility in the same region as the seller’s generation assets; and do not raise other vertical market power issues. Category 2 sellers are those that do not fall into category 1 and are required to file updated market power analyses.

SPP TCR Collateral Requirements Upped

The commission on Wednesday accepted SPP’s proposed Tariff revisions to establish minimum collateral requirements for transmission congestion rights (TCRs) (ER21-79.)

The RTO’s stakeholders and staff strengthened the use of credit in SPP’s TCR market following the 2018 GreenHat Energy default in SPP Board/Members Committee Briefs: April 28, 2020.)

Tri-State Order 845 Compliance Lacking

FERC ruled last week that Tri-State Generation and Transmission Association has partially complied with Orders 845 and 845-A, directing a further compliance filing within 60 days (ER20-687).

The commission in May said Tri-State had partially complied with the orders, directing the cooperative to describe the specific technical screens or analyses and the triggering thresholds or criteria it will use to determine which facilities are contingent facilities — unbuilt interconnection facilities and network upgrades upon which an interconnection request’s costs and timing are dependent.

In its order on Thursday, FERC found Tri-State’s proposed changes to its pro forma large generator interconnection procedures described the specific technical screens and analyses and provided requisite transparency. However, it said Tri-State’s proposal to evaluate system performance “against the technical screens” was not clear as to where the cooperative would post the information and what is included in its “posted engineering standards.”

The commission directed Tri-State to submit a description of the transmission provider’s posted engineering standards and the posted information’s location. FERC also ordered Tri-State to identify whether the interconnection customer’s costs, timing and study findings are dependent on the unbuilt facility, consistent with the definition of contingent facilities.

FERC disagreed with renewable energy developer Gladstone New Energy’s protest that Tri-State’s proposed changes were beyond the scope of the proceeding. The commission said the cooperative did not add to its existing procedure for determining contingent facilities, but instead revised it.

FERC issued Orders 845 and 845-A in 2018 and 2019 to increase the generator interconnection process’ transparency and speed. The changes are grouped into three categories: improved certainty for interconnection customers; promoting more informed interconnection decisions; and process improvements. (See FERC Order Seeks to Reduce Time, Uncertainty on Interconnections.)