NYISO on Feb. 9 proposed a three-tier approach to its Grid in Transition initiative and measuring the effects of market changes to make sure they are working as intended.

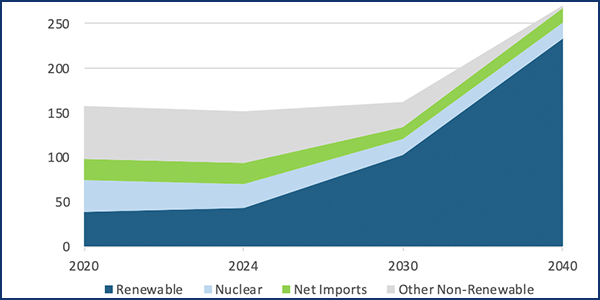

The ISO in December 2019 issued a report on reliability and market issues related to integrating a host of clean energy resources into the electric power system over the next few years, a “grid transition” driven primarily by state policy. (See Public Policy Challenges Top NYISO Grid Plans.)

NYISO proposed categorizing projects under the initiative as imminent or underway; medium-term; or long-term.

The first category includes carbon pricing, which went through the NYISO stakeholder process but has yet to receive the state support needed to move beyond the planning stage, James Pigeon, manager of distributed resource integration, told the Installed Capacity Working Group.

Other projects underway now and expected to be completed this year and next are the ISO’s Comprehensive Mitigation Review, which involves updating its buyer-side mitigation processes. (See NYISO Explores Improving BSM Processes.)

There is also a separate effort to refine NYISO’s participation model for distributed energy resources. The ISO this year will deploy a software‐defined wide area network, an enabling technology for telemetry that could potentially be used by market participants, including demand‐side ancillary services program resources and energy storage resources (ESR).

Tracking and Metrics

The new recommendations build on a more detailed analysis presented to stakeholders in December, with NYISO now proposing tracking and metrics to establish an early warning system to review if the market rules are inconsistent with what is needed for reliability, starting with whether net forecast uncertainty is causing inefficiencies.

The ISO’s strategy is informed by its own Climate Change Study and Reliability Gap Assessment of last year. The proposal “addresses that narrow subset of the recommendations … with the idea being that these tracking and metrics would really address some of the questions that we have based on that gap analysis,” Pigeon said. “Part of it is to see if some of these metrics can give us an early-warning indicator … on a monthly or quarterly outline basis to keep an eye out for any problems indicative of a changing fleet and grid.”

One stakeholder asked if the ISO is going to have metrics for when the early-warning system is triggered, and how long it would have to be tracked before the need for a change became obvious.

“We don’t know yet because it requires further analysis,” Pigeon said. “The first question concerns net forecast uncertainty and whether or not there are some inefficiencies being born out of that,” which the ISO would answer by starting to track some units’ revenues and other aspects of inflexibility in the system.

The main point is to provide accurate price signals for the market to run efficiently, said Michael DeSocio, NYISO director of market design. “Given the way the system is evolving and the way the market tools are committing resources that we have access to today, can we come up with more efficient ways to run the grid, given the resources we have in front of us, or are the current market processes best?”

To the extent that there are resources that get day-ahead market awards that then self-schedule in the market and take flexibility away, “we probably need to go back and reconsider the market rules to consider whether that should be allowed,” DeSocio said. “And if it shouldn’t be allowed, what’s the penalty or the market incentive to prevent it? So those are the kind of things we’re trying to get at here.”

The ISO also needs to “get a good grasp” on some of the existing run-limited resources to understand the services they provide and their limitations, Pigeon said.

Run-limited resources include ESRs, demand response, emissions-restricted output and noise-restricted output resources.

NYISO will come back in early March “and talk more in detail but limit the ballooning of hypotheticals that would sidetrack discussion,” Pigeon said. It would ten begin discussions in the second quarter on energy market improvements.