Utilities and cooperatives in 11 Southeastern states on Friday proposed using automation and free transmission capacity to expand bilateral trading and allow 15-minute energy transactions.

Led by the Tennessee Valley Authority, Southern Co. and Duke Energy, the Southeast Energy Exchange Market (SEEM) seeks to reduce the “friction” in bilateral trading by using an algorithm to match buyers and sellers and eliminating transmission rate pancaking in the region’s 10 balancing authority areas.

Electric providers purchase cheaper power when they can back down more expensive generation in their own fleets; sellers earn profits to offset their operating costs.

To make a transaction currently “the parties must discover one another, negotiate the terms of the sale, arrange and pay for transmission service across all utilized transmission systems, and schedule the delivery of energy. All of this is done with ‘traditional’ methods of communication, by phone and electronically, thus creating transactional friction,” Southern Company Services said in a FERC filing on SEEM’s behalf (ER21-1111, et al.). “Trades generally occur on an hourly basis as the shortest increment, and most often occur only with entities in the same or directly interconnected balancing authorities.”

The SEEM proposal, which would allow participants to move power over unused transmission capacity at $0/MWh, “will enhance efficiencies and reduce opportunities to exercise market power by allowing more buyers to transact with more sellers over a much bigger region,” SEEM said.

Although the group’s name includes “market,” participants made clear that they do not see the proposal as a prelude to an RTO. “The Southeast EEM is not — and was never intended to be — a top-to-bottom reimagining of the Southeast energy market; rather, it reflects incremental improvement to the existing bilateral market,” the group said.

Among SEEM’s “core principles” are that each electric service provider and state will maintain control of generation and transmission investment decisions and that each transmission provider will remain independent, with its own transmission tariff. There will be no changes to reliability, state jurisdiction or responsibilities for resource adequacy, it said.

SEEM had provided some details of its proposal in an informational filing with the North Carolina Utilities Commission in December. (See Southeast Utilities Announce Regional Energy Market.) Friday’s filings provided many more details on its governance, cost allocation and measures to address potential market power.

Fourteen utilities and cooperatives have signed the SEEM agreement and five others are “contemplating or in the process of seeking” approvals to do so. Members opened 13 dockets detailing the agreement and changes to their transmission tariffs. (Some of the members are not FERC jurisdictional.)

Members and Participants

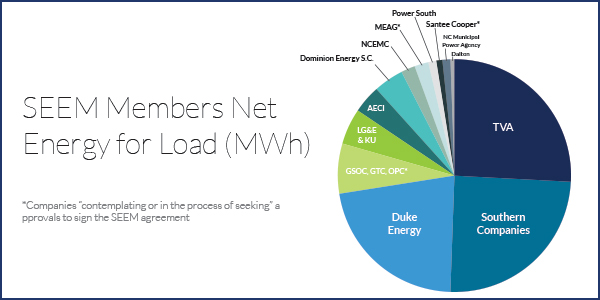

TVA; Southern’s Alabama Power (ER21-1111, ER21-1125), Georgia Power (ER21-1119) and Mississippi Power (ER21-1125, ER21-1121; and Duke Energy Carolinas (ER21-1116) and Duke Energy Progress (ER21-1115, ER21-1117) represent nearly three-quarters of SEEM’s net energy for load (NEL).

The other initial members are: Associated Electric Cooperative Inc.; Dalton Utilities; Dominion Energy South Carolina (ER21-1112, ER21-1128); Louisville Gas & Electric (ER21-1114, ER21-1118) and Kentucky Utilities (ER21-1120) (LG&E/KU); North Carolina Municipal Power Agency Number 1; PowerSouth Energy Cooperative; and North Carolina Electric Membership Corp.

Those planning to join are Georgia System Operations Corp. (GSOC); Georgia Transmission Corp. (GTC); Municipal Electric Authority of Georgia (MEAG); Oglethorpe Power Corp. (OPC); and South Carolina Public Service Authority (Santee Cooper).

The 19 expected members have 160 GW of summer generating capacity (180 GW winter) in parts of 11 states across the Eastern and Central time zones and serve more than 32 million retail customers.

New members — which must have a load-serving responsibility or serve an entity with that responsibility — will be allowed to join during an enrollment period from July 1 through Sept. 30 annually. Nonmembers that want to submit bids and offers into SEEM will be called participants.

Yes or No Decision for FERC

SEEM asked FERC to allow a comment period of 30 days, rather than the usual 21, and sought an effective date in 90 days — May 13. Members hope to select a vendor to build the system in the first quarter of this year with the buildout complete by the third quarter and trading beginning in the first quarter of 2022.

SEEM said FERC can only opine on whether the rates proposed in the group’s Federal Power Act Section 205 filing are just and reasonable, limiting any changes to “minor deviations.”

But FERC is likely to hear complaints from intervenors who contend SEEM does not go far enough to modernize the region’s electric industry.

When news of SEEM’s efforts became public in July, the Solar Energy Industries Association and the Southern Environmental Law Center said they would push regulators to demand more competition. The Southern Alliance for Clean Energy said SEEM appeared to be an effort to avoid legislative action to create an RTO in the Carolinas. “We remain concerned that SEEM is being constructed as a way for participating utilities to avoid being pushed to form or join a competitive energy market.” (See Southeast Utilities Talking Regional Market.)

Stakeholder Outreach

The proposal arose out of a year of discussions among the electric providers and other stakeholders, including “governmental entities and non-governmental entities such as environmental groups, trade associations and individual customers,” SEEM said.

“Comments have been overwhelmingly supportive, but a common request was that the members take the Southeast EEM construct further, to have more ambitious aims entailing far greater complexity. … The current proposal is the one that struck a delicate balance among the members, and thereby enables, for the first time, a regionwide market enhancement in the Southeast.”

“This is not the first effort to develop a regional market in the Southeast … but it is the first one to enjoy such broad support from the transmission owners and load-serving entities in the region,” Aaron Melda, TVA’s senior vice president for transmission and power supply, and Lonnie Bellar, chief operating officer of LG&E/KU, said in an affidavit submitted to FERC, referencing the collapse of a four-year effort following Order 2000 in 1999.

The group said it will post trading data on a public website and that it will hold annual meetings “open to all interested parties.”

Any changes to the market rules will be filed at FERC, providing an opportunity for public comments.

No Impact on Reliability

SEEM proposes a new zero-cost, non-firm energy exchange transmission service (NFEETS) provided on an as-available basis after all other uses have been considered. It would be available solely for 15-minute energy exchanges, have the lowest curtailment priority, and unable to be reassigned, sold or redirected.

It could only be provided by a transmission provider whose system — when added to the other participating transmission providers — creates a continuous contract path. Because it would be a non-firm, as-available product, no transmission studies would be required.

“The Southeast EEM will not have any negative impact on reliability, because it will not change any current reliability roles or responsibilities and will rely on unused transmission given the lowest curtailment priority,” the group said, adding that the market will not offer capacity transactions. “The reliability obligations that BAs and transmission providers have today are unchanged under the Southeast EEM.”

Split the Savings

SEEM said it will save customers money by allowing more efficient use of unused transmission capacity over a large footprint, increasing the opportunities for win-win trades. It will use a “split-the-savings” approach with the transaction price at the midpoint between the seller’s offer and the buyer’s bid, with an adjustment for transmission losses.

SEEM will be a “low-risk, high-reward venture,” members said, citing a 20-year benefits analysis by Guidehouse and Charles River Associates that projected a minimum of $40 million in benefits per year (2020$) in a scenario based on recent integrated resource plans and equivalent data.

Under a “carbon constrained” scenario, benefits will increase to more than $100 million annually by 2037, according to the analysis. The scenario was based on participants’ IRP carbon-reduction plans and “reasonable assumptions of what a high-renewable-and-storage, low-carbon future may look like in the Southeast.”

Start-up and ongoing costs are estimated at a total of $3.1 million annually (2020$) levelized over the 2021-2040 period.

SEEM acknowledged that the new free transmission service could result in a “slight decrease” in point-to-point revenues used to offset network service charges but said the revenues at stake are “minimal.”

Its benefits will result from bilateral trades unlikely to occur under current rules, the group said. “The automated system will have a substantial advantage in searching for transmission paths with available transmission to complete beneficial trades, overcoming transaction costs and information barriers. Further, the algorithm will exhaustively seek out all possible beneficial trades across the territory.”

In addition, it “will allow for better integration of diverse generation resources, including rapidly growing renewables, and will reduce renewable curtailments,” Melda and Bellar said in their affidavit.

Because of the lack of sub-hourly market liquidity, transmission providers currently must balance all variation in renewable output across the full hour.

“By creating greater liquidity in sub-hourly wholesale transactions, especially across a broad geographic area encompassing possibly different weather conditions and renewable policies, the Southeast EEM can provide additional opportunities for transmission service providers to either procure additional energy or to dispose of excess energy, rather than having to rely exclusively on increasing or decreasing the output from their own generation resources that provide imbalance service,” they said.

Governance, Cost Allocation

Each of the members would have a seat on a Membership Board, which “will be responsible for all significant decisions,” while a revolving subset of four members would run the Operating Committee, responsible for overseeing the day-to-day operations and working with an independent entity that would administer the system.

The Operating Committee would have two members from the investor-owned utility sector and one each from the cooperative sector and governmental utility sector, reflecting the sectors’ shares of load. To prevent any subset of members from dominating, votes by the Operating Committee would have to be unanimous, with any issues that cannot be resolved taken to the Membership Board. All members would be permitted to “attend, observe and participate” in Operating Committee meetings.

The group plans a hybrid cost allocation formula, with 25% of costs allocated equally among all members and 75% assigned based on NEL.

Market Power

The members said they would contract with an auditor to “review and analyze” market data to ensure that the system is functioning properly, but they have no plans to create a market monitor, contending that SEEM does not create new opportunities to exercise market power.

“Any additional market monitoring functions beyond the auditor’s responsibilities would be superfluous, creating additional administrative costs that are not justified. For these reasons, members are unwilling to fund the costs of a market monitor and believe the traditional means of commission oversight of [market-based rate] transactions will continue to provide adequate opportunities for review and regulatory protection,” SEEM said.

To avoiding potentially anticompetitive price discovery, all reported pricing information would be aggregated and its release delayed until at least the day after the trading day.

The group submitted an affidavit from Susan Pope, a managing director at FTI Consulting, who said no participant could exercise market power in SEEM “unless it already could exercise market power in today’s hourly bilateral market.”

Companies will be able to put constraints into the algorithm to ensure that they continue to obey current mitigation measures, Pope said. “Dominion Energy South Carolina, Duke and LG&E/KU anticipate complying with their mitigation requirements by toggling ‘off’ their home BAAs, thus ensuring that they are not matched with any bidder in their home BAAs and more than meeting the market power mitigation requirement.”

Pope said it would be problematic if a participant could unfairly obtain zero-cost NFEETS or profit from manipulating the average hourly energy exchange prices.

But she said the requirement that all participants have “toggled on” at least three unaffiliated potential counterparties would prevent collusion “to trick the algorithm into moving the schemers to the front of the line for zero-cost transmission.”

“The number of counterparties renders it difficult and risky for parties to coordinate to implement such a scheme, particularly in light of the small benefit to be obtained (i.e., a greater probability of obtaining zero-cost NFEETS),” she said.

TVA ‘Fence’

In crafting the SEEM agreement, members said they were careful to honor the so-called TVA “fence,” which Congress enacted to prevent the federal utility from selling power outside the areas it was selling to as of July 1, 1957.

Among the current SEEM participants, TVA can sell power to only Duke, LG&E/KU and Southern, although it can purchase from any SEEM participant.

“Given TVA’s central location in the Southeast, if TVA cannot participate in a redesigned market, then others (LG&E/KU and AECI) would not have a contiguous connection to the rest of the market,” Pope noted. “If they cannot connect through TVA, they must connect through one of the neighboring RTOs, thus adding another wheel, and the added transmission expense, to any transaction with a counterparty in the Southeast.”