Acknowledging environmental and political realities, SPP staff and stakeholders have added an accelerated decarbonization future to the RTO’s 20-year long-term assessment.

Developed by the Economic Studies Working Group, the future is designed to reflect the change of administrations in D.C. and aggressive energy and environmental policy changes. It retires all coal and oil generation, driven by a 93 to 95% emission reductions target in 2042 from 2017 levels. Environmental regulation assumptions are based on changes in federal policy, mandated carbon cuts and a carbon tax.

The future, one of four in the 2022 20-year assessment, also assumes higher solar, wind and energy storage resource additions than SPP’s normal Futures 1 and 2 because of changes in environmental policy and technology that lower capital costs and increase energy conversion efficiency.

“It makes good sense for us to study these things, given the political implications and voluntary reduction measures in the footprint,” ITC Holdings’ Alan Myers, the ESWG chair, told the Markets and Operations Policy Committee during its virtual meeting Jan. 12.

“It’s extremely important to consider how fast and aggressive environmental policy changes will affect SPP,” said Casey Cathey, the RTO’s director of system planning. “We have companies that desire this; the political climate … all these variables are pushing the envelope of renewable energy more than we’ve seen the last few years.”

The accelerated decarbonization future assumes that by 2042 SPP will have 65 GW of wind capacity and 48 GW of solar capacity, with almost 17 GW of energy storage. The grid operator already has 26 GW of installed wind capacity on its system and another 39.9 GW of proposed projects are under some form of study in its generation interconnection queue.

Other Futures

The future was one of two added to the two futures developed as part of the 2022 Integrated Transmission Plan (ITP): a business-as-usual reference case (Future 1) that reflects continued industry trends and environmental regulations, and an emerging technologies case (Future 2) driven primarily by the assumption that electric vehicles and distributed generation will affect energy growth rates. Future 1 predicts 41 GW of wind capacity and 19 GW of solar, and Future 2 foresees 50 GW of wind and 27 GW of solar.

“These are good futures to extend out. We’re saving additional work on the overworked engineering staff,” Myers said.

The fourth future, the SPP-MISO zero hurdle rate (Future 4) focuses on the potential benefit of greater market efficiency between SPP and MISO. Future 4 sets hurdle rates between the two RTOs to zero, with all other input modeling assumptions the same as Future 3.

Both Future 3 and Future 4 assume a moderate increase in SPP’s load because of increased electric transportation and electric home heating, resulting in the grid operator become a winter-peaking RTO.

Asked how SPP could ensure a quality study when the overall peak load is just over 51 GW, Cathey said the model will adjust solar and wind around conventional resources, filling in the valleys when renewable energy drops.

“It’s not just a matter of looking at 51 GW as the overall peak load. It’s a process of doing the right siting,” he said. “What we’re ultimately trying to do is determine what actually will be built … and try to simulate that. We’re trying to get ahead of the game and not wind up with congestion costs.”

The ESWG developed the futures with input from the MOPC and the Strategic Planning Committee. They will be used to create the year 2042 market economic models that will be analyzed in the assessment.

Additional sensitivities will be performed and eventually scoped out by altering some of the futures assumptions, Cathey and Myers said. Some of the potential sensitivities include load, hurdle rates for exports, gas prices and retirements.

The MOPC unanimously approved the scopes of both the long-term assessment and the 2022 ITP, which adjusts the futures with several assumptions about fossil retirements, storage and renewable capacity. Futures 1 and 2 are weighted 50/50 in the 2022 scope.

Cathey promised a more robust report on the 2022 plan during the governance meetings in April.

STEP Down

The committee also approved the 2021 SPP Transmission Expansion Plan (STEP) report that lists the grid operator’s endorsed and approved transmission projects for a 20-year planning horizon. The current plan includes all ongoing network upgrades or those where construction has been completed, but not all closeout requirements fulfilled.

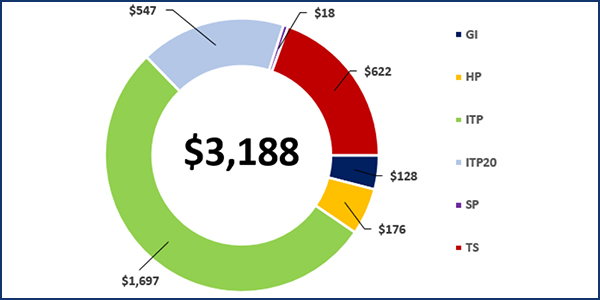

The current STEP’s value has been reduced to $3.2 billion from $5.2 billion in 2019 and $4.6 billion last year.

“That represents a lot of projects that have closed out,” Cathey said.