Its work complete, the ERCOT task force working on the real-time co-optimization of energy and ancillary services is living on borrowed time.

Staff told the Technical Advisory Committee on Wednesday that when the group next meets in February, it will be asked to sunset the Real-time Co-optimization Task Force (RTCTF) and instead focus on the Passport Program and its “three-and-a-half-year trek.”

“This is our first time out of the gate,” said ERCOT’s Matt Mereness, who chaired the RTCTF, in referencing the work that lies ahead. “We could probably have a one-day meeting on some of these topics.”

In the task force’s stead, Mereness said staff are proposing that the TAC develop a Passport Program implementation working group or task force in the coming months. He suggested that policy and analysis items from the RTCTF’s work be parceled out to some of the committee’s subcommittees this year, when business requirements and designs will be developed.

ERCOT’s Board of Directors in December approved nearly three dozen revision requests by the task force and a separate group developing policies and principles for energy storage resources (ESRs). (See “Passport Program to Take off in 2021,” ERCOT Board of Directors Briefs: Dec. 8, 2020.)

That work is now being taken up by the Passport Program, which faces a 2024 deadline to combine real-time co-optimization’s and ESRs’ implementation with that of ERCOT’s energy management system (EMS) upgrade. Storage and distribution generation functionality will be added before 2024, with Passport “tying up any loose ends.”

The program will expand ERCOT’s real-time market to clear energy and ancillary services every five minutes, bringing the grid operators in line with most others. The day-ahead market, which is already co-optimized, will allow virtual ancillary service offers, while the operating reserve demand curve’s price adders will be replaced by converting it into demand curves for each service, reflected in real-time energy and ancillary service prices.

ESRs will be modeled and dispatched as a single device that charges as load and discharges as a generator. Devices within the distribution system will still be dispatched with improved mapping techniques.

Passport has a total budget of $85.5 million. The bulk of that is attributed to real-time co-optimization ($51.6 million) and the EMS upgrade ($27.1 million).

“We have limited resources and funding beyond the [Passport] projects,” Mereness said, noting staff have already been reviewing protocol changes to ensure their impact analyses don’t affect the program. “The ones that did had a small impact, small enough and discrete enough that we didn’t want to stop what’s in flight.”

He said additional budget details will be shared with ERCOT’s Board of Directors during its Feb. 9 meeting.

Staff Loosens Transmission Outage Restrictions

Healthier reserve margins have allowed staff to loosen some restrictions around planned transmission outages during ERCOT’s summer months (May 15 to Sept. 15).

Outages will still be prohibited from noon through 9 p.m. on 345-kV lines, with 138-kV and 69-kV lines barred from planned outages during that same time should they affect generation dispatch. However, planned 345-kV bus outages and transformer outages will be allowed, and 138-kV outages will be limited to seven continuous days and restoration times of less than six hours.

No outages will be allowed that alter system topology either before or after a contingency. Transmission owners will still have the same list of potential exceptions as the previous two years.

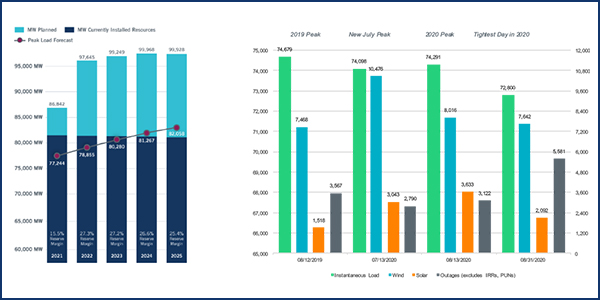

The grid operator goes into this summer with a reserve margin of 15.5%, almost double the 8.6% margin it took into summer 2019. Last year’s reserve margin was 12.6%. (See Solar Power Boosts ERCOT’s Reserve Margins.)

“Even with higher reserve margins, we think it makes sense to leave some restrictions in place for planned outages,” said Dan Woodfin, ERCOT’s senior director of system operations. “This will allow the TOs to do some work during the summer that was maybe not allowed during the last two.”

Lange, Blakey to Lead TAC

The TAC approved nominations to leadership positions for 2021, choosing South Texas Electric Cooperative’s Clif Lange as its chair and Just Energy’s Eric Blakey as its vice chair. Because Lange was not able to participate in last week’s meeting, Blakey wound up chairing.

“It’s such an honor to even be a member of this group. We very much appreciate your support,” Blakey said upon assuming his virtual position. “Last year was very challenging, but I hope there are fewer challenges this year so we can get together.”

The committee also confirmed the leadership for its subcommittees: incumbents Martha Henson (Oncor Electric Delivery) and Melissa Trevino (Occidental Chemical) for the Protocol Revision Subcommittee; Jim Lee (American Electric Power) and John Schatz (Luminant) for the Retail Market Subcommittee; Chase Smith (Southern Power) and Katie Rich (Golden Spread Electric Cooperative) for the Reliability and Operations Subcommittee; and Resmi Surendran (Shell Energy) and Ivan Velasquez (Oncor) for the Wholesale Market Subcommittee.

Members OK Another SCT Directive

The TAC endorsed another in a series of directives tied to Southern Cross Transmission, a proposed HVDC line in East Texas that would ship more than 2 GW of energy between the Texas grid and Southeastern markets. (See “Members Debate Southern Cross’ Bid to be Merchant DC Tie Operator,” ERCOT Technical Advisory Committee Briefs: Feb. 22, 2018.)

Staff recommended that any DC tie facility with an initial energization date or that is replaced after Jan. 1 have at least a 0.95 power factor leading/lagging reactive power capability for voltage support. A Nodal Protocol revision request (NPRR) will need to be drafted to codify the endorsement.

The Southern Cross DC tie’s imports and exports will cause reactive losses on the ERCOT system because its facilities are not currently planned to have any reactive capability to support system voltage. According to a staff report, thermal limits will be reached before voltage limits during summer peak imports. The same report indicated the system has enough margin to support up to 1,289 MW of export before voltage limits are reached.

“We’re still trying to work through all the angles of this concept,” said Cratylus Advisors principal Mark Bruce, speaking for the Southern Cross developers. “Southern Cross is not necessarily opposed. There are ways to get there. … We’ll be interested in the specific NPRR language.”

Virtual Meetings Likely to Last into May

ERCOT’s Kristi Hobbs told stakeholders that they should expect to continue holding virtual meetings through at least May, continuing a practice that has been in place since last March when the COVID-19 pandemic exploded. Staff have been encouraged to work from home and discouraged from traveling, while outside visitors have been restricted from the grid operator’s facilities.

“We continue to monitor the case trends [and] all the government guidelines, as well as how things are progressing with vaccine opportunities,” she said. “We want to see how the vaccine rollout goes and the success of that vaccine.”

Hobbs promised to return to the TAC in April for another update, following another checkpoint with staff in late March.

RUC Hours Consistent with 2019

ERCOT’s reliability unit commitment (RUC) usage for 2020 remained comparable to 2019, staff told the committee, with 224 instructed resource-hours resulting in 220.1 effective RUC resource-hours. The prior year’s numbers were 228 and 201.7, respectively.

All the resource-hours were for local thermal congestion or voltage concerns, with 83% of the total stemming from damage caused by Hurricane Hanna and associated congestion in the Rio Grande Valley.

Staff also told the committee the Board of Directors will be told in February that the system administration fee is forecast to be adequate for 2022. The fee has remained at 55.5 cents/MWh since 2019.

Market participants had asked for more advance notice of any future administration fee increases during the 2016-2017 budget process. Staff deliver that forecast during the Finance and Audit Committee’s first meeting of the calendar year.

‘Significant’ Price Corrections Defined

The committee unanimously approved its combination ballot by a 30-0 margin. The ballot included the Southern Cross directive, 11 NPRRs, three revisions to the Planning Guide (PGRRs), and single changes to the Resource Registration Glossary (RRGRR) and the Settlement Metering Operating Guide (SMOGRR).

Among the endorsed changes was NPRR1024, drafted in response to the recent spate of price corrections in the day-ahead and real-time markets. (See “Board Approves 2 Sets of Price Corrections,” ERCOT Board of Directors Briefs: Oct. 13, 2020.)

Staff promised the board in October that they would work with stakeholders to reduce price-correction requests by better defining “significance,” the only threshold for determining which market errors require board-approved corrections. NPRR1024 defines “significance” as:

-

-

- the absolute value change to any single day-ahead market (DAM) settlement point price at a resource node or day-ahead market-clearing price for capacity (MCPC) is greater than 5 cents/MWh;

- requiring ERCOT to change more than 10 DAM settlement point prices and day-ahead MCPCs; or

- the absolute value change to any DAM settlement point price at a load zone or hub is greater than 2 cents/MWh.

-

Members voted separately on another Protocol change when Morgan Stanley’s Clayton Greer indicated he would vote against NPRR994. The measure, which passed 29-1, clarifies which transmission improvement projects associated with the interconnecting new generation resources should be classified as “neutral” projects, including new substations, and delineates which interconnection facilities are considered before ERCOT performs an economic analysis.

“I don’t think it’s in compliance with the spirit of the original order that established the gen interconnect process at ERCOT,” explained Greer, who also opposed the measure at the subcommittee level. “The process as it has been up until five years ago was run in compliance, but it has moved away from that. … It would restrict a generator’s ability to get their energy out to market.”

The rest of the combo ballot included:

-

-

- NPRR1034: creates a new protocol section (Frequency-Based Limits on DC Tie Imports or Exports) that enables ERCOT to establish import or export limits on DC ties and avoid the risk of unacceptable frequency deviation during an unexpected loss of one or more DC ties during the import/export. Staff will be able to curtail DC tie schedules on a last-in-first-out basis to address this risk.

- NPRR1040: establishes compliance metrics for ancillary service supply responsibility.

- NPRR1044: requires generation resources and ESRs to develop and implement subsynchronous resonance mitigation plans to address vulnerabilities in the event of six or fewer concurrent transmission outages, an increase from the current threshold of four or fewer.

- NPRR1048: changes certain required system-adequacy reports to being aggregated “by forecast zone” instead of being aggregated “by load zone.” Forecast zones have the same boundaries as the 2003 congestion management zones: North, South, West and Houston.

- NPRR1049: removes the requirement to obtain board approval to add, delete or change a DC tie load zone and also removes the 48-month waiting period before such actions can go into effect.

- NPRR1050: changes the summer projected commercial operations date deadline from the start of the summer peak load season to July 1.

- NPRR1051: removes the administrative price floor of -$251/MWh from all day-ahead settlement point prices.

- NPRR1052: ensures that energy storage systems registered as settlement-only generators will continue to have their injections and withdrawals settled at load zone pricing until nodal pricing for injections and withdrawals is approved and implemented.

- NPRR1053: establishes an exemption from ancillary service supply compliance requirements for any qualified scheduling entity (QSE) representing an ESR whose ability to charge is restricted during a Level 3 energy emergency alert event. The change also clarifies that the compliance exemption does not impact the QSE’s financial responsibility because of the AS insufficiency.

- NPRR1054: removes all references to Oklaunion Exemption from the protocols and adjusts the affected sections’ remaining language accordingly. The coal-fired Oklaunion plant was retired in October.

- PGRR085: adds a requirement for resource entities, interconnecting entities (IEs) and TOs to provide reports benchmarking the power system computer-aided design (PSCAD) model against actual hardware testing and to provide parameter verification documentation confirming model settings match those implemented in the field.

- PGRR086: clarifies that resource entities and IEs must provide dynamic model data and model-quality tests to complete a full interconnection study application.

- PGRR087: clarifies that remedial action schemes should not be relied upon to resolve planning criteria violations.

- RRGRR027: clarifies that resource entities and IEs must provide dynamic model data and model-quality tests to complete a full interconnection study application. PSCAD models should be required before the applicable quarterly stability assessment deadline.

- SMOGRR024: makes modifications to accommodate telemetered auxiliary load and allows a site to comply with NPRR1020.

-