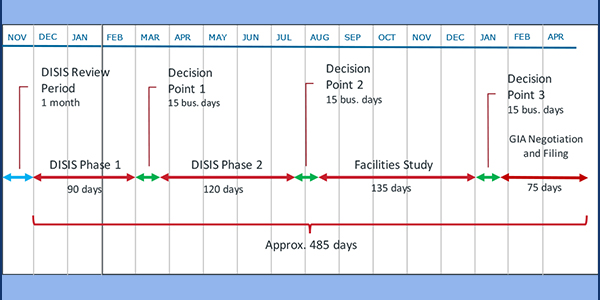

SPP staff last week unveiled a proposed mitigation plan to reduce the four-year backlog in the RTO’s generation interconnection queue, a result of legacy study processes that can take as long as 485 days to complete — and longer if restudies are required.

David Kelley, SPP’s director of seams and tariff services, told the Markets and Operations Policy Committee that staff are currently working on their first cluster of GI requests from 2017 and are soon scheduled to tackle a second set.

“That’s just indicative of where we are,” he said during the Jan. 11-12 virtual meeting.

Kelley said that SPP’s new, streamlined three-stage study process, approved by FERC OKs New SPP Interconnection Process.)

“The three-stage process was not designed to get us out of the backlog we’re in,” he said. “We had a four-year backlog when we implemented the three-stage process, and we have it today. We still think the process will take too long to get to that point where we clear the backlog.”

Staff said the problem is that the queue has been formed by interconnection customers with different business purposes: some with a definitive proposal, and others that are simply speculating. Low financial commitments keep speculative customers in the queue, and the uncertainty triggers restudies that extend timelines.

“Left alone, the three-phase process will take too long to eliminate the DISIS backlog,” SPP’s Juliano Freitas said, referring to the definitive interconnection system impact study the RTO uses to cluster GI requests.

The three-stage process involves a thermal and voltage analysis, stability analysis and facilities study. It eliminates feasibility and preliminary queues, changes the amount and timing of security deposits, publishes study models earlier in the process, and allows penalty-free withdrawals when costs increase above certain thresholds.

Under the mitigation plan, Freitas said staff will remove the redundant facility study report for SPP and transmission owners and begin the first phase of a DISIS study in parallel with the preceding cluster’s second phase. Staff will also provide better cost estimates for each phase’s first decision point and implement a nonrefundable payment on the TOs’ interconnection facilities cost estimates for the first two decision points.

Freitas said these steps will save about 205 days for each DISIS cycle, beginning with the first 2018 cluster. Assuming a restudy for each cluster, including the two 2017 DISIS groups, he projected SPP would catch up by the end of 2024.

“I like the concept,” Southwestern Public Service’s Bill Grant said. “These queues are so saturated and don’t reflect the actual results of the queue studies.”

Stakeholder discussions have revealed “vastly differing views” as to what success looks like, staff said. Much of the developer community believes the three-phase process should be allowed to work before pursuing additional major overhauls of the GI process, they said, while a number of load-serving members have expressed significant concern with increased generator retirements and the ability to interconnect new generation to meet their service obligations.

“Staff is of the opinion that relying on the three-phase process alone won’t get us out of the hole anytime soon,” Kelley said. “We think success is measured when we reduce and eliminate the study backlog and we’re interconnecting new resources on a timeline that customers expect. It took us many years to get into [the hole], and it’ll certainly take us a while to get out of it. It’s going to take some pretty fundamental changes to the process.”

Omaha Public Power District’s Luke Haner said he was supportive of SPP’s proposals and urged the RTO to take steps to accelerate the process. “We would like to see serious requests sped up,” he said.

Al Tamimi of Sunflower Electric Power argued against a suggestion that cluster sizes be reduced to speed up the process. “I’m concerned we’re focusing on efficiencies and reducing the backlog, but we would be losing the quality of the studies,” he said. “I feel the quality of the studies need to be measured as you make those changes.”

“If your intention today was to get robust discussion, you got that,” Grant said. “I also heard people say, ‘The status quo is good; let’s work our way through it.’ The status quo is not good. Taking four to five years to get a [GI agreement] when you have load to serve is not acceptable, but I do think we’re on the right track.”

SPP COO Lanny Nickell admitted staff still have some work to do in generating consensus about the mitigation proposals. “For far too long, a majority of our members and stakeholders haven’t understood all the things happening behind the scene,” he said.

Nickell said staff need to further develop the proposal and share it further with stakeholder groups and the Board of Directors before it can begin drafting revision requests and tariff language.

SPP on ‘Cutting Edge’ with ESR Initiatives

SPP continues to grapple with how best to integrate electric storage resources (ESRs), belying at times its traditional “evolutionary, not revolutionary” approach to gaining stakeholder consensus.

The Strategic Planning Committee on Wednesday approved the Electric Storage Resource Task Force’s recommendation to continue developing rules to allow ESRs to participate in the markets as generation resources and transmission-only assets. The idea is to create a foundation for ESRs to eventually perform as multiuse transmission assets.

The task force said stakeholders and staff should complete rules and policies governing ESRs as transmission assets before evaluating their use in providing energy, capacity and ancillary services. Staff should continue to monitor rules being developed by other grid operators and regulatory efforts, it said.

“No RTO has it worked out. In some cases, we’re more on the cutting edge than normal,” Richard Dillon, SPP’s director of market policy, told the MOPC.

He said SPP now has a greater understanding of ESRs’ complexity. “By the same token,” Dillon said, “we don’t want an extremely complicated filing at FERC that gets rejected. We need to take smaller bites, so if revisions are necessary after FERC has seen [the proposal], we don’t take the ship down with one massive filing.”

Dillon serves as staff secretary on the Electric Storage Resources Steering Committee (ESRSC), which reports to the MOPC and is led by its chair, Evergy’s Denise Buffington. The group is responsible for coordinating and overseeing the stakeholder groups working on 37 different ESR-related initiatives spread over six issue categories.

Ten of those initiatives are focused on transmission, energy and capacity issues, work that had been on hold pending the task force’s recommendations. The initiatives encompass how to use ESRs for transmission only, energy and related services, and meeting resource-adequacy requirements. The ESRSC has determined that planning items, reliable-response items (capacity, fast start) and hybrid resources are high priorities.

Dillon said ESRs’ role as a distributed energy resource is out of scope. That issue will be taken up by another task force working on FERC Order 2222.

“If you look through all of the items, what I believe needs to be resolved first is the hybrid resource,” Dillon said. “Those are on our doorstep. We already have hybrid units we’re working around. We already have storage as transmission.”

The committee has engaged SPP’s Project Management Office to help with bundling the initiatives into a comprehensive project. It has also increased its membership to expand its experience and geographic representation, including a yet-to-be named representative from the Dakotas. Among the new members are Southern Co.’s Chase Smith, who chaired the ESR Task Force; Greg Rislov, an adviser to the South Dakota Public Utilities Commission; NextEra Energy Resources’ Matt Pawlowski; and attorney Heather Starnes.

EDP Renewables’ David Mindham complimented SPP on the governance structure, saying it would “bring clarity to the issues.”

“Clarity around these installations is really important for these developers,” he said.

Asked to endorse an ESR-related white paper, MOPC members instead agreed to send the document to the ESRSC and task force for their consideration. The Operating Reliability Working Group (ORWG) drafted the paper, which recommends that SPP manage the charging and discharging of transmission-only ESRs and coordinate any transmission operators’ reliability actions.

“I’m concerned about the arguments of the resources being treated differently without due cause,” the Advanced Power Alliance’s Steve Gaw said.

The committee separately approved two other white papers related to the ESR initiative:

- the ORWG’s recommendation that SPP require ESR data for all unregistered behind-the-meter sites so it can determine their overall effect on the grid. The paper also suggests developing minimum ramp-rate requirements and determining the ESRs’ minimum and maximum limits for charging and discharging.

- the Transmission Working Group’s (TWG) paper that included a recommendation to use a load-curve analysis to determine the ESRs’ required duration in the planning processes.

PTP Tx Revenue Service Tweaked

Members approved a Regional Tariff Working Group’s (RTWG) recommendation to modify SPP’s point-to-point (PTP) transmission service revenue allocation that essentially leaves the process in place.

Stakeholders have generally agreed that the current process is complex, prone to inaccuracies and lacks transparency. SPP currently splits its distribution of PTP service revenues to TOs 50/50, with half determined by the ratio of the annual transmission revenue requirement and half allocated by a megawatt-mile process.

When some megawatt-mile modeling effects forced the RTO to resettle revenues, engineering staff conducted a review in 2018 that found the process was developed 11 years ago using a source-sink methodology that current staff were unfamiliar with and resulted in more than 1 million combinations in the calculations.

Following a staff presentation on the issue last July, the MOPC directed the RTWG to simplify the process with the TWG’s technical input. (See “Point-to-point Revenue Allocation Sent Back,” SPP MOPC Briefs: July 15-16, 2020.)

However, the group was unable to reach consensus, settling for minor tweaks to the process that leave the status quo in place. The RTWG looked at 10 different options, but all shifted revenue between various TOs.

“So it’s up to staff to simply make it less burdensome?” American Electric Power’s Richard Ross asked.

“That’s fair,” SPP’s Charles Hendrix responded.

“The way I read the literal language, the only mechanism we would be given … would be simply to reduce the number of needed or requested reruns. Revenue shifts would be off the table,” SPP’s Nickell said.

The measure cleared the MOPC’s 67% approval threshold at 74%. Twelve of the 17 TOs and 28 of 36 transmission users voted for the motion.

Order 2222 Task Force Underway

Michael Desselle, SPP’s chief compliance and administrative officer, said the RTO has created a task force to take on compliance with FERC Order 2222, which directs grid operators to allow DER aggregators to compete in their markets. (See FERC Opens RTO Markets to DER Aggregation.)

The 16-person Order 2222 Task Force, comprising a cross-section of stakeholders and two regulators (Arkansas’ Ted Thomas and Missouri’s Scott Rupp), will be responsible for developing and approving policies and governing document changes to comply with the order. Evergy’s Grant Wilkerson will chair the committee, Desselle said.

The group has an ambitious schedule of 14 meetings over the next six months in order to meet FERC’s July 19 compliance deadline. SPP will propose a “reasonable implementation date” in its filing.

The task force will evaluate 10 policy issues, which include establishing minimum size requirements for DER aggregations that don’t exceed 100 kW.

Coming Soon: Order 1000 Task Force

MOPC Chair Buffington and Nickell, the committee’s staff secretary, are working to provide a “game plan” for yet another task force, this one charged with improving SPP’s Order 1000 selection process.

SPP followed a similar process after approving its first competitive project in 2016. In October, the RTO’s Board of Directors approved an industry expert panel’s (IEP) recommendation to grant SPP’s second competitive project, the 75-mile, 345-kV Sooner-Wekiwa project in Oklahoma, to Transource Missouri. (See Transource Tapped for SPP’s 2nd Competitive Tx Project.)

Staff in December reviewed with stakeholders initial suggestions to improve how it awards competitive transmission projects. The suggestions focused on the continued use of incentive points for future projects; whether to share with project bidders how the IEP will score proposals; and developing and publishing standardized scoring guidelines. (See SPP Out to Improve Competitive Tx Selection.)

“Those will be the conversations we have going forward,” SPP’s Ben Bright said. He noted that SPP has begun accepting applications for the pool of experts from which the IEP is formed to review competitive construction proposals in 2021. “We always need new experts.”

Buffington Lays out Goals

Buffington marked her first meeting as chair by outlining her goals, which include increasing stakeholder engagement in a committee that has grown to 104 members representing 10 sectors across 14 states.

“We’re excited there’s growth in SPP, but we’re interested in hearing new voices and ideas in our discussions,” she said. “We want to encourage new ideas to challenge traditional thoughts.”

Board Chair Larry Altenbaumer applauded the MOPC’s “diversity initiative,” saying he is “looking forward to hearing what comes out of that.”

2 HITT White Papers on Consent Agenda

The MOPC unanimously approved a consent agenda that included a pair of white papers stemming from the Holistic Integrated Tariff Team’s work.

The Market Working Group recommended approval of its white paper on offer requirements for variable energy resources in the day-ahead market. The study found wind resources’ effect on price divergence are largely dependent upon the offer behaviors … exhibited in the [day-ahead market] from both a financial and physical offer perspective.”

The MWG also combined with the ORWG and TWG on a second white paper that urged SPP continue supporting dynamic line ratings’ implementation and use, as they remain voluntary at the TO’s discretion.

The agenda also included the Project Cost Working Group’s recommendation for a $25.6 million cost reduction to SPS’ Multi-Hobbs-Yoakum 345/230-kV project in West Texas and a $5.1 million cost increase to an 230/115-kV SPS network upgrade north of Amarillo; withdrawal of RTWG RR334, which included the 20-year Integrated Transmission Planning assessment (ITP20) as an eligible study for determining competitive upgrades; and six revision requests:

- MWG RR429: corrects and/or clarifies existing Market Monitoring Unit language in the Integrated Marketplace protocols. The changes do not change functionality or policy and do not require tariff adjustments.

- MWG RR433: updates tariff and protocol language by replacing references to the jointly owned combined resource option that no longer exists under MRR266.

- RTWG RR417: clarifies that no projects can be approved for construction from ITP20.

- RTWG RR436: removes all facilities associated with an interconnection study preceding the Integrated System’s 2015 membership in SPP. Following the system’s integration, SPP completed a study that resulted in different network upgrades.

- Staff RR424: removes duplicate language currently located in the system operating limit methodology.

- TWG RR434: modifies outdated tariff language that is not consistent with current processes, including clarification that aggregate transmission service studies are now a six-month process.