“2020 was the year for agility and transformation,” Executive Vice President and CFO Steve Young said during the company’s fourth quarter 2020 earnings call. He said the company plans $59 billion in capital spending over the five-year planning period ending in 2024, about 70% of which will be for clean energy and “green infrastructure.” Capital investments from 2025-2030 are expected to grow to $65 to $75 billion, Young said.

The company’s reported earnings were hurt by charges from the cancellation of the Atlantic Coast Pipeline and a $1 billion coal ash settlement in North Carolina for Duke Energy Carolinas and Duke Energy Progress.

CEO Lynn Good framed Duke’s coal ash settlement as an achievement, despite the $77 million loss (-$0.12/share) the utility reported for the quarter. Adjusted fourth quarter earnings were $1.03/share. A year earlier, the company posted fourth quarter net income of $660 million ($0.88/share) and adjusted earnings of $0.91/share.

For all of 2020, Duke reported net income of $3.77 billion ($1.72/share) and adjusted earnings of $5.12/share.

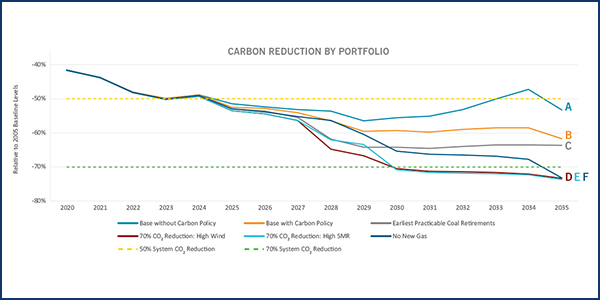

Good was upbeat throughout the call, expressing optimism about the utility’s 2020 integrated resource plans for North and South Carolina and its goal of reducing its carbon emissions 50% by 2030 and achieving net-zero emissions by 2050. She said the IRPs were developed with broad stakeholder involvement and illustrate “the trade-offs between the pace of transition and the cost implications.”

The IRPs offer six different pathways to net zero, from a base case that still includes substantial new natural gas generation, to a no-gas option that would accelerate emissions reductions to 70% by 2030.

The North Carolina IRP is now before the state’s utility commission, with public comments due in April and the commission’s own comments due possibly in the fall, Good said.

Questions from analysts on the call focused on regulatory and legislative initiatives underway in North Carolina. Following a series of stakeholder meetings throughout 2020, a recent report by the Rocky Mountain Institute and the Regulatory Assistance Project included recommendations for new laws to transition the state to performance-based regulation (PBR) and help accelerate the retirement of fossil fuel generation.

PBR links utility compensation not to traditional capital investment in infrastructure, but to the achievement of specific performance metrics. Other recommendations in the report included changes to wholesale power markets and more competitive procurement processes.

Good said Duke worked with stakeholders around common objectives including “moving away from coal, carbon reduction, regulatory mechanisms that incent that move and then, of course, increase investment in renewables, all with the construct of maintaining reliability and affordability.”

But some solar and environmental groups have been strongly critical of both the North and South Carolina IRPs, in particular for the utility’s plans to continue building new natural gas plants. A recent report from the Sierra Club gave Duke’s North Carolina IRP 5 points out of a possible 100. The South Carolina Solar Business Alliance filed extensive comments on Duke’s South Carolina IRP, calling the utility’s ongoing reliance on natural gas generation risky and inconsistent with its 2050 net-zero goal.

Positive Population Migration

Other takeaways from the call included:

- While the COVID-19 pandemic reduced commercial and industrial demand, Duke saw a significant increase in residential customers and demand. The customer growth was caused by “positive population migration” in Duke’s service territory, Young said.

- Duke Energy Florida reached a settlement with consumer groups, committing the utility to scrapping a planned nuclear project and investing instead in solar energy, smart meters and grid modernization projects. Deployment of electric vehicle charging stations and development of an energy storage pilot project are also included in the settlement.

- Duke recently announced that GIC, a Singapore-based infrastructure investor, had acquired a 19.9% interest in Duke Energy Indiana for $2.05 billion. The investment “displaces all common equity needs” in its five-year plan.