Speaking during an earnings call Wednesday, Arriola pointed to offshore wind projects and the construction of the New England Clean Energy Connect (NECEC) transmission line in Maine as critical drivers for Avangrid’s future.

The Connecticut-based subsidiary of Spanish energy giant Iberdrola reported fourth-quarter profits of $166 million ($0.54/share) and 2020 earnings of $581 million ($1.88/share).

Avangrid’s networks division serves more than 3.3 million customers in New York and New England through its eight electric and natural gas utilities, while its renewables business owns and operates renewable energy generation facilities across the U.S.

Arriola said Avangrid sees “strong prioritization of clean energy policy going forward” under the Biden administration, citing the president’s targets to decarbonize the power sector by 2035 and reach net-zero emissions economy-wide by 2050, first with several climate-focused executive orders and then through a proposed $2 trillion investment in clean energy over the next five years.

“For us, this translates into an acceleration of renewables deployment, grid enhancements and transmission projects to support growing demand for clean energy,” Arriola said.

He said NECEC is the largest clean energy project in New England and equivalent to removing more than 700,000 passenger vehicles from the road in terms of greenhouse gas emissions.

Construction of the $1 billion NECEC with Central Maine Power technically began in January, which followed a lengthy court battle over a referendum on the project that was ultimately deemed unconstitutional after tens of millions of dollars were spent by advocates for and against it.

NECEC spans 145 miles with the capacity to carry 1,200 MW of Canadian hydropower from the Maine-Québec border to Lewiston, Maine, where it will connect to the New England Control Area. The HVDC project includes upgrading 50 miles of existing AC transmission, a new converter station and substation and other upgrades. It has an in-service date of 2023.

“While we recognize there is a vocal minority in [Maine] that is basically against any infrastructure development anywhere, we remain confident that NECEC will be completed and will provide affordable clean energy and substantial economic benefits, including jobs, to the people of Maine,” Arriola said.

Avangrid currently owns 8.2 GW of renewable energy in 22 states and that portfolio is set to increase when its acquisition of PNM Resources officially closes, likely in the second half of 2021. The deal will create one of the biggest clean energy companies in the U.S., with 10 regulated utilities in six states and renewable energy operations in 24 states. (See Avangrid to Acquire PNM Resources for $4.3B.) Avangrid would become the third-biggest U.S. renewables operator, with most of its current portfolio being onshore wind, and a growing pipeline of offshore projects including Vineyard Wind and Park City Wind in New England. (Note: An earlier version of this article misstated Avangrid’s renewable capacity.)

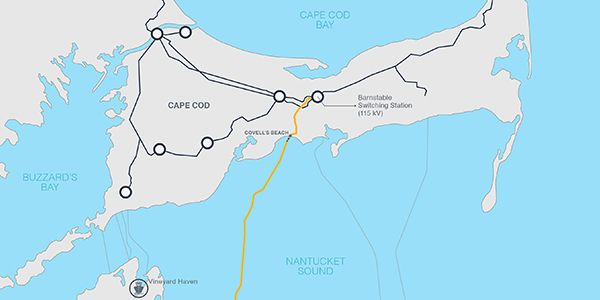

Arriola said that the 800-MW Vineyard Wind, a joint venture between Avangrid and Copenhagen Infrastructure Partners (CIP) off the coast of Martha’s Vineyard in Massachusetts, now has an in-service date of 2024 as the U.S. Bureau of Ocean Energy Management resumed its oft-delayed work on the final environmental impact study and record of decision.

Avangrid also partnered with CIP to develop the 804-MW Park City project in Bridgeport, Connecticut, which has an expected in-service date of 2025. Arriola added that the recent addition of a 30% federal investment tax credit means that Vineyard Wind will “generate additional value.”

“We’re one step closer to placing turbines in the water at the nation’s first utility-scale offshore wind farm,” Arriola said.

The CEO added that Avangrid is poised to grow its renewable energy capacity “nearly 70% by 2025, with significant growth driven by offshore wind.”

Call transcript courtesy of Seeking Alpha.