Stakeholders told FERC Monday that the proposed Southeast Energy Exchange Market (SEEM) doesn’t go far enough to increase competition, asking the commission to require more transparency, broader governance and increased consumer protections.

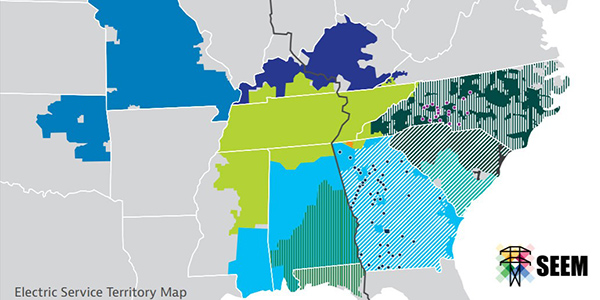

Several stakeholders also requested FERC and states conduct a technical conference on the proposal, filed last month by utilities and cooperatives in 11 Southeastern states (ER21-1111, et al.).

SEEM members said their plan would reduce the “friction” in bilateral trading by using an algorithm to match buyers and sellers, eliminating transmission rate pancaking and allowing 15-minute energy transactions. (See Southeast Seeks FERC OK for Expanded Bilateral Market.)

Led by the Tennessee Valley Authority, Southern Co. and Duke Energy, 14 utilities and cooperatives have signed the SEEM agreement and five others are considering doing so. The companies insisted that FERC could only determine whether their Federal Power Act Section 205 filings were just and reasonable, contending the commission lacked authority to require substantive changes.

As proposed, membership in SEEM would be limited to those with a load-serving responsibility or serving an entity with that responsibility. Each of the members would have a seat on a Membership Board that would determine “all significant decisions,” while a revolving subset of four members would run the Operating Committee, responsible for overseeing the day-to-day operations.

But several organizations said FERC should force SEEM to open its membership and governance and require market monitoring.

The Southern Renewable Energy Association warned that SEEM could prevent “true market reform.” It said the lack of wholesale competition in the region caused “billions of dollars in failed projects and lost opportunities,” including the canceled VC Summer nuclear reactor in South Carolina, TVA’s rejection of the Plains and Eastern HVDC transmission project and the Kemper IGCC facility in Mississippi.

The group said FERC should provide regulators an oversight role through a Regional State Committee and open membership to independent power producers and large commercial and industrial customers. Public interest organizations should be given a role in governance, it added.

It also called for use of LMPs for settling trades and more transparency in market results.

Public Citizen also opposed SEEM’s proposed governance and said FERC should consolidate the multiple dockets opened by individual members into a single proceeding.

“Concentrating all management authority for the new market only among utilities is unjust and unreasonable, as the lack of balanced decision making will lead to uncompetitive outcomes,” Public Citizen said.

South Carolina state Sen. Tom Davis (R) was among those asking FERC and the Southeastern states to convene a joint technical conference. Davis said South Carolina has the fourth-highest electric rates in the U.S., largely because of the Summer plant. Federal-state cooperation “might reduce consumer bills, reduce the risk of imprudent investment and promote a cost-effective transition to newer, cleaner energy technologies,” he said.

Davis said the conference should consider the potential benefits of an “independently operated” RTO or imbalance market, noting that the South Carolina legislature last September approved a bill to study potential market reforms.

SEEM, he said, will not maximize the region’s opportunities “in part because it limits competition by non-utility parties and has an extremely limited reach.”

Qualified Support — and Some Protest

The Environmental Defense Fund said although SEEM’s potential benefits “are limited compared to a more fully integrated transmission and wholesale market system” such as an RTO, it “represents a step in the direction of a more coordinated and efficient electric system.”

But EDF said FERC should require SEEM to provide monthly reporting of transaction details, open its Membership Board and Operating Committee meetings to the public and conduct further analysis on potential participation by demand response and distributed energy resources. The SEEM proposal said that DR and DER “cannot be a registered source or sink today, but could at some point be able to participate in the market under revised state laws.”

“Limiting full membership to load serving entities and limiting a voting role in the governance process to members may be reasonable at this time,” EDF said. “However, to the extent that there is any increase in the role or scope of the Southeast EEM, the governance structure should be modified to provide a greater role for participants and other stakeholders.”

In a joint filing, Advanced Energy Economy, the Renewable Energy Buyers Alliance and the Solar Energy Industry Association said FERC should require that SEEM members adopt a pool-wide open access transmission tariff.

The groups added that membership should be open to any bulk power market participants and that FERC should consider other market options that “likely provide much greater cost savings.”

R Street Institute said SEEM should include a market monitor “to ensure the SEEM market is operating fairly and providing benefits to members and customers.”

“While the Southeast has historically eschewed RTOs, the SEEM proposal is a modest attempt for its member utilities to leverage market opportunities. Unfortunately, the proposal fails to realize those opportunities and would be insulated amongst its membership from outside competitive pressures which would effectively expand its monopolistic practices across the region,” R Street said.

MISO said FERC should require SEEM members and participating transmission providers to work with the RTO to develop “appropriate coordination arrangements” if SEEM increases “the level and frequency of transactions among Southeast EEM members or changes in form of such transactions.

“This would allow MISO and other affected parties to present their concerns to the commission before the change can affect MISO’s markets and operations,” the RTO said.

Entergy said FERC should require that transactions under the SEEM agreement are treated comparably to market flows between the MISO South and Central areas.

“When market flows entirely within MISO, but between MISO Central and MISO South, exceed the physical capability of the transmission facilities linking those MISO areas, the flows cannot occur unless there is available capacity on the systems of certain of those Southeast EEM members or Southwest Power Pool, Inc. and unless MISO compensates those parties.”

Several public interest groups, including the Sierra Club, the Southern Alliance for Clean Energy and the Sustainable FERC Project also filed a joint protest.

“Instead of embracing meaningful reform, the SEEM proposal represents an incremental improvement to coordination that comes at much too great a cost and risk: increasing the market power of monopoly utilities, disadvantaging clean independent power producers seeking transmission access and reducing transparency and oversight,” they said. “If approved, this proposal could lock the region into a flawed market structure and stymie the meaningful reform at work in the states.”