RTO policies assigning most costs of large network upgrades to interconnection customers violate FERC’s “beneficiary pays” principle and are no longer just and reasonable, renewable advocates said in a new report.

The report by the American Council on Renewable Energy and Americans for a Clean Energy Grid (ACEG) contends that the “participant funding” policy under FERC Order 2003 is “obsolete” and is hampering the transmission expansion needed to accommodate growing renewable generation.

Before the 2003 order, FERC required generators to pay 100% of “interconnection facilities” needed to establish the connection between the generator and the transmission network. The costs of “network facilities” — those at or beyond the point of interconnection needed to address stability and short-circuit issues — were initially funded by the generator but repaid through transmission credits. Order 2003 ended the crediting, which critics said diminished the incentive for interconnection customers to make efficient siting decisions.

The report’s authors said the order worked for gas-fired generation, which can interconnect in locations that avoid transmission constraints. “Transmission planning is less important with gas generation, as locational wholesale market prices and network upgrade costs assigned to interconnecting generators are able to direct gas generation investment to economically efficient locations,” they said.

But the authors said the policy doesn’t work for location-constrained wind and solar generation that now dominate interconnection queues. “Wind turbines located near the best wind resources are several times more productive than wind turbines at a typical site selected at random, while the best solar resource sites are about twice as productive as less optimal sites,” the authors said. “Wind and solar are also scalable and benefit from economies of scale, so most projects are large and built in remote areas where large amounts of land are available at low cost. As a result, these renewable projects often require larger transmission upgrades to serve load.”

Free Riders

The report contends the policy violates the Federal Power Act and results in “inefficiently small upgrades, raising costs to consumers.”

However, Rob Gramlich, executive director of ACEG and one of the authors of the report, said the two organizations have no plans to make a formal complaint to FERC. “We plan to issue another report in a week or so with what we think the real solution is — a comprehensive transmission planning rule,” he said. “It has been 10 years since the last such rule, Order 1000, which followed [Orders] 890 and 2000. ACEG will be sharing ideas broadly and hoping to stimulate discussion.”

The current policy means that after one project is assigned high-cost network upgrades, subsequent projects could use the additional capacity created without paying a fair share for the improvements. “Project developers, knowing there was a chance of getting lucky with a lower network upgrade cost assignment, had an incentive to enter multiple project proposals and multiple locations,” the report said. “Thus, many projects would enter queues, and many projects would cancel, leading to a cycle of continuous churn.”

Increasing Costs

In the past, interconnection charges for new renewables represented less than 10% of renewables projects’ total cost. Now, however, interconnection costs have risen so much they can represent 50% or more of project costs, according to the report.

“The system has reached a breaking point recently as spare transmission has been used up. Presently in most regions, new network capacity is needed for almost all of the projects in the queues,” it said. “When an increasing amount of location-constrained generation applies for interconnection in the same area, the grid begins to require not only ‘driveway’ type transmission facilities, but also bigger roads and highways. … What we are observing is that interconnection studies for individual generators (or groups of generators) are increasingly identifying costly regional upgrades.”

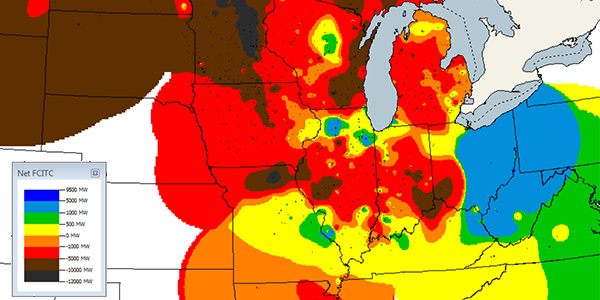

The authors cited research from Lawrence Berkeley National Laboratory that they said show that costs to integrate new generation “have reached levels that are unreasonably high for a developer to proceed in MISO and PJM.”

After Order 2003, MISO required generation owners to pay 100% of costs of network upgrades for lines below 345 kV and 90% for those above 345 kV. Wind projects in MISO, which historically paid about $66/kW to interconnect, are now being billed at $317/kW, five times as high.

MISO reported last year that it needs network upgrades exceeding $3 billion to accommodate the initial queue volume in its West region, a trend it expects to also hit its Central and South regions. (See MISO West Risks Becoming ‘Dead Zone,’ Stakeholders Warn.)

In PJM, interconnection costs for wind projects has risen to $54/kW from $19/kW while that for solar has more than doubled to $132/kW, from $62/kW. In 2019, a 120-MW solar-plus-storage project in southern Virginia was told it would face as much as $1.5 billion ($12,086/kW) in system upgrades, including the demolition and rebuilding of several 500-kV lines.

“The construction of large transmission lines required by some interconnection studies, which leads to such high network upgrade costs, are not isolated incidents,” the report said. “A number of offshore wind projects in PJM, for example, are expected to build long, 500-kV lines that are clearly network elements that benefit the entire region and should be planned and paid for through the regional planning process.”

Order 2003 allowed participant funding only in RTO and ISOs territories. In non-RTO areas, “where transmission upgrade costs are rolled into rates for all users, we do not find evidence of similar problems,” the report said.

Planning Reforms Needed

The authors said RTOs’ “siloed” transmission study processes, which consider reliability, economic and public policy transmission projects separately because of their different cost allocation methods, result “in a race that no one wants to win, as it will result in them bearing the cost for the transmission upgrades.”

“Each group of stakeholders attempts to free ride on other groups of stakeholders by failing to plan transmission that they would have to pay for, in the hope another group of stakeholders will plan and pay for it. Unfortunately, the typical result is that nobody builds the transmission, and all customers suffer from increased congested and reduced reliability.”

“Cluster” studies that analyze groups of generators simultaneously are an improvement, the authors said, but are limited because they consider only what is in the current queue. The report called for “proactive” transmission planning like the Competitive Renewable Energy Zones (CREZ) in ERCOT, Multi-Value Projects in MISO and priority projects in SPP that incorporate assumptions about wind and solar development and can maximize economic and reliability benefits.