MISO on Friday said it will soon present proposals for reformulating its value of lost load (VoLL) while its Independent Market Monitor once again urged the RTO to nearly triple the current value during a scarcity pricing workshop teleconference.

Monitor David Patton said MISO should bump its VoLL to $10,000/MWh from the current $3,500/MWh, an increase the Monitor has been recommending for more than three years.

Patton said different areas of the footprint place different importance on avoiding interruption of service. Referring to a Lawrence Berkeley Labs model with 2018 data, Patton said MISO residential outage costs range from $3,600 to $3,900/MWh depending on customer income, only “escalating modestly” from the current VoLL. However, commercial and industrial customers place a much higher value on interruptions, ranging anywhere from $32,000/MWh for a non-manufacturing customer to $73,000/MWh for manufacturers. He said commercial and industrial VoLL can go even higher, but those customers would probably have installed backup generation.

Patton said he weighted those amounts based on MISO load data to identify an average value of $23,000/MWh. However, he said the RTO should use a “more reasonable” and more economic $10,000/MWh.

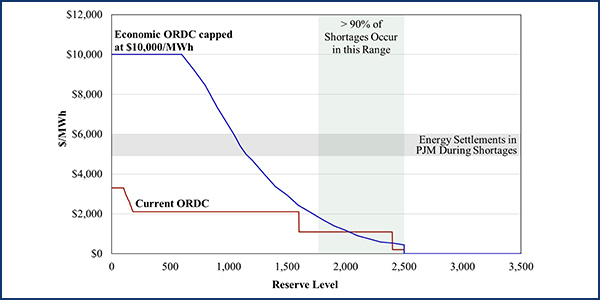

“Very few shortages will occur in that range,” Patton explained of the upper bounds of the operating reserve demand curve (ORDC).

MISO’s ORDC based on VoLL, begins at $3,300/MWh, dropping to $2,100/MWh for much of the curve when the RTO clears 8% of its requirement level. At 89%, the level falls to MISO’s original $1,100/MWh, remaining there until 96% or more of the requirement is cleared, when the curve flattens at $200/MWh.

The Monitor is calling for a curve that eliminates step-based pricing in favor of a gently sloped descent from $10,000/MWh.

Patton said shortage pricing is important because MISO’s capacity market doesn’t provide sufficient performance incentives. He said the growth of intermittent resources, which lead to “more output uncertainty and more frequent shortages,” means economic reserve pricing will become more critical. Higher scarcity prices will provide a “natural buffer” for non-intermittent resources to stave off retirement, he said.

He added that a higher VoLL will better ensure that MISO can cover its load in shortage conditions, competing with PJM’s more attractive pricing.

“When both MISO and PJM are in a shortage, there’s no question that generators will sell to PJM, whether the generators are in PJM or MISO,” Patton said. “Certainly, it’s not completely solved. I think [this] will go a long way in ensuring our prices are more in line.”

Patton said even with the increase, PJM will still produce higher shortage prices more of the time.

FERC Filing on the Horizon

MISO Principal Adviser of Market Design Mike Robinson said the RTO is using the Monitor’s analysis as a “starting point” for updating pricing but must also account for the footprint’s geographic diversity.

The RTO has not updated VoLL pricing since 2009. Robinson acknowledged MISO’s reliability-based vertical demand and supply curve “do not meet” in a way that signals new, appropriate price ranges.

Director of Market Design Kevin Vannoy said MISO hopes to file an updated VoLL with FERC in June. He said staff will appear before the Market Subcommittee during spring meetings to discuss alterations and ORDC changes.

Some stakeholders said MISO was on an ambitious timeline considering it hadn’t yet decided if VoLL should apply to force majeure events or used to price dead buses. (See MISO Questions VOLL Pricing During Abnormal Events.)

“It just seems like MISO is going about reestablishing VoLL without first discussing where VoLL can applied,” Xcel Energy’s Kari Hassler said.

Great Plains Institute’s Matt Prorok asked MISO to consider the increasing electrification of essential services when valuing lost load.

“You’re right, those will affect the values,” Robinson said.

Akshay Korad, research and development engineer at MISO, said the RTO would have to update its LMP cap when it pursues a VoLL change because LMPs are capped at VoLL. Korad said the cap was a “design decision made at the beginning of the market that was never revisited afterwards.” He said MISO and stakeholders should decide whether to continue capping LMPs at the new VoLL or another value or stop capping LMPs altogether.