Washington state senators this week introduced a bill to establish a cap-and-trade program that would gradually limit the state’s greenhouse gas emissions while funding decarbonization efforts.

Sponsored by Sen. Reuven Carlyle (D), the Climate Commitment Act (Senate Bill 5126) would implement the vision outlined by Gov. Jay Inslee last month to cap statewide GHG emissions and direct state spending into clean energy resources, transportation electrification, building retrofits and climate resilience programs.

Under SB 5126, any climate-related investments would be subject to review by a newly created Environmental Justice and Equity Advisory Panel. The bill would also allocate cap-and-trade revenues to partially fund Washington’s Working Families Tax Credit, the state’s version of the federal earned income tax credit.

“As our state begins to break out of the grip of the pandemic, I believe courageous climate action that invests in clean energy jobs, embeds equity at every level and reduces emissions to Paris Accord levels is central to rebuilding our quality of life,” Carlyle said last month when the governor released his plan.

The bill would also grant the Washington Department of Ecology the authority needed to adopt emissions standards to help the state meet GHG limits and implement a climate program. Bill sponsors included the provision after the state Supreme Court last year found the department lacked the statutory authority to set standards that held producers and distributors of fossil fuels accountable for their indirect emissions.

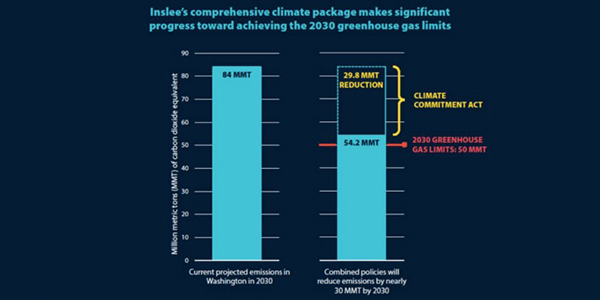

The cap-and-trade program is designed to put teeth into the GHG reduction targets the legislature upgraded last year without enacting any supporting legislation (RCW 70A.45.020). Those targets require the state to reduce GHGs to 45% below 1990 levels by 2030, 70% by 2040 and 95% by 2050.

“The greenhouse gas emissions limits established in RCW 70A.45.020 are not merely aspirational. Rather, they are intended to guide the implementation of all other state laws and policies that have an impact on greenhouse gas emissions in the state,” the bill says.

Cap-and-trade would cover any entity within the state responsible for emitting at least 25,000 metric tons of GHGs annually, including electricity generators, importers and utilities; industrial facilities; and natural gas and other fossil fuel suppliers. Other entities can opt to participate in the program on a voluntary basis.

Potential Linkage

Central to SB 5126 is the development of carbon allowance auctions overseen by the Department of Ecology but managed by an independent contractor.

Auctions would be held no more than four times each year. The bill directs the department to design the auctions to allow — “to the maximum extent possible” — integration with other GHG trading programs, such as the Western Climate Initiative, which includes California and the Canadian province of Quebec.

“The department may conduct auctions jointly with other jurisdictions with which it has a linkage agreement,” the bill states.

The bill calls for the cap-and-trade program compliance obligations to begin Jan. 1, 2023, with the first compliance period running through the end of 2026. The Ecology Department would need to adopt a budget of allowances for the first compliance period by Oct. 1, 2022. Emissions data reported to the department for 2017 through 2021 would be “deemed sufficient” for adopting annual emissions budgets and demonstrating compliance, according to the bill.

To minimize the impact of cap-and-trade costs on electricity customers, the program would allocate free allowances to consumer- and investor-owned utilities for the first compliance period starting in January 2023. Any allowances allocated at no cost would be consigned to the next auction with proceeds rebated back to ratepayers. Before the second compliance period commences in the January 2027, the department would need to adopt rules for allocating no-cost allowances to only consumer-owned utilities with an approved clean energy implementation plan.

Natural gas utilities would be allocated free allowances for the first compliance period in amounts proportional to their provision of service to low-income customers, measured by the number of customers who receive bill or rate assistance from the utility. Those allowances would be consigned to the auction for the benefit of low-income customers.

The bill also calls for free allocations during the first compliance period for “emissions-intensive, trade-exposed” industries. The category covers a wide swathe of sectors, such as primary and secondary metal manufacturing, paper manufacturing, aerospace, wood products, mineral manufacturing, chemical producers, computers and electronics, food production and cement.

Industrial users would be allocated 90% of their compliance obligation for the 2023, declining by 5 percentage points each year through 2026.

“By Jan. 1, 2024, the department must adopt by rule objective criteria for both emissions’ intensity and trade exposure for the purpose of identifying emissions-intensive, trade-exposed manufacturing businesses during the second compliance period of the program and subsequent compliance periods,” the bill says.

Funding Source

The bill would also require the department to complete an evaluation of the program’s performance in reducing GHGs statewide and criteria pollutants in overburdened communities by the end of 2035. It would allow the department to adjust emissions budgets if the evaluation shows the program is coming up short of meeting the 2040 goal.

Auction revenues would be deposited into a climate investment account created in the state treasury. Funds could be spent on clean transportation programs; programs to improve the climate resilience of the state’s waters, forests and vital ecosystems; clean energy transition programs that assist affected workers and low-income individuals; and emission-reduction programs.

“Projects or activities funded from the account must meet high labor standards, including family-sustaining wages, providing benefits including health care and pensions, career development opportunities, and maximize access to economic benefits from such projects for local workers and diverse businesses,” the bill says.

The bill would require the governor’s office to convene a climate commitment task force consisting of state agencies, other governments and stakeholders by July 1. The task force would be charged with hammering out the details of the legislation and preparing for rollout of the program.