PJM delayed an endorsement vote on an issue charge regarding the allocation of capacity transfer rights (CTRs) for a month after stakeholders raised questions over the initiative’s scope and potential impact.

Kevin Zemanek, director of system operations for Buckeye Power, reviewed the problem statement and issue charge by the Ohio-based company during last week’s Market Implementation Committee meeting, saying current rules are exposing his cooperative to price separation.

Under the Reliability Pricing Model (RPM), CTRs return to load-serving entities (LSEs) capacity market congestion revenues that occur when there is a difference between capacity prices paid by load and market revenue received by cleared capacity resources. CTRs permit LSEs with load inside a constrained locational delivery area (LDA) to receive a credit for the import of capacity from a lower-priced region.

Zemanek said PJM does not have a way to allocate CTRs to an LSE that corresponds to the network load identified in its network integration transmission service agreement. Instead, PJM allocates CTRs pro-rata to each LSE serving load in the LDA or zone based on the LSE’s share of the zonal unforced capacity obligation.

Although an LSE may have resources that are deliverable to load inside the constrained LDA, current rules do not allocate an equivalent number of megawatts, Zemanek said.

Buckeye Power has been harmed because the existing RPM rules disregard the “historic structure” of Buckeye and Ohio TO’s, Zemanek said, leading to “millions of dollars” in excess charges.

He added that Buckeye seeks to explore market rule changes that would account for resources within PJM’s footprint that existed prior to the implementation of RPM.

“We’re asking the committee to consider a rule change that would account for historic resources internal to PJM’s footprint and have the deliverability to designated load,” Zemanek said.

He said he anticipates two months of education followed by discussions on potential rule changes.

Paul Sotkiewicz of E-Cubed Policy Associates said he’s inclined to support the problem statement to start the discussion, but one of his concerns would be adding to the key work activities on how incremental capacity transfer rights (ICTRs) would be impacted by any changes.

Zemanek said Buckeye didn’t intend to have ICTRs impacted by the issue charge and was not looking to impact any existing contractual rights.

Sotkiewicz asked if Buckeye would be open to a friendly amendment to look at the potential impact to ICTRs, but Zemanek said he wasn’t sure if the issue charge needs to be changed.

Sotkiewicz said he doesn’t see a way to address CTRs without also addressing ICTRs.

“Some of us have felt like we’ve gotten burned on issue charges where we think topics are in scope and then we’re being told they’re out of scope,” Sotkiewicz said.

Jeff Bastian, PJM senior consultant in market operations, said the CTRs that Buckeye is considering allocating are those remaining after ICTR megawatts are determined. Bastian said there would be no impact on the ICTR calculation from the issue charge.

One stakeholder questioned language in the issue charge, saying it seemed to find a way to allocate CTRs to entities like Buckeye while leaving other issues “undisturbed.” He said he’s not sure there’s a way to allocate the CTRs without disturbing the existing system.

Independent Market Monitor Joe Bowring said the Monitor is “skeptical” about introducing a contract path as the basis for the rights to CTRs.

Lisa Morelli of PJM suggested deferring the endorsement vote until the March MIC meeting to allow for refinements to the issue charge and problem statement from the stakeholder feedback about what is in scope and out of scope.

Capital Recovery Factors Discussion

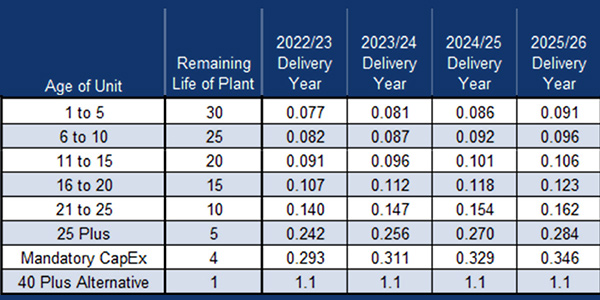

Bastian provided a second first read of the problem statement and issue charge to regularly update the value of capital recovery factors (CRFs) based on current federal tax rates. CRFs are a component of the net avoidable cost rate (ACR) of a resource, which determines a resource’s market seller offer cap or minimum offer price rule (MOPR) floor price, depending on which is applicable.

The Monitor notified PJM in a letter Dec. 4 that the CRF values, which were set in 2007, do not reflect the 2017 reduction in federal corporate tax rates.

The RTO has proposed to address the CRF issue as part of a quick fix process in which the MIC would simultaneously approve the issue charge and the proposed tariff revisions at the March 10 meeting.

The Monitor said the tables should have been updated in 2018 and must be changed before the next capacity market auction, for the 2022/23 delivery year, takes place in May. The RTO said it was concerned that seeking an earlier effective date would further delay the auction, which was originally scheduled for 2019. (See PJM Sets BRA for May 2021.)

The RTO said it agrees with the Monitor that offers including the avoidable project investment rate in net ACR values are unlikely to impact the May auction results.

PJM proposed that after the upcoming auction, the table of CRF values be posted on the PJM website no later than 150 days before the beginning of the offer period of each auction. The values would reflect federal income tax laws in effect for the relevant delivery year at the time of the determination.

Bastian said PJM revised its initial proposal to reflect feedback at the January MIC meeting, when stakeholders requested more transparency in the key input assumptions. (See “Challenge on CRF Quick Fix,” PJM MIC Briefs: Jan. 12, 2021.)

Sotkiewicz thanked PJM for listening to the stakeholder feedback and said the changes reflected much of the discussions. He said the only potential concern he had was making the formulas used to calculate the CRFs accessible on PJM’s website rather than stated as a “generic financial model.”

Erik Heinle of the D.C. Office of the People’s Counsel said PJM was able to come up with a “reasonable solution” that addresses concerns of not falling behind in tax laws and constantly trying to catch up with changes.

Long-term Five-minute Dispatch

Aaron Baizman, senior engineer for PJM, reviewed the solution package matrix for the long-term five-minute dispatch and pricing issue worked on in the MIC special session meetings and said an endorsement vote on the PJM/IMM package would be delayed until the March MIC meeting.

Baizman said PJM wants to take a “measured approach” for the implementation of the long-term evaluation of five-minute dispatch and pricing, especially with the number of changes affecting dispatch.

Stakeholders approved the short-term proposal to resolve five-minute dispatch and pricing at the July MRC meeting. The RTO had said it expects to continue evaluating long-term solutions late into this year, with a quantitative analysis of the pros and cons of different approaches. (See PJM Stakeholders OK 5-Minute Dispatch Proposal.)

Baizman said highlights of the long-term package include real-time security-constrained economic dispatch utilizing previous generator dispatch instructions to create guidelines. PJM dispatchers will also be provided flexibility for exceptions for case approval caused by unanticipated conditions or application issues.

A first read of the proposed tariff language was also moved to the March 24 Markets and Reliability Committee meeting. Baizman said PJM and the Monitor are still reviewing the tariff changes, and a review of the draft tariff language will be held at the five-minute dispatch and pricing special session on Wednesday.

Baizman said the current long-term timeline calls for software development until April, testing of the software from May to June, parallel operations and evaluation from July to September and a pilot evaluation and implementation by Nov. 1.