FERC handed SPP an early Christmas present Wednesday when it approved the RTO’s second version of a tariff for its five-minute Western Energy Imbalance Service (WEIS) market.

The commission accepted as just and reasonable the proposed tariff, the Western joint dispatch agreements (WJDAs) executed by eight entities and a charter for the Western Markets Executive Committee (WMEC). FERC found the WEIS market will yield “diverse benefits to the participating utilities and customers in the Western Interconnection” (ER21-3, ER21-4).

FERC said SPP’s proposal addressed its concerns with the RTO’s first filing, which it rejected in July. The commission said the earlier version failed to respect the transmission rights of nonparticipants and could improperly burden reliability coordinators, among other issues. (See FERC Rejects SPP’s WEIS Tariff.)

This time, FERC said SPP’s tariff “presents a just and reasonable regional solution.”

“We expect that the WEIS market will improve energy imbalance management by making a broader pool of resources available to serve load, enabling participating utilities to meet their energy imbalance needs at lower cost,” the commission said. “Additionally, we expect that the WEIS market will improve reliability by managing resources that could relieve transmission constraints more effectively, leveraging a larger, more diverse set of resources to operate the system within limits and creating price signals that lead to actions that could enhance reliability.”

The commission agreed with SPP that the WEIS market will help integrate and manage increasing levels of variable energy resources “by pooling variability over a larger area and re-dispatching resources to help manage imbalance energy caused by variable energy resources.” It said it expects the market to realize similar benefits as those of other energy imbalance markets.

The order keeps SPP on schedule to launch the WEIS market on Feb. 1. It had asked for a response from FERC by Dec. 3.

Bruce Rew, SPP’s senior vice president of operations, said in a statement that the grid operator is pleased with the order and “excited to be able to proceed with our implementation efforts, which are well on their way.”

The tariff defines rates, terms and conditions for the WEIS market and sets the rules and obligations for market participants. It includes a market participant agreement effective on the date participants begin their WEIS involvement. The tariff will be administered separately from SPP’s tariff in the Eastern Interconnection.

WEIS market participants began parallel operations earlier in December, giving them a chance to test their systems and train staff in the market’s production environment.

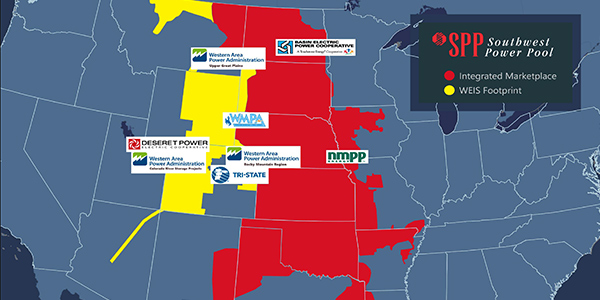

SPP will launch the WEIS with eight members covering the Western Area Power Administration’s Colorado Missouri (WACM) and Upper Great Plains West balancing authority areas. SPP said in November that several of its WEIS market participants are evaluating full membership in the RTO.

SPP also serves as an RC for about 12% of the Western Interconnection. It will add about 3.45 GW of generating capacity to its RC footprint — eight generating resources that are part of Gridforce Energy Management’s BA in Washington, Oregon, Arizona and New Mexico — effective April 1, 2021. (See SPP Expands its Western RC Footprint.)

Protests Rejected

Several intervenors protested the filing, including Xcel Energy-Colorado, Colorado Springs Utilities and Black Hills Energy, which plan to join CAISO’s Energy Imbalance Market (EIM).

Black Hills complained that its costs for energy imbalance service will significantly increase under the WEIS through the WACM BA, even though they are nonparticipants and that SPP did not conduct the kind of detailed cost-benefit analysis that was used to support CAISO’s EIM.

Filing jointly, Earthjustice, Natural Resources Defense Council, Sustainable FERC Project, Western Grid Group and Western Resource Advocates said SPP should allow them and other stakeholders to help develop a cost-benefit analysis.

The commission said a centralized imbalance market “can deliver significant benefits, including reliability benefits that are not easily quantified.”

“We do not find protesters’ arguments that SPP must demonstrate quantifiable net benefits persuasive. Although the commission carefully considers evidence of costs and benefits, it does not require a quantified cost-benefit analysis of proposals.”

FERC said SPP’s proposal to allocate costs based on net energy for load “reasonably reflects cost causation because net energy for load correlates to the size of the market.”

It rejected complaints that costs would be passed through to nonparticipants, saying there is “nothing in the WJDAs assesses costs to nonparticipants. To the extent WEIS market costs will be passed through to nonparticipants through other agreements, those agreements are not part of SPP’s filing and are not before the commission in the instant proceeding.”

The commission also rejected challenges to the SPP’s proposed governance structure, saying limiting voting rights to WJDA signatories “is reasonable because only WJDA signatories have made a financial commitment to the WEIS market.”

SPP provided ways for non-WJDA signatories to participate in open meetings, FERC said, noting the WMEC charter “is explicit in delineating that only portions of meetings voted as having a need for confidentiality by the WMEC will be closed to the public.”

The commission said SPP’s market mitigation provisions are “largely structured like those in SPP’s Integrated Marketplace but with additional measures, including a more stringent set of mitigation thresholds and a provision to address structural systemwide market power.”

It also rejected challenges to SPP’s proposal to include marginal losses in dispatch and LMPs, saying it was “necessary to ensure least-cost dispatch and will minimize imbalance costs, provide prices that accurately reflect marginal costs and preserve resources’ incentives to follow dispatch.”

SPP’s proposal to activate constraints to incentivize supply adequacy and prevent market participants from leaning on others was responsive to the commission’s July order, FERC said.

It also rejected a protest over SPP’s modeling of transmission availability, saying “if nonparticipants do not voluntarily offer their transmission for use in the WEIS market, the constraint enforced in [security-constrained economic dispatch] will not allow the WEIS market dispatch to utilize the nonparticipants’ transmission rights.”

Newly installed Commissioner Allison Clements did not participate in the proceeding.